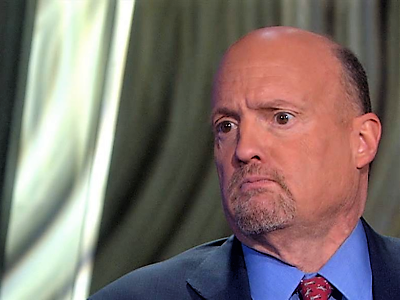

Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

We are immersed 24/7 in a Fiat World, where we are TOLD that inflation does not exist, where we are TOLD that wealth inequality and meager productivity and negative savings rates just “happen”, where we are TOLD we must vote for ridiculous candidates and buy ridiculous securities and borrow ridiculous sums.

We’re not Flat Earthers. Ha Ha! Those guys are idiots! Can you imagine believing that stuff?

No, we’re not Flat Earthers. We are Fiat Earthers.

Ladies and gentlemen, your Narrative-world assault words du jour … “sponsored content”, “democratic justifications”, “fishing expeditions”, “diversification”, “value investing”, and “growth of $1”.

The ET Zeitgeist, because if you don’t know who the sucker is at the poker table … it’s you.

Kashkari on Brexit, Cramer on Tesla, Breitbart on China, and “shorting unethical stocks” … all in a day’s work for The Zeitgeist!

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

Fiat News and narrative construction galore in today’s set of the most on-narrative financial media articles.

What links them all? Dopamine is a helluva drug.

It’s not impossible for market volatility to spike massively through some deflationary shock to the financial system like a China-driven credit crisis or an Italy-driven euro crisis. What’s impossible is TO GET PAID for taking out an insurance policy against the last war.

The new Zeitgeist is here! Now with all the snippets and twice the snark.

Every morning, we run the Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

Why are institutional investors in trouble with the new Zeitgeist of capital markets transformed into a political utility?

Because everything you think you know about portfolio diversification will fail. Because emerging markets are going to be crushed before this is over. Because everyone’s inflation-investing muscles have atrophied to the point of helplessness. Because you think long-vol and crisis-alpha are things.

Now that Jay Powell’s semi-annual Congressional testimony has finished up, it’s time for a brief walk down Memory Lane.

As with everything else in our Washington clown show, nothing really changes. This has all happened before.

Whether it’s ITT and Hal Geneen, or Teledyne and Henry Singleton, or GE and Jeff Immelt, or Berkshire Hathaway and Warren Buffett … at some point these companies get too big to continue growing through acquisition. There’s no more step-function P/E growth to be had on the E side of the equation. So they ALWAYS start focusing on the P side – the multiple – which is entirely a creature of narrative.

What killing active investment management? It’s not some monster hiding behind the rabbit. No, it IS the little white bunny. It’s the Zeitgeist of capital markets transformed into a political utility, innocuous on the surface … but with killer teeth.

How do you defeat the Zeitgeist? You don’t. The smart move, in fact, is to help the killer rabbit.

But there IS another way.