To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

“I think we all agree with you that more money for Main Street is needed. But maybe not in spite of the money to all of these companies and whatever that make up the economy, as well. More money is needed everywhere, perhaps.

Why does anybody deserve to get wiped out from a crisis created like this? It’s like a natural disaster! Why does anyone deserve to be wiped out? Wouldn’t that be immoral itself?”

“Mr. Clarida also dismissed a question about whether the central bank had created a “moral hazard” that encouraged risky investor behavior when the Fed moved quickly to backstop swaths of credit markets.

“This is entirely an exogenous event,” said Mr. Clarida, noting how the virus—not private-sector behavior—had forced widespread business closures and revenue losses.”

I, for one, am delighted to learn of the “Through No Fault of Their Own” exemption to stock market risk.

What a relief to learn that there’s no need for the plebes to hog all of the money, that so long as investment losses are from an “exogenous event” as opposed to “private sector behavior” – whatever the hell that means – the Fed will provide unlimited amounts of money – their words, not mine – to make the rich investors whole.

Could this possibly be a bad idea … some form of moral hazard … for the federal government to insure the rich investors against capital market losses by buying TRILLIONS of dollars in financial assets and providing TRILLIONS of dollars in interest-free loans liquidity facilities? You know, provided that these losses weren’t their fault.

LOL.

These are exactly the same people who paid off Goldman Sachs 100 cents on the dollar with their AIG losses in 2009. You think they give a flying fuck what you think about moral hazard or precedent or optics or fairness or decency? You think these oligarchs and their CNBC/fintwit Renfields care about ANYTHING other than getting their MONEY back?

Why, it would be immoral NOT to pay off the rich investors on their market losses. I mean, sure, let’s hope that Congress gets its act together and throws a bone to the poors, but c’mon, man. First things first.

Besides, you wanna know the REAL moral hazard here? Wanna know what sort of immoral behavior your sociopath “leaders” are worried about encouraging?

“Claiming the relief package will encourage people to stay out of the workforce, Graham told reporters that the bill “pays you more not to work than if you were working,” noting that it would provide the equivalent of $24.07 an hour in South Carolina versus the state minimum wage of $7.25 an hour. “If the federal government accidentally incentivizes layoffs, we risk life-threatening shortages in sectors where doctors, nurses, and pharmacists are trying to care for the sick, and where growers and grocers, truckers and cooks are trying to get food to families’ tables.”‘

I am not making this up. It’s the old Welfare Queen argument, all dolled-up for the age of COVID-19. Can’t make unemployment too attractive, you know … all those good-for-nothing poors will laze at home eating bonbons and sucking on the gummint teat instead of getting off their ass and doing an honest day’s work.

Meanwhile, back at the ranch, the Big 4 airlines will be accessing tens of billions of dollars in cash grants and easy 10-year loans, all explicitly designed to support entrenched management and equity shareholders. But hey, fret not, concerned citizen! Management will be prevented from making more stock buybacks until Sept. 30, 2021. That’s a whole eighteen months of no stock buybacks, so don’t tell me that Wall Street doesn’t understand shared sacrifice. And yikes! Management will also have to get by on their current salaries for the next three years, as hard as it may be to imagine the privation and human misery that will entail.

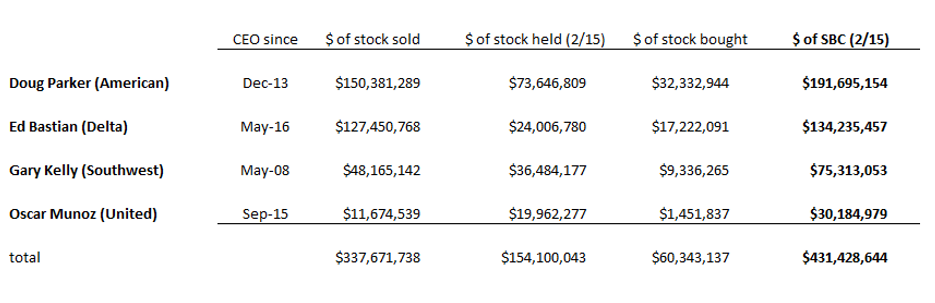

Oh yeah, here’s the stock-based comp, not including salaries and bonuses and deferred comp, for the CEOs of the Big 4 airlines since 2014.

One day, and soon, there will be a reckoning. Time to choose a side.

Well said Ben. Isn’t it odd that Senator Graham can identify one moral hazard but not the glaring lesson that should be obvious from all of this? Which is to say that many management teams have been terrible risk managers. That the real moral hazard has been incentivizing short-term returns (for stock-based comp reasons) over long-term results.

Why does anyone deserve to be wiped out? I’m reminded of a quote from Downton Abbey.

“My fortune is the work of others who laboured to build a great dynasty. Do I have the right to destroy their work or impoverish that dynasty? I am a custodian, my dear, not an owner.” - Robert Crawley

Why does anyone deserve to be wiped out? Because the management teams who have siphoned millions of dollars from their companies have been terrible custodians.

I agree with your conclusion but I think saying “Because the management teams who have siphoned millions of dollars from their companies have been terrible custodians.” actually undermines the message. Capitalism means you get the benefit of good luck and the downside of bad luck. Whether or not they were good/bad managers doesn’t really matter. Good managers should get better arm’s length market terms than bad ones - nothing personal. The government also shouldn’t bail out equity holders, and whether you were a good/bad custodian, outside of fraud, is sort of irrelevant.

Ben, I was so glad to read your note today! Turns out that, over the past decade, I’ve had some investments that, through no fault of my own, well, let’s just say haven’t turned out that well. And since Mr. Powell said on his interview with CNBC that the Fed is there to keep everyone ‘whole’, I’m planning on sending him an invoice for all my underperforming investments. (I’m pretty sure the markets I was trading in were ‘broken’ btw). Do you think it would be too much to ask that rather than simply being reimbursed for any losses, I would be given the return for the highest performing major stock or bond index for each year since I incurred my losses? Thanks.

“One day, and soon, there will be a reckoning. Time to choose a side.”

Hmmm. It’s not the sides that are the problem, it’s the game itself.

Not about sides, Ben. That just encourages people to blame each other and promotes divisive, us vs. them narratives. You know, the you only win if you get yours regardless of whether I get mine competitions.

Time to choose a different system. Time to choose a different philosophy. Time to make, protect, teach.

Keep passing the open windows. Haters gonna hate. Renfields gonna Renfield.

The part I struggle with is so many of these companies cant operate BECAUSE the Govt will not let them. AMC would love to be open and have some policies in place to limit patron contact I am sure. In Ky we have a travel ban , The Governor in Nevada mandated that all the hotel/casino’s close. Are we going to wipe the equity because Govt policies made it impossible for those business’ find their own solution? Talk about moral hazard? Our high functioning sociopaths will put that in their memory banks the next time someone opposes them. There is a 5th Amendment issue here IMO.

I don’t pretend to know the answer these are very complex times and I see both sides.

I certainly am not carrying water for the Airline CEO’s and their boards , I also do not think that idleness should pay better than work. I’m going to disagree. I still don’t see these things as mutually exclusive.

Chris - no disrespect but the fallacy in your argument is the implicit assumption that there is a game that relies on luck at all. Rather the way management (broadly defined) has rigged the game to ensure that luck has nothing to do with it. It is all about expropriation of shareholder wealth by rigging the game (there’s a Kobayashi Maru analogy here) through fake compensation committees relying on the compensation consultants with false comparisons to enable everyone to extract wealth. This isn’t about capitalism at all but rather about “Yay Capitalism!” as Ben and Rusty have been commenting on for many moons.

I don’t think that’s unreasonable at all!

Lawrence, I think you make a false assignment of blame. Yes, the governors of various states have issued orders that have required large and small businesses to close their doors in order to protect the citizens from exposure to a potentially deadly disease. They cannot be allowed to remain open because there is no practical way to reliably prevent them from becoming ground zero for the next SARS-CoV-2 hot spot.

The Governors did not order those business to leverage their operations based on everything going perfectly. They did not order them to run with limited cash reserves or without business interruption insurance programs. The Governors have not prevented them from going out into the equity and capital markets to find their own disaster relief. The boards of directors and the executives of those firms made the choice to operate their business as if everything would continue to be sunshine and roses. They put themselves in a position where investors and lenders do not feel comfortable providing additional funds to allow them to stay solvent while the health care crisis resolves itself.

Capitalism does not work if the gains are private and the losses are public. I don’t know where to place this pandemic in a probability distribution, but I don’t think we’re anywhere near a 6 sigma level event. (2.5-3 sigma seems about right). Pandemics have happened in the past. This is the 3rd major economic event in the 21st century. (9/11, '08-'09, and now this) It doesn’t seem unreasonable to expect a well run business to have contingency plans, cash reserves and liquidity for a negative economic event. I don’t think we as a society have done a good job of defining what level of catastrophe we expect people or corporations to plan for and withstand. I do think there is a lot of hypocrisy and double standards. If the Citizens United decision says that Corporations have the same first amendment rights as people (and Money = Speech) and you want to extend 5th amendment rights to them, then shouldn’t people get the same level of economic protection. If we’re going to prevent companies from going bankrupt “through no fault of their own”, then shouldn’t we do the same for individuals and families? Corporations are not people; they exist because we have passed laws that allow them to exist. If families have to plan for and weather hard times, shouldn’t corporations? It seems to me that an entity authorized by law for the more efficient allocation of capital should be expected to withstand a greater economic shock, without public assistance, than an individual or family.

I think we are doing that —-people just got a capital injection ,is that not what all this unemployment debate is about? Som did small business’ my fiancé s company got 300k and a clients restaurant got 200K …maybe we should let them all fail…again I’m not pretending to have all the answers.

I think we’re predominantly taking issue with publicly listed or private equity owned businesses getting public funds. Few are taking issue with true small businesses getting aid, and they are even being crowded out currently in the SBA loan space by publicly traded companies.