To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

That’s Salesforce.com CEO Marc Benioff chatting with his buddy Jim Cramer in the top photo, and on the bottom that’s Benioff and his fellow multi-billionaire Ray Dalio from their perch at Davos, where they appeared to tsk-tsk us about populism and wealth inequality.

More recently, both Benioff and Dalio have been making a full-scale media blitz calling for the “reform of capitalism”, with appearances on 60 Minutes (Dalio) and appearances on … well, anyplace with a microphone or a website (Benioff).

And then yesterday there was this:

Marc Benioff: We Need a New Capitalism [New York Times]

To my fellow business leaders and billionaires, I say that we can no longer wash our hands of our responsibility for what people do with our products. Yes, profits are important, but so is society. And if our quest for greater profits leaves our world worse off than before, all we will have taught our children is the power of greed.

It’s time for a new capitalism — a more fair, equal and sustainable capitalism that actually works for everyone and where businesses, including tech companies, don’t just take from society but truly give back and have a positive impact.

“To my fellow billionaires …”

I mean, that’s an all-time cringey line, and the rest of this piece is just as drecky and anodyne. If Benioff had concluded with something like “I believe that children are our future”, it would not have surprised me one whit.

But all snark aside, what did surprise me was my strong negative reaction to all this.

How is this being full-hearted of you, Neb, to react so negatively to a guy who I have every reason to believe is sincerely interested in doing good?

Now, to be fair, Marc Benioff has never been my favorite guy, as he epitomizes (IMO) the robber baron financialization ethos of the past 20 years in capital markets. Last year I wrote an entire note on the subject:

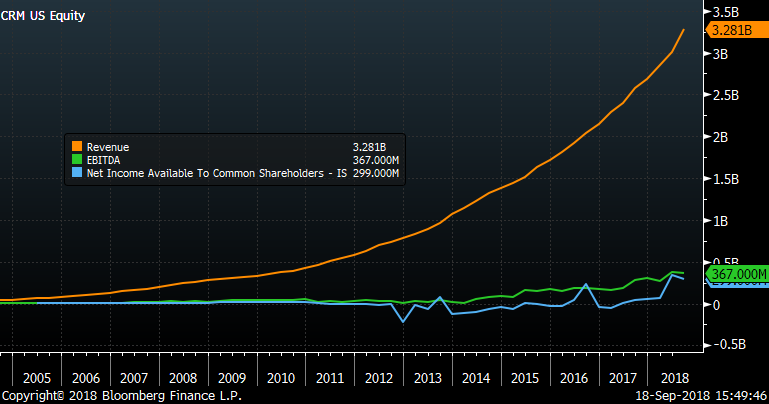

Since Salesforce became a public company, its revenues have grown at a wonderful clip. It’s EBITDA (earnings before interest, taxes, depreciation and amortization) and net income available to common shareholders… not so much.

Where have all the revenues gone, if not into earnings and net income? Well, if you read the Wall Street analyst reports about Salesforce “beating its earnings estimates” every quarter, you’d think that this chart above must be wrong. Why, Salesforce has lots of profits! Sure, it trades at a high P/E multiple, as befits a company with such great revenue growth, but the consensus Wall Street earnings estimate for this quarter is $0.50 per share. With 756 million shares outstanding, that’s about $375 million in earnings this quarter alone. What gives?

What gives (among other things) is stock-based compensation. The earnings estimates that you’ll hear the CNBC analysts talking about Salesforce “beating” or “missing” are pro-forma earnings. They do not include stock-based compensation. Actual money paid to employees? Yes, that’s included. Stock paid to employees in lieu of actual money? No, that’s not included. If you included stock-based compensation (and all the other pro forma adjustments) as actual expenses, which of course they are, then the consensus Wall Street earnings estimate for this quarter is not 50 cents per share. It’s 2 cents per share.

Since it became a public company in 2004, Salesforce.com has paid its employees $4.8 billion in stock-based compensation. That’s above and beyond actual cash compensation. For tax purposes, it’s actually expensed quite a bit more than that, namely $5.2 billion. The total amount of net income available for common shareholders? $360 million. On total revenue of $52 billion.

Note that none of this includes the money that Benioff himself made in stock sales from 2004 through 2010, where he sold between 10,000 and 20,000 shares of stock in the open market PER DAY, EVERY DAY, for SIX YEARS.

In the immortal words of Ron Burgundy, I’m not even angry. It’s AMAZING what Benioff has been able to pull off for himself and his people. Nor am I suggesting in the least possible way that any of this is illegal or immoral or ethically suspect.

What I am saying is that you can sell a lot of software if you pay your sales team handsomely and investors don’t care about the expense or the profitability of those sales.

What I am saying is that this is only possible within a vast Wall Street and media ecosystem that tells investors not to care about the expense or the profitability of those sales.

So sure, Marc, tell me again how your recipe for the “reform” of capitalism does ANYTHING to change that Wall Street and media ecosystem that allowed YOU to achieve an almost unimaginable inequality of wealth.

I say ‘almost unimaginable’ because Ray Dalio’s wealth is even less imaginable.

And while I have less of a problem with how Dalio made his (truly) unimaginable fortune, I have exactly the same mistrust for Dalio as I do for Benioff and all the other “fellow billionaires” who now scold us on “solutions” for ain’t-it-awful wealth inequality.

My mistrust is not because they are rich.

My mistrust is because Marc Benioff and Ray Dalio spent their adult lives becoming as unequally wealthy as humanly possible. It wasn’t an afterthought. It wasn’t a side effect of noble deeds. It wasn’t luck. They succeeded in their direct, lifelong goal. And good for them!

But now they have to own it.

Was SOCIETY wrong to have allowed you to achieve mind-bogglingly unequal wealth? Or is society just wrong now … going forward, as it were.

Were YOU wrong to have made the accumulation of mind-bogglingly unequal wealth your life’s work? Or are others just wrong now … going forward, as it were.

Unless Marc Benioff and Ray Dalio are able to say YES to either of those questions … that either the world was wrong to allow these great fortunes or they were wrong to seek those great fortunes … then you’ll pardon me if I think they should STFU on the wrongness of great fortune-building.

You know, a really smart guy once said, “It is easier for a camel to go through the eye of a needle than for a rich man to enter the Kingdom of God.”

Not because the rich man is a bad man. The rich man hearing this lesson followed all the Commandments diligently. He was not a bad man, and neither are Benioff or Dalio.

It’s hard for a rich man to get into heaven because the Money gets in the way of the Good. It’s hard because his Love of Money – the devotion of an adult life to making lots and lots of money, and the self-imposition of an Identity based on making lots and lots of money – crowds out his Doing of Good, and you can’t change that life and Identity without repentance.

Repentance. Such an old-fashioned word, like honor or shame. Words that are in really short supply these days, especially among Benioff and his fellow billionaires.

Everything has a price. Including the creation of great wealth.

Especially the creation of great wealth.

Avoid those who search for your soul in a moneybag. For when they find a penny in the purse, it is dearer to them than any soul whatsoever.

That’s from Martin Luther, writing in 1517. He was in a bit of a tizzy about the sale of indulgences, where rich people could buy a dispensation from the Pope so that they could get into heaven.

Same.

“So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value. Money is not the tool of the moochers, who claim your product by tears, or of the looters, who take it from you by force. Money is made possible only by the men who produce. Is this what you consider evil?” - Hunger and Freedom, The Ayn Rand Letter.

Love of money, I think, not money per se.

It’s the power money gives to the moochers that causes the damage. Think of John Galt, the 20th Century Motor Company, and the girl w the golden tooth.

Ayn Rand made the same mistake that many have - misquoting 1 Timothy 6:10. It actually says “For the love of money is a root of all kinds of evil. Some people, eager for money, have wandered from the faith and pierced themselves with many griefs.”

A few questions…why did these guys develop all of a sudden “consciences” and the derivative question…why now? What’s stopped them from just giving it away…their help to level the inequality using self as example? More importantly, what’s in it for them?

Lecturing us on inequality from your personal submarine is a bit tone deaf. Hearing Benioff spout off about “a new capitalism” is like a pedophile telling us we need a new approach to human sexuality. The system has been perverted and distorted and the folks that successfully took advantage of the Great Distortion are not all bad actors but it does not change what they did to create massive wealth. They lack authentic introspection and that will be needed in the coming “paradigm shift” as Ray calls it.

I’ll admit I had a pretty big man crush on Dalio a couple years back. Read literally everything he’s published and learned a lot. One of the last things I read was the essay on rising Populism on the Bridgewater website. About the same time, I saw Dalio’s appearance on 60 Minutes.

I got the distinct impression that Dalio was doing his best to take out a life insurance policy of the type Louis XVI wishes he had. Not the one that pays your beneficiaries when the proles chop your head off, but the one that saves your ass because “he’s alright guys, he’s one of us,” or at least"he’s on our side."

Pretty sure Jamie Dimon’s shopping for the same policy.