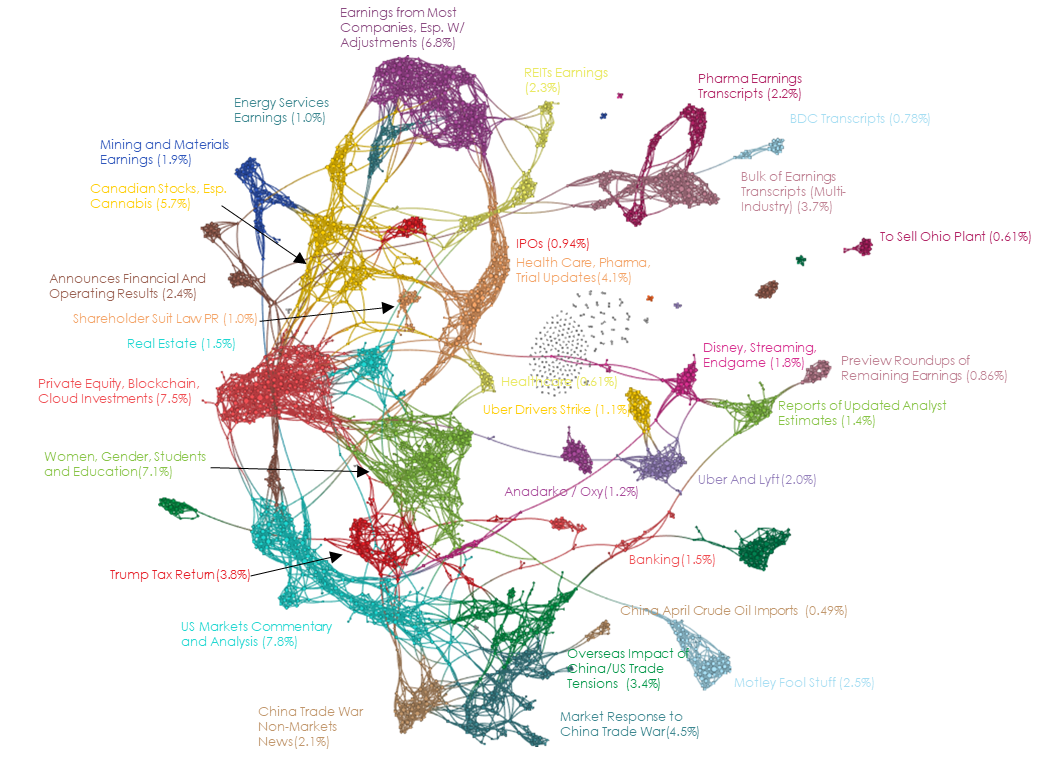

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

May 9, 2019 Narrative Map – US Equities

China Backtracked on Nearly All Aspects of U.S. Trade Deal [NY Times]

Process stories (what’s happening behind the scenes at the campaign / the White House / the locker room / the negotiations) are the original Fiat News. They are designed to make you angry and further the aims of whoever sourced the “reporting”.

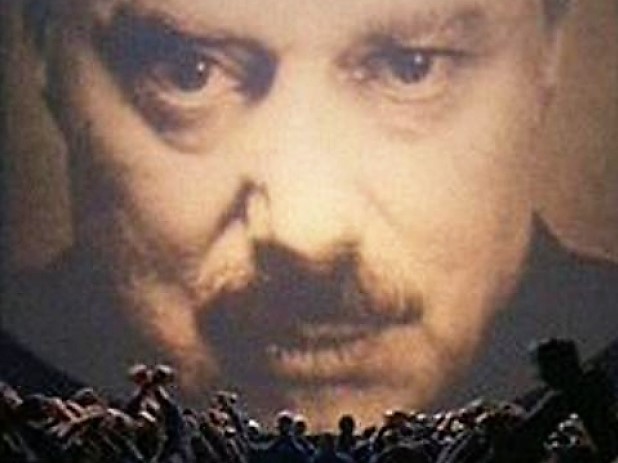

Who benefits from making you angry at China and their “reneging” on a deal that never existed in the first place? Who benefits from a narrative of the Lying Enemy Abroad?

Think about that before you engage in your Two Minute Hate.

Oceania has always been at war with Eastasia. Or was it Eurasia? I don’t seem to remember so well these days.

The NYT is running hard with this story because they think it reflects badly on Trump. LOL. It’s HIS story.

More evidence that the NYT is the worst metagame player in the history of the world.

Trade Talks Have Two Key Implications for Markets [Bloomberg]

Each Word of Trump’s Tariff Tweets Wiped $13 Billion Off Stocks [Bloomberg]

How To Trade The China Trade War [Forbes]

Once more with feeling …

THERE ARE NO ODDS IN A GAME OF CHICKEN.

It’s not 50/50. It’s not 60/40. It’s not whatever you think they are. You have no edge and there are no odds in the China trade talks. Just stop it.

Delays to Brazil’s Pension Overhaul Raise Economic Concerns [Dow Jones]

“My costs have increased 20% [in two years] because of the stronger dollar,” Mr. Carvalhal said in a bare-bones office in his sprawling warehouse stocked with Argentine wine, German beer, Spanish cheese and other imports. “How can I pass that along to the consumer if the economy is tanking?”

The only bright spot for him and millions of other businesspeople and consumers comes from Brazil’s central bank, which on Wednesday is expected to hold its benchmark interest rate, known as the Selic rate, at the historic low of 6.5% where it has been at since March, 2018.

The dollar is now stronger than it was when the world was going to end in January 2016.

What do you think the odds are for a Shanghai Accord today? LOL.

Dimon Says Yields `Extraordinarily Low’, 4% Wouldn’t Be Bad [Bloomberg]

My president.

Lyft’s stock is plunging, flirting with a record low after its first public earnings report fails to impress investors [Business Insider]

I’m old enough to remember when a company wouldn’t go public until it was ready to rock with a stellar first public earnings report to confirm all those sell-side firms initiating coverage with a Strong Buy.

Business Genius Trump Lost More Money Than Anyone in America Between 1985-1994 [Rolling Stone]

Oooh, they’ve got him now! Burn … sick burn!

Yawn.

My favorite subcategory of Process Stories are what I call Feeling Stories, explaining what somebody important REALLY thinks about an issue. So many hops in that game of telephone that the reader can’t help but get played by somebody.

BTW, Nadler has the look of a man who is looking around the table and can’t find the patsy.

More evidence that the NYT is the worst metagame player in the history of the world.

I think this is important and deserves a more detailed discussion.

Is the Times just following the same behavior patterns of the rest of the MSM or do they really stand out as substantially worse than the cable TV networks and other national publications? My gut says you see the NYT/WSJ/CNN fixate on slightly different types of manufactured narratives (because of audience/ideological differences) but that the underlying problems are virtually identical. My gut says that the widening gyre of public debate is largely due to the willful ignorance of these outlets as to how they are being manipulated by the various groups selling their manufactured narratives. But would love to get your thoughts and see more hard evidence.

Feeling stories reminded me of this SNL Cold Open (https://youtu.be/Z8UZn7PmyXc) which at some point contains the hilarious line:

“You can’t dismiss that idea simply because it isn’t true and sounds insane. In fact, let’s add that to our list of “Feel Facts,” which aren’t technically facts but they just feel true.”