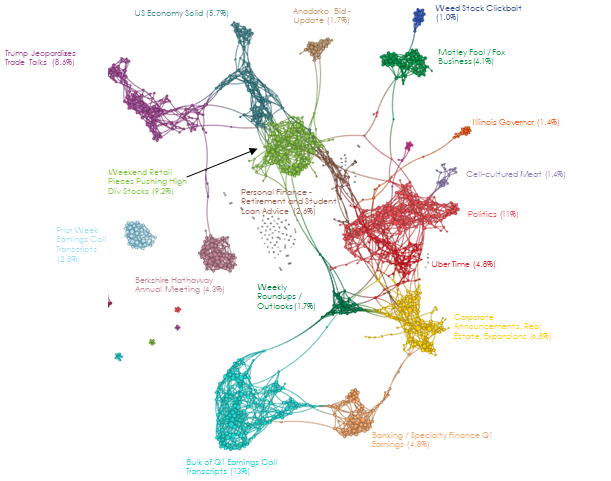

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

May 6, 2019 Narrative Map – US Equities

Everything You Missed At This Weekend’s Berkshire Hathaway Meeting [Fortune]

Warren Buffett and his business partner Charles Munger held court for more than five hours at the Berkshire Hathaway annual meeting, fielding questions from shareholders and imparting their views with their usual wisdom, wit and down-to-earth personalities.

It’s like in Frank Herbert’s Dune books where Leto Atreides ultimately becomes a near-immortal sandworm.

The transformation of Warren Buffett into a near-immortal Cartoon is now complete.

Coursera Gets $103M in Series E from New and Existing Investors [Press Release]

Since raising a Series D in June 2017, Coursera’s learner base has grown from 26 million to 40 million. The 3,200 courses and 310 Specializations available on the platform are increasingly stackable, enabling learners to acquire new skills and earn valuable credentials while also building a pathway towards a full degree. The portfolio of degrees on Coursera has also grown to 14 world-class degrees from the top universities in high-demand areas of business administration, data science, computer science, and public health.

The business model isn’t about knowledge, it’s about credentialing.

How To Solve America’s $100 Trillion Problem Of Wealth Inequality [Forbes]

It turns out that maximizing shareholder value as reflected in the current stock price was not only bad morally and socially: it was also bad economically and financially. It doesn’t work, even on its own terms.

Why have so many of the biggest and most respected companies in America gotten involved in wealth extraction on such a massive scale? Why is it still tolerated by regulators?

You’re going to see a lot more of this sort of stuff going into the 2020 elections. It’s all part of the Zeitgeist to transform capital markets into political utilities, and it’s all based on that final, chilling question: “Why is it still tolerated by regulators?”

As if the core small-l liberal ideals of free markets and free elections were things to be doled out from a central pot.

As if our liberty extends only as far as the State tolerates it.

You think that this is the path to defeating the Oligarchy, but I tell you it only makes it stronger.

IPOs bring tax jackpot for California; can lawmakers resist? [Fox Business]

The state has a projected $21 billion surplus in the first year of Newsom’s administration, and that’s without factoring in money from the IPO wave. Former Gov. Jerry Brown began his administration with a deficit, and he frequently clashed with fellow Democrats who wanted to spend more while he wanted to save it.

As he left office, with the California economy humming, Brown warned Newsom might have a tough time convincing the Legislature not to drastically increase spending.

Did you know that California has a budget surplus? I didn’t.

The American entrepreneurial spirit and its resulting productive growth can survive ANYTHING … even the doubleplusgood CalSocs in Sacramento … even the Insane Clown Posse in the White House … even the Mandarins at the Fed.

It’s the only thing that keeps me from slipping into political despondency, and the next subject of a long-form ET note, “A Song of Ice and Fire”.

Junk bond market rally turns Chinese borrowers more aggressive [Reuters]

A surge in junk-rated bonds has made Chinese borrowers more aggressive, with select ones succeeding in cutting their costs for repaying bonds early, a change from standard practice that worries some investors and bankers.

Welcome to the Cov-Lite World.

Resistance is futile.

Market Fallout in Charts: Investors React to U.S. Tariff Threat [Bloomberg]

Stocks Slump as Trump’s Threat of New Tariffs Scares Investors [New York Times]

US-China Trade Talks Tensions Escalate As Trump Threatens 25% Tariffs On $200B Goods [IB Times]

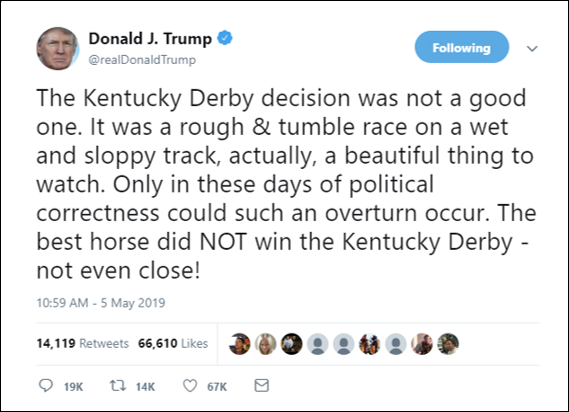

Here’s the tweet that got everyone so exercised.

Wait … you mean that’s not the tweet?

No, I’m pretty sure it is. Or rather, from an Epsilon Theory perspective this tweet about the Kentucky Derby is exactly the same thing as the tweet about China tariffs.

If you’re buying or selling the market because the China deal is on or because the China deal is off, you’re no different from everyone who had a ticket at the Derby.

What if the same dynamic applies to the U.S.’s pay-to-play political industry where the government promotes or approves of something through a policy, subsidy or financial guarantee due to private sector influence. Benefits accrue only to the purchaser of the network effects, and consumers, induced by the false signal of large network size, ultimately suffer from asymmetric risk and experience what I’m calling a loss of intangible net worth for each additional member after the “bandwagon” wares off. https://www.lbs.co/blog/why-us-political-risk-should-be-a-factor-in-portfolio-risk-budgets