Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

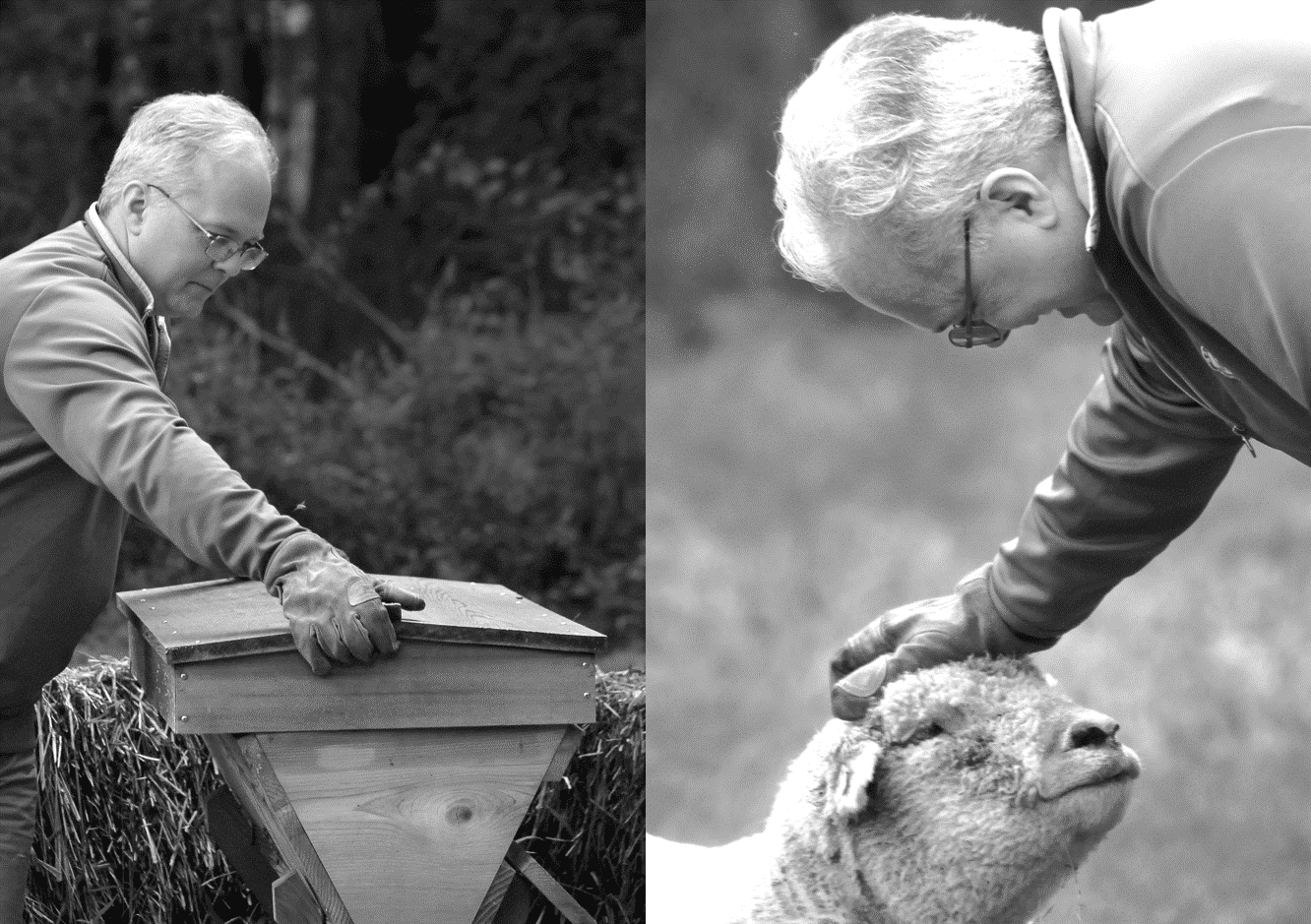

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

The inevitable result of financial innovation gone awry, which it ALWAYS does, is that it ALWAYS ends up empowering the State. When too clever by half people misplay the meta-game, that’s all the excuse the State needs to come swooping in and crush them, just as they are with Bitcoin today they did with Bear and Lehman in 2008. Installment #10 from Notes from the Field.

Everyone reading this note has, at one time or another, gotten scared about markets and decided to hedge their professional portfolio or personal account. The Game of Markets is changing. But should we be scared?

We’ve had a heckuva busy year at Epsilon Theory, so to ring out 2017 I thought it might be helpful to distribute a master list of our publications over the past 12 months. We’re long essay writers trying to make our way in a TLDR world, so even the most avid follower may well need a map!

What if I told you that the dominant strategies for human investing are, without exception, algorithms and derivatives? I don’t mean computer-driven investing, I mean good old-fashioned human investing … stock-picking and the like. And what if I told you that these algorithms and derivatives might all be broken today? You might want to sit down for Part 9 of the Notes from the Field series.

The pecking order is a social system designed to preserve economic inequality: inequality of food for chickens, inequality of wealth for humans. We are trained and told by Team Elite that the pecking order is not a real and brutal thing in the human species, but this is a lie. It is an intentional lie, formed by two powerful Narratives: trickle-down monetary policy and massive student debt financing. Part 8 of the Notes from the Field series.

On episode 26 of the Epsilon Theory podcast, we welcome back Rusty Guinn, our executive vice president of asset management, to talk about political markets — a topic just as important to Ben as capital markets. Be sure to also check out the companion pieces to this podcast: “Always Go To the Funeral,” “Sheep Logic,” and “Before and After the Storm.”

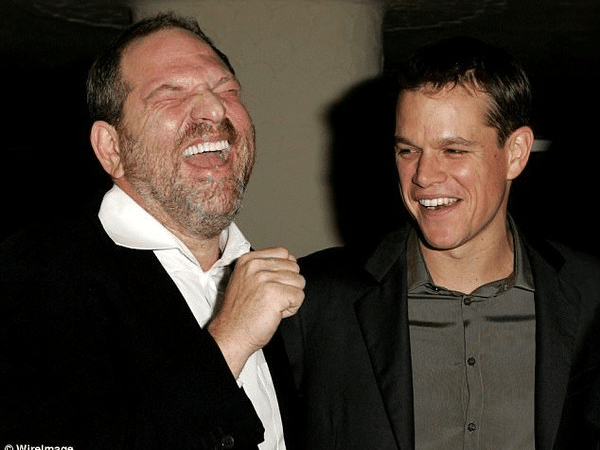

It was no great secret that Weinstein was and is a serial rapist. Apparently everyone in Hollywood was familiar with the stories. It was ubiquitous private knowledge, and pretty darn ubiquitous public knowledge. I mean, if you’re making jokes about it on 30 Rock, it’s not exactly a state secret.

But there was never a Missionary.

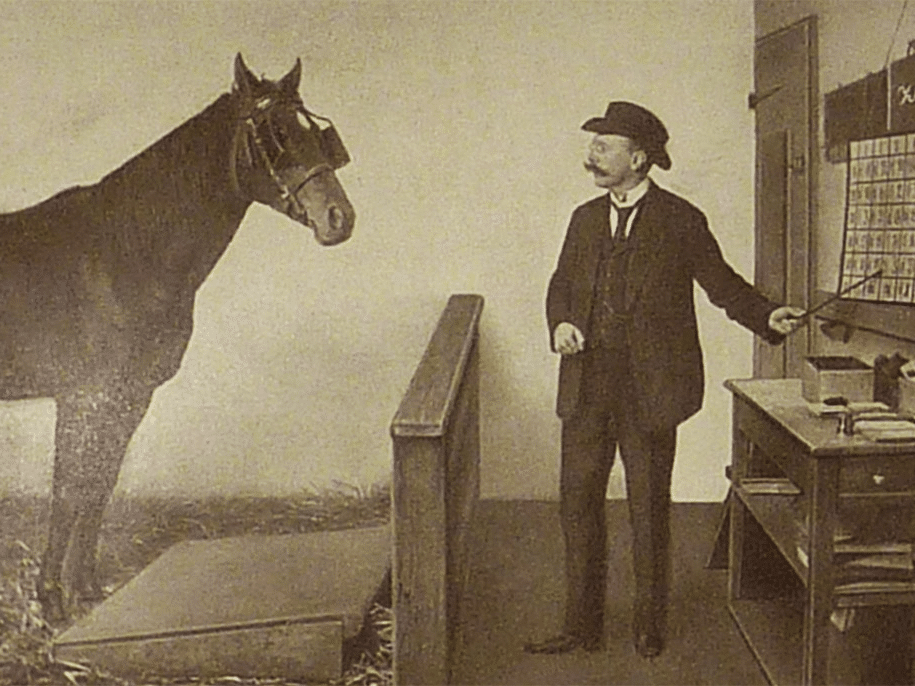

Part 7 of Ben’s Notes from the Field series reminds us that you don’t break a wild horse by crushing its spirit. You Nudge it into willingly surrendering its autonomy. Because once you’re trained to welcome the saddle, you’re going to take the bit. We are Clever Hans, dutifully hanging on every word or signal from the Nudging Fed and the Nudging Street as we stomp out our investment behavior.

On episode 25 of the Epsilon Theory podcast, we’re joined by Peter Cecchini, Chief Market Strategist, Head of Equity Derivatives and Cross-Asset Strategy at Cantor Fitzgerald, to discuss one of his recent notes, “Failure to Inflate.” As Peter writes, “The theories that guide monetary policy fail to explain why growth and inflation remain so low in developed economies.” Tune in to hear why this is and what might bring about higher inflation.

I’m limiting this week’s Rabbit Hole to three links which represent the rapid tick-tock of the trifecta of massively fast compute, AI algorithms and blockchain development as I believe that these are the top three technology mega-trends of the 2015 – 2025 period (ex-Life Sciences innovation).