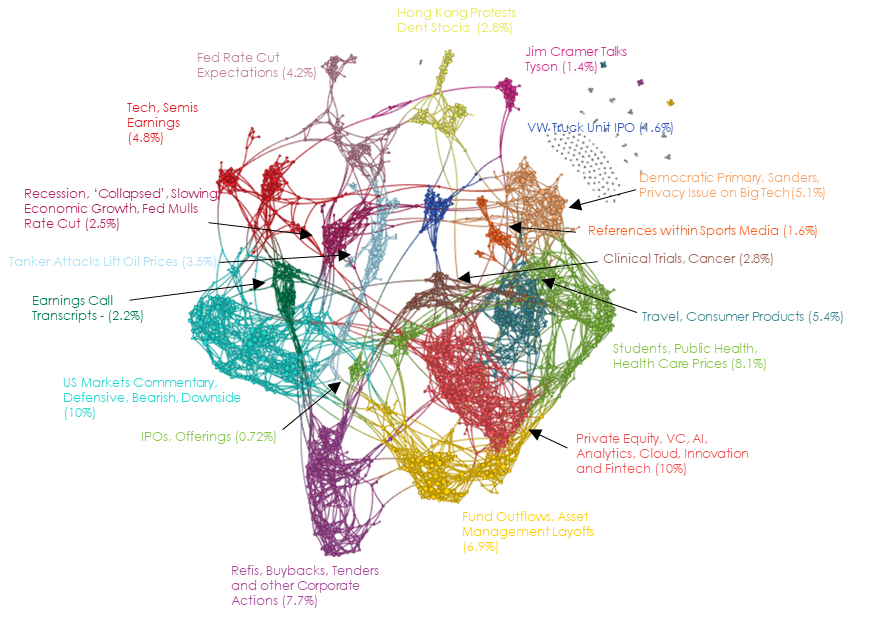

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But this is the map that links them all together.

- Usual mix of core topics in financial media today, although extracted ngrams from the commentary cluster have tended toward terms like ‘defensive’, ‘bearish’ and ‘downside.’

- Commentary is more closely related to the Fed Cut discussion language, indicating what we think is greater attention to these public market concerns than the more positive tech/health care/private equity chatter on the right hemisphere of today’s narrative map.

- IPOs have faded from the radar a bit from summer in terms of quantity, but discussion of them is still intensely connected to the narrative of markets from a linguistic perspective.

- Privacy and Big Tech break-up language, especially from the campaign trail, is starting to filter a bit more into financial media. It’s a narrative we’ll have our eye on.

What is with the bizarre regularity of that “VW Truck Unit IPO” segment in the upper right?