Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories. On the weekend, we leave finance to cover the last week or so in other shifting parts of the Zeitgeist – namely, politics and culture. It’s not a list of best articles or articles we think are most interesting … often far from it.

But these are articles that have struck a chord in narrative world.

The Oppression of the Supermajority [New York Times]

This is an opinion piece, so it isn’t Fiat News per se; still, I hope that you have become aware enough in your content consumption practices to spot attempts to steer facts in a direction that is convenient for the author. This is an especially fascinating attempt, given that it seeks to diminish the existence of polarization on the basis of poll responses that would seem to imply that we all agree on rather a lot.

No kidding!

The argument is facile for several reasons. The first is that the primary evidence for the claim on which the entire piece hinges is an arbitrary and cherry-picked list of polls on policy opinions. The second is that those polls are terrible. Tell me whether you want me to prove that a ‘supermajority’ supports or opposes greater restrictions on abortion, for example, and I’ll get you the questions to make the polls sing whatever tune you prefer. The third is that the argument that polarization is the leading political issue of our time isn’t really based on strong fundamental differences in major policy opinions. It is based on the observation that we align ourselves increasingly with identity-based poles with dynamic and shifting underlying links to policy. Are we to deny that Trump is a polarizing figure simply because polls from three years ago would tell us that free trade and support for NATO were really popular among self-described conservatives? C’mon.

The main contention – that our policymakers don’t focus on issues that matter to people – is very obviously true. But the reason for it – that the shifting Zeitgeist from cooperative to competitive makes it far more politically expedient (fundraising, notoriety, support) to focus on the fault lines of identity and division – is equally obvious. The polarized abstractions of the Widening Gyre are the root problem, and poor governance is the outcome.

Not the other way around.

Risks And Rewards: From Rome To Manhattan [Global Finance]

Can’t escape some finance, apparently, even on the weekend.

My first temptation was to just roll my eyes and move on. My second temptation was to poke fun at the milquetoasty goodness here. Too cynical. Sure, Digitization with a human touch is a familiar death rattle of bankers the world over that have no earthly idea how they’re going to reach a skeptical, underbanked generation while keeping something akin to their current margins.

But the second bit, the tailored investment offerings? That’s a portion of how you actually do the first thing that most financial services firms are waving their hands at. But it won’t happen through product. Look, if your company’s name doesn’t rhyme with Schmanguard or Schmackrock, the profitability of your public markets asset management business is going to keep tanking for a very long time. Trading? Same, although most of that damage has already been done. There’s some market for less liquid, less scalable strategies, sure, but at industry scale, the market is screaming at all of us: Be in the business of advice or die slowly.

Am I saying that financial advice is immune to disruption? Yeah, actually, that’s pretty much what I’m saying. Spare me the “actually, our digital advisory platform is really making inroads with…” stuff. When it comes to the biggest pool of wealthy families globally, human advisers aren’t going anywhere.

Commentary: Concrete Steps Can Strengthen U.S. Democratic Institutions [US News]

OK, I’m sure this is all fine.

But let’s be real: the But our Democratic Institutions! Meme is just too good for both political poles. It’s a familiar charade. The political left stands in a circle beating their chests about the electoral college. Someone writes an article having discovered some magical way to make it go away. And they legitimately, seriously pretend that anything will ever happen to it. The political right stamps around in a circle about unregistered voters and imaginary widespread voter fraud, miserable at how they are subverting the legitimacy of our elections. The media jumps into the fray by happily conflating social media-based influence by agents of foreign powers with “manipulation of elections” to fire up both.

I’m sure the Secure Elections Act is just dandy policy. But as long as But Our Democratic Institutions! remains such an effective obedience collar, the vilification of those institutions will continue.

With mortgage rates rising, more homeowners are opting to remodel instead of move [Dallas Morning News]

Huh. It’s almost like…nah.

Something is seriously wrong with Trump [Salon]

OK, the CPAC speech was really weird.

But y’all: Right-wing truthers tracking Hillary’s every cough, determining how much of her body weight was being supported by security personnel after an apparent fainting episode is weird, too. Left-wing podcasters emphasizing they are not a mental health professional before engaging in a dozen paragraphs of armchair mental health diagnosis of Trump is weird, too.

This health fixation is an unsettling feature of the widening gyre. We cannot fathom that The Other could be smart, decent, thoughtful, un-evil or even mostly healthy. It’s certainly possible that they aren’t, but it takes a force of will to convince ourselves to even consider the alternative.

Wait, scratch that. None of this is really happening. Didn’t you know that 60% of Americans agree on privacy laws?

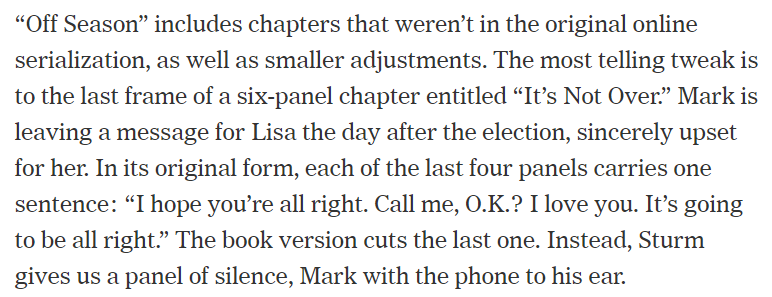

Graphic Novels in the Age of Trump [New York Times]

I really should have saved this one for Ben. He’s the kind of guy who cherishes graphic novels, while I’m the kind of guy who buys a Flash t-shirt at Marshalls because it’s $8, and stares blankly at the bartender when he asks me, “What’ll you have, Mr. Allen?”

But this poignant observation of the shift between the older online serialization and the later published book hit me this morning. There is a slow seep of humanity that runs out of us as we circle in the widening gyre. Something worth thinking about this weekend.

Start the discussion at the Epsilon Theory Forum