The Zeitgeist

The average American news consumer is exposed to far more headline text on news websites, social media apps and content aggregation sites than they are to the prose of the articles themselves. It should be no surprise, then, that more Fiat News and Missionary behavior exists in headlines than almost anywhere else. It typically gets a pass because, well, the whole job of a headline writer is to summarize what an article is about. But that’s precisely the task that lends itself so perfectly to telling us how we should think about the article. What’s important? What should our conclusions be? How should we feel about it?

I’ll give a free subscription to our free newsletter if you can find the fiat news language in this gem of a headline to a CNN news article.

Here are the companies rushing workers back to the office — and the ones that aren’t [CNN]

Aside from the general observation to take care in our content consumption habits, remember that it is the constant barrage of articles – and headlines – like this that reinforces our belief that the missionaries of the “Work From Home Forever!” narratives are dominating the field, at least in the Narrative war.

— Rusty Guinn | June 22, 2021 | 9:58 am

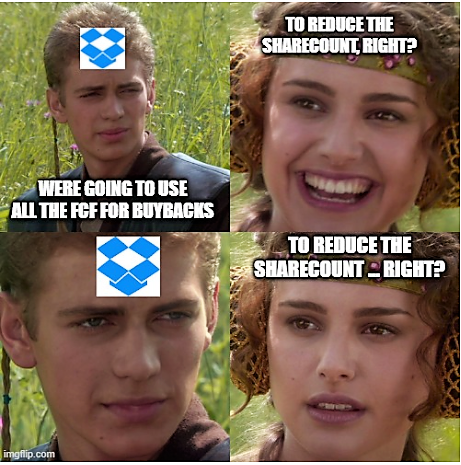

I saw this work of art on Twitter today, referring to Dropbox management using stock buybacks to sterilize their outrageous stock-based comp, and it made my day.

The Epsilon Theory notes I wrote about stock buybacks in 2019 are the most controversial thing we have ever published. They generated more anger, more arguments and more cold shoulders from the mainstream finance community than anything else we’ve done. Here’s my position:

When stock buybacks are used to sterilize stock-based comp (i.e., a company gives managers stock with one hand and buys it back from them with the other hand), no money is “returned to shareholders”. This is true whether or not management actually sells its shares into the buyback program.

Stock buybacks only “return cash to shareholders” to the degree that the buyback program reduces the sharecount. To the degree the buyback program does not reduce the sharecount, but simply sterilizes new issuance to management, it is purely a transfer of wealth from shareholders to management.

As the kids would say, it’s just math.

I think you would be AMAZED at the proportion of stock buyback programs that go towards sterilizing stock-based comp. I certainly was. I think it’s the greatest transfer of wealth in human history.

Not to founders. Not to entrepreneurs. Not to risk-takers.

Nope … to managers. To asset-gatherers. To fee-takers. To rent-seekers. To rakes.

Yep, Jamie Dimon is the rake. But then so is every S&P 500 management team. So is every Wall Street management team. That I’m aware of, at least. It’s the water in which we swim.

“Yay, Stock Buybacks!”

It’s amazing how many people get very angry at me when I say this.

Anyhoo … in addition to The Rake, here are the notes that started all the fuss.

— Ben Hunt | June 15, 2021 | 4:04 pm

In Epsilon Theory-speak, we use “Yay, Good-Thing!” as shorthand for a Narrative that takes a linguistic construction that we all agree is a Good Thing (something like “capitalism” or “freedom” or “democracy”) and turns it into a behaviorally powerfully argument for something that is decidedly not that Good Thing, but can be painted with other behaviorally powerful words into something that sorta kinda looks like that Good Thing if you squint really hard and you say the behaviorally powerful words loudly enough.

In rhetorical construction, “Yay, Good Thing!” is a variation on begging the question (in the correct way of understanding that phrase, where the conclusion is assumed in the proposition), or if you’re in marketing or sales you would recognize this as a variation of the assumptive close. The typically-but-not-always unspoken corollary to the “Yay, Good Thing!” narrative construction is “You’re not against Good Thing, are you?”, which is the linguistic stick to the “Yay, Good Thing!” carrot.

Socrates would call “Yay, Good Thing!” sophistry, and he hated the Sophists with a deep and abiding passion. Same. In the modern world, the Sophists are powerful government and corporate interests (aka the Nudging State or the Nudging Oligarchy if we’re going to continue in Epsilon Theory-speak), and the “Yay, Good Thing!” construction is their go-to narrative weapon in the Forever War of stripping away our autonomy of mind.

If you want to read more about our take on “Yay, Good Thing!” narratives, here’s the Epsilon Theory note that started all that.

Anyhoo … I was thinking about “Yay, Good Thing!” today because of how the “Yay, Environment!” implementation of this narrative device is being used to shape the politics of two issues that we’ve been writing a lot about recently: work and crypto.

“Yay, Environment!” is now one of the primary threads in the narrative-world battle over the future of work.

It’s a very powerful narrative thread. It’s a big reason why “Remote work is here to stay!” is winning this narrative war, and you are going to see a lot more “Yay, Environment!” rationalizations for remote work policies in the future.

Similarly, “Yay, Environment!” is now one of the primary narrative threads in the narrative-world battle over the future of Bitcoin.

Here’s the latest, from Elizabeth Warren, but you’re no doubt familiar with Elon Musk’s oeuvre here, as well.

And yes, this construction of “Yay, Environment!” does indeed speak the usually silent part – “You’re not against the Environment, are you?” – out loud. And yes, you’re going to be seeing A LOT more of this narrative. Not because it’s right. Not because it’s wrong. But because it WORKS.

It’s all just another weapon in the ongoing narrative war for Wall Street control and US Treasury visibility over Bitcoin.

— Ben Hunt | June 10, 2021 | 9:24 am

It wasn’t enough for ProPublica to do actual news reporting by publishing these tax records.

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

No, they had to tell you how to think about their news reporting.

They had to turn news into Fiat News by constructing a metric of “true tax rate” based on unrealized capital gains, because … you know … the actual true tax rate just wasn’t damning enough for ProPublica’s purposes.

To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.

We’re going to call this their true tax rate.

What is Fiat News? It’s the presentation of opinion as fact. It’s an interpretation of factual events projected with the same authority as the factual events themselves.

Fiat News (in this case the opinion that wealth in the form of unrealized capital gains should be taxed) is to hard news (in this case the tax filings of the very wealthy) what fiat currencies are to hard currencies.

We write a lot about Fiat News. Here’s the money quote from the note that started it all, Fiat Money, Fiat News:

There’s really no such thing as “real money”, i.e., gold and silver as a medium for exchange or a store of value, in existence in the world today. That used to be the meaning of gold, but those days are long gone. Today fiat money completely and utterly dominates all global commerce and exchange. Why? Because it supports the existential aims of government: taxation (sovereignty), price control (stability), and liquidity provision (growth). Without the invention of fiat money, global GDP today would be at … I dunno, maybe mid-18th century levels? Something around there, I’d guess.

Fiat news serves exactly the same existential aims of government, just in a less overt (but more powerful for being hidden) fashion. There’s just too much at stake for status quo regimes, what with modern referenda like Brexit and national elections like we just experienced in the U.S. and are forthcoming this year throughout Europe, for regime institutions to do anything other than double-down in their embrace and promulgation of fiat news.

Ten years from now we will be awash in “news” to a degree that we can hardly imagine today. That’s what happened with fiat money, and that’s what I think happens with fiat news.

The exponential growth in fiat news is still ahead of us, not behind us.

Gresham’s Law: bad money drives good money out of circulation.

Hunt’s Law: fiat news drives hard news out of circulation.

— Ben Hunt | June 8, 2021 | 9:42 am

Yesterday, one of Softbank’s largest portfolio companies – Katerra – filed for bankruptcy.

Katerra was at the heart of the relationship between Softbank and Greensill, and I think it’s the most viable path by which the Greensill fraud and financial crimes can be shown to be Softbank fraud and financial crimes.

You can read our full take on Greensill and Softbank here …

… but the skinny is this:

in 2019, Softbank put ~$3 billion into Greensill, turning it into the Vision Fund’s private bank. In 2020, Greensill lent Softbank portfolio company Katerra $435 million. When Katerra ran into trouble, Greensill wrote off the $435 million loan in exchange for 5% of common equity. LOL. A $435 million senior secured loan – which had been packaged and sold to Credit Suisse – was exchanged for a 5% equity position in a bankrupt company.

Credit Suisse has announced that they are filing suit against Softbank over this and all of the other Softbank/Greensill shenanigans. And in the WSJ article describing the Katerra bankruptcy filing, you can see how Softbank is going to try and spin this (all caps mine).

When Katerra ran into financial difficulties last year, Greensill forgave the loan.

SoftBank, in turn, invested $440 million into Greensill, EXPECTING THE MONEY TO GO TO CREDIT SUISSE’S INVESTORS.

Instead, Greensill put the proceeds of the SoftBank investment in a bank it owned in Bremen, Germany, according to a bankruptcy administrator’s report. The report said Greensill had used money it received from SoftBank, including the $440 million, to boost its bank’s capital position and fund Greensill’s overall operations.

The Softbank defense is going to be that their back door pay-off to Greensill for forgiving the Katerra loan was really intended to be a back door pay-off for Credit Suisse, but that rascal Lex just kept the money. Who knew!

As always, the best way to rob a bank is to own a bank.

— Ben Hunt | June 7, 2021 | 11:41 am

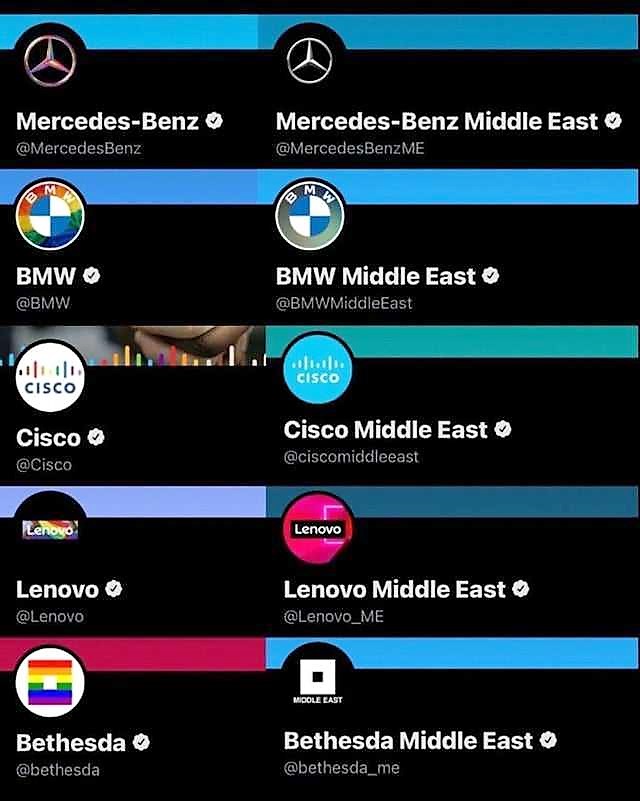

The Deadly Theatre of corporate signaling on Pride Month continues to run rampant, with feel-good rebranding pop-ups in all the geographies where this is a marketing advantage … and nothing in geographies where it isn’t.

What is Deadly Theatre? It’s a performance that is so deeply abstracted from its source material that it has become painfully, obviously artificial to anyone who is paying attention.

And yes, there’s an Epsilon Theory note on that.

— Rusty Guinn | June 4, 2021 | 10:34 am

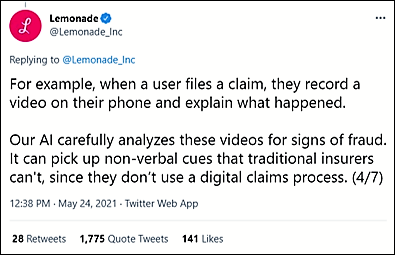

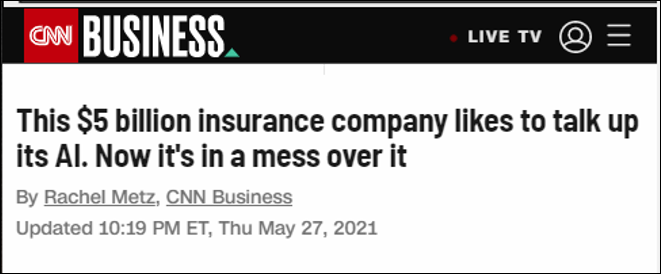

P&C insurer Lemonade (LMND) went public last year and now has a $5 billion market cap. They’re not just a sleepy insurance company, of course. No, no … they’re actually a cutting edge AI Company! TM.

They’ve deleted the tweet above and issued a classic non-denial denial on their blog:

Let’s be clear:

AI that uses harmful concepts like phrenology and physiognomy has never, and will never, be used at Lemonade.

We have never, and will never, let AI auto-reject claims.

LOL. So their AI Jim textbot + video recognition program (I am not making this up) isn’t using phrenology and it can’t auto-reject claims. No, no … the supervisor will reject the claim. BITFD.

— Ben Hunt | May 28, 2021 | 7:47am

Honestly, I kinda like Chamath-the-CNBC-talking-head. He’s iconoclastic and smart. A little too much Ben Shapiro / college debate team-esque with the “if I talk really fast maybe you’ll just ignore that jaw-droppingly stupid thing I just said”, but better than the usual CNBC fare regardless.

But Chamath-the-portfolio-manager? Raccoonery in action.

Here’s the Social Capital 2020 annual letter, published five months into 2021. There’s no mention of the disastrous year to date, which demands that you ask the core Epsilon Theory question: Why am I reading this NOW? But even taken on its own terms – hey, let’s talk about 2020 performance going into June, 2021 – this is just a complete crock.

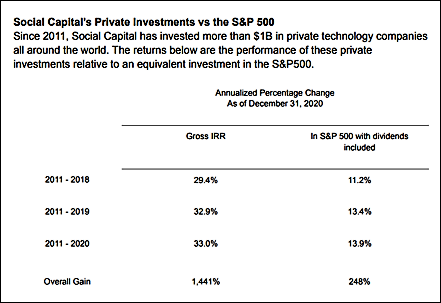

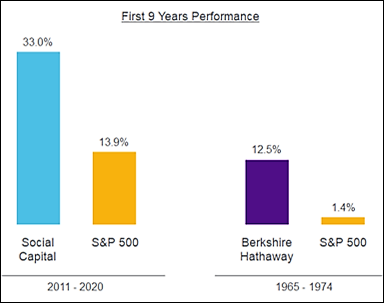

Chamath describes his fund’s performance as “gross IRR” over aggregated multi-year periods. We have no idea of the fund’s performance in 2020, even in “gross IRR” terms, but are required to compare 2011-2019 average annual return to 2011-2020 average annual return. Then Chamath compares his “gross IRR” to S&P 500 total return over the same periods. Then he compares that to Berkshire Hathaway over “the first nine years” of the two investment funds. LOL.

The final picture below – a tweet I put out after a Chamath tweet storm in early March – highlights the rest of his Raccoon math.

When I think about all the compliance pushback I’ve gotten on investor letters and marketing decks over the years … when I think about all of the SEC and regulatory proctology exams my funds have endured … this just makes me so angry.

— Ben Hunt | May 27, 2021 | 10:25 am

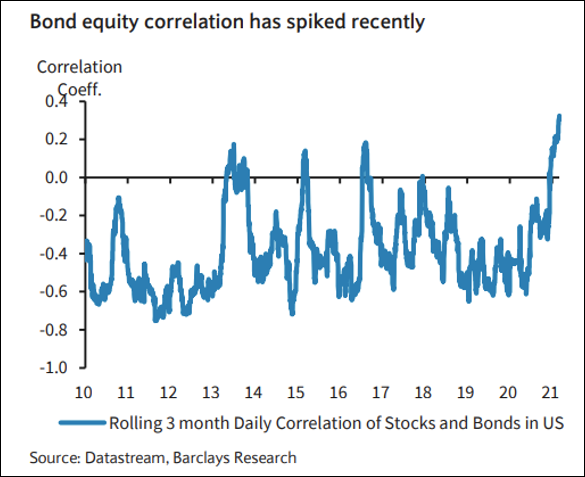

Good chart out from Barclays this morning showing the key problem for investors and financial advisors as inflation fears take root: bonds no longer provide portfolio diversification.

— Ben Hunt | May 26, 2021 | 11:35am

I think a homeschooling VMPT is a natural for the ET Forum!

On last week’s Office Hours conversation, ET Pack member Dan W. brought this up:

I would love to have a conversation about the state of public education in the US right now. My wife taught in public schools for ~10 years before deciding she wanted to stay home with our children (and homeschool them, something ET deserves a lot of credit for). Over the past year, several friends have reached out to us because they’re suddenly contemplating either homeschooling or… something different. It’s kind of heartbreaking – people in our circle are desperately looking for some kind of option that doesn’t seem to exist at present. I am not that interested in the politics of public education, but very interested in pack-sourcing some solutions for people that have had their confidence in public education shaken over the last year. Thanks!