Brent Donnelly is a senior risk-taker and FX market maker, and has been trading foreign exchange since 1995. His latest book, Alpha Trader, was published last summer to great acclaim (by me, among others!) and can be found at your favorite bookseller. I think it’s an outstanding read, and not just for professional traders.

You can contact Brent at his new gig at bdonnelly@spectramarkets.com and on Twitter at @donnelly_brent.

As with all of our guest contributors, Brent’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

[Ed. note – The most damaging stories and narratives are not those that others tell us, but those that we tell ourselves.]

A retail trader friend of mine whose target is to make $1m this year trading mostly FX was $500,000 in the green as of two weeks ago then quickly drew down to $300,000. Yesterday he pinged me as he had his best day ever and is now +$570,000 YTD. His text was like “Party time! I’m gonna be up a million bucks by May 1!”

My advice to him was: “Cut your risk by 75% for a week. And chill out.”

You can go on tilt as much when you are over-earning as you can when you are losing money. This is a lesser-known leak that can be a huge problem for me and is evident in my friend’s situation/attitude.

Traders should operate close to the middle of the emotional spectrum most of the time. If you are feeling invincible; you are probably about to lose a ton of money. Many traders will feel more and more confident as they perform well and then finally blow up as rising confidence turns to a feeling of invincibility and excessive risk appetite.

Just like market prices, P&L tends to overshoot.

Rarely will I see my P&L crash after an average or negative trading period. My biggest drawdowns always come after a sustained period of over-earning. I get overconfident. Cartoon dollar signs flash in my eyes. I double a position that is deep in the money when I should be taking profit.

There is a particular level of P&L where I know I tend to get sloppy, so now I use conditional formatting in my P&L spreadsheet to create an alert. The month-to-date cell turns orange as the “I’m doing too well” level gets close and then the cell turns red once the overearning threshold is crossed. For me, trading well initially leads to more good performance, until a point—then I tip into overconfidence.

This phenomenon is called “Winner’s Tilt”. Tilt is usually a condition associated with traders or poker players that are losing, or on a run of bad luck. They go on “tilt” which means they start overtrading or chasing pots with bad cards in bad situations, because their minds are flooded and they are seeing red.

In contrast, Winner’s Tilt is another way of describing The House Money effect: temporary madness brought on by a series of winning trades or winning days. I can feel this coming on now as usually I feel a bit giddy when it’s happening and might even find myself singing or joking around more than usual on the desk.

Thaler and Johnson find strong evidence of the House Money Effect in their 1990 paper: “Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice”. The gist of the paper is that when wagering with uncertainty, we should logically make decisions based on the probabilities associated with various outcomes and those decisions should be rational and independent of what happened beforehand.

Instead, humans gamble much more recklessly when our pockets are full of black chips.

You are never invincible. The market wants your money, and it will figure out all sorts of ways to take it. Always exercise caution if you feel the urge to cheer or high five or celebrate or sing out loud. If you feel this way, it is very likely you are near an emotional zenith. Get flat and reset. If you are singing on the desk or yelling with excitement or pumping your fist… Achtung!

You are about to get punched in the mouth.

Here’s a short post I wrote on this topic in 2020:

Joyful yelling signals imminent P&L crash

Excerpted from “Alpha Trader” by Brent Donnelly

One of the underappreciated features of working on a trading floor is that you are allowed to yell; pretty much whenever you want. In contrast, at other jobs I have held in the past (pizza maker guy at Little Caesar’s, data entry clerk at Statistics Canada, gas pumper at Texaco) … It would be super weird to randomly yell out (for example) the number 32 at max volume. It would generally be frowned upon if I suddenly screamed: YOU’RE DONE!!! from a government office cubicle.

But on a trading floor, random yelling is perfectly fine!

As much as it is fun to yell on a trading floor, though, it can sometimes be a sign of euphoria and overconfidence.Overconfidence leads to overtrading, poor sizing, confirmation bias and a failure to see alternative hypotheses (because you know you’re right, why bother thinking about how you could be wrong, right?) Overconfidence is also one of the main reasons men underperform women in trading.

Anyway, I am generally a fairly humble guy and I like to think about alternative hypotheses and all that… But one of my leaks is a particular type of momentary overconfidence. When I am doing abnormally well, I get excited; I want to add risk even though I should be reducing. I am momentarily swept up by a wave of irrational exuberance and should be thinking about reversion to the mean, not further upside momentum. Many traders commit this error.

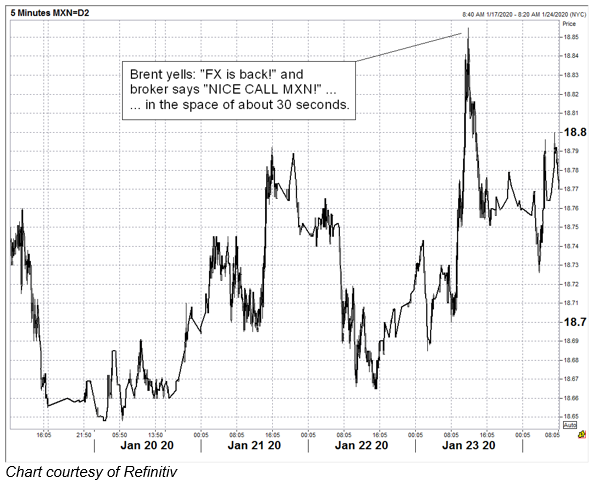

Example: Last Thursday I could sense the market putting on a bit of a deflation trade (or, more accurately, taking off the popular reflation trade) and so I bought a USDMXN call to hedge a predicted flurry of coming risk aversion. Almost instantly, USDMXN ripped higher from 18.76 to 18.85 and our franchise lit up. All at once, a flood of client trades came through from sales.

Excited about my good timing and all the flow coming in, I yelled “FX IS BACK!” across the trading floor… A hopeful nod to the idea that the recent long and painful months of low FX volatility might be over. Then, I looked over to my chat log and saw one of my brokers had just typed “Hey Brent: NICE CALL MXN!”. A trader on the options desk congratulated me a few seconds later. I glanced at my P&L and saw one of my best days in the past two months. And then…

You can probably guess what happened next. Sad trombone. It all went terribly wrong. Here is the chart:

This is a phenomenon I call the Cheer Hedge. When you cheer for a position or yell or sing or fist bump on the trading floor—watch out. Your P&L is about to crash. The reason I call it the Cheer Hedge is that when I was a manager, whenever one of my traders started singing or cheering for a position, I always hedged the position in the management book right away. And the hedge always made money!

I now make this mistake less than I used to. But knowing the rules and following the rules is not always the same thing. That’s one reason trading is so hard.

Love this. Wish I had read in 2007!

On WallStreetBets and the various investing/trading/speculating subreddits, there is a saying in response to people gleefully posting screenshots of their unrealized gains and asking like “Should I sell or should I wait for even more gains?”

The answer is: If it’s good enough to screenshot, it’s good enough to sell.

Very much appreciated this post! It made me feel better about all the blunders I have made breaking my own (investing/trading) rules, and hopefully I will have more discipline going forward, but most likely the blunders will persist. Dang! One consolation is that when asked what was the secret to investing success, Sir John Templeton allegedly said “I usually sold too soon”.

Edit: I tried to find that quote, but instead it seems to have been from Bernard Baruch: “I made my money by selling too soon.”

“The market wants your money and it will figure all sorts of ways to take it”

Best line of the entire article.

You have burned a meme into my brain. Thank you!

Great advice, I gave in to this as well as an aversion to realizing taxable gains last year. No one ever went broke taking a profit is what my mentor told me…

Excellent piece; thanks!

Great article and great book. Thank you for both. The book has helped me and I’m not even a trader.

Wish I didn’t have to say this has happened to me. More than once. Damnable options. Too easy to go from 4X gain to zero value in a few weeks.