Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

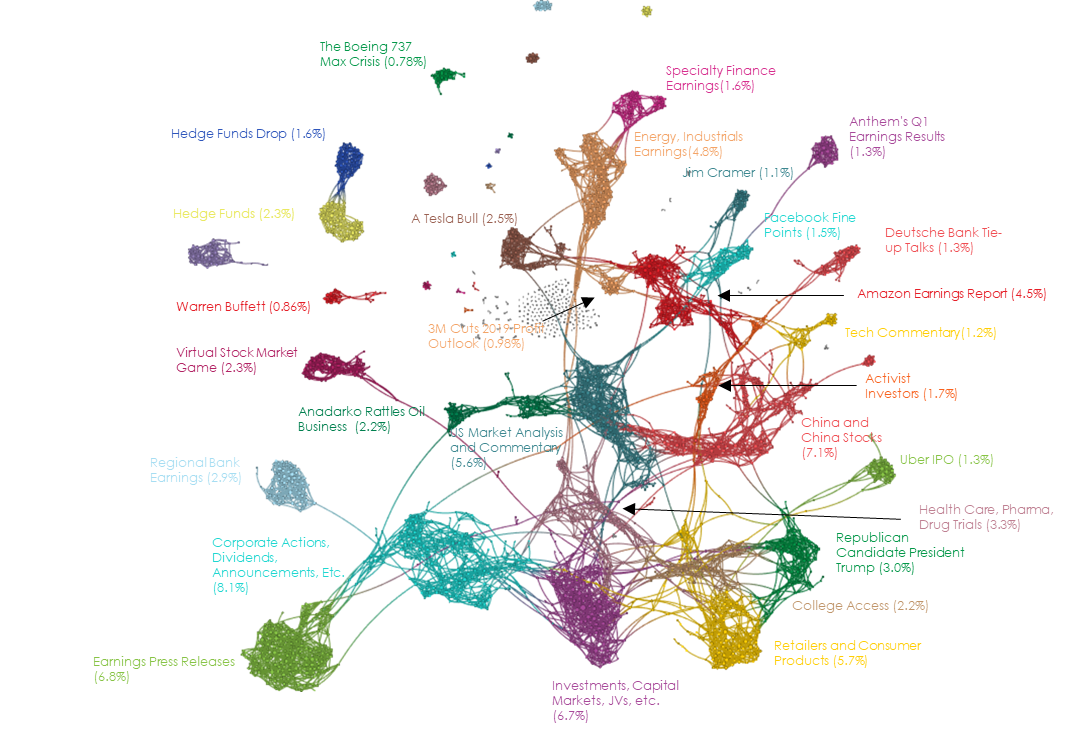

April 26, 2019 Narrative Map – US Equities

American IRA Discusses Does Volatility in the Stock Market Demonstrate the Value of the Self-Directed IRA? [Press Release]

“The stock market is a powerful vehicle for wealth creation,” said Jim Hitt, CEO of American IRA. “But it’s not the only vehicle. Why should an investor trust all of their eggs in the basket of the public stock market when there are so many different avenues for building a powerful retirement portfolio? There may even be other options for them, such as using leverage with real estate, that they did not know they could do with a retirement account. These methods help produce wealth that lasts even when the stock market is down.”

Yeah, we’re at that point in the cycle where you will be told about all the wonderful opportunities provided by levered private REITS.

For your IRA.

Because of all this craaaazy volatility in the stock market.

Snap Surges as Android Improvements Driver User, Revenue Growth in First Quarter [The Street]

Download Now: Get Jim Cramer’s Top 5 Mergers & Acquisitions Candidates for 2019 Special Report. Get special report

I’d tell you more about the Very Exciting News from Snap, but first I had to wade through these “special reports” from Jim Cramer.

It’s the Rule of Five.

Top Ten lists don’t work in a TL;DR world, and Top Three … well, you clearly aren’t getting value if you’re only getting three of anything.

Google Announces More Policy Changes After Employee Protests [Bloomberg]

Google unveiled another round of policy changes to address employee concerns about misconduct at the world’s largest internet search company.

Staff can now lodge complaints and concerns about harassment and other misconduct at work via a new website. During meetings related to investigations, workers will have more freedom to bring along colleagues to support them. There’s also a new program to provide better care for employees during and after investigations, the company said Thursday.

First I was going to write something about how you start off by creating a corporate culture, but then sometimes the corporate culture turns around and creates you.

And then I was going to write some reference to The Culture sci-fi books by one of my all-time fave authors, Iain M. Banks.

But finally I was struck by something else entirely.

Google is the new Ma Bell.

One Big Argument for Dollar Strength: It’s Expensive to Short [Bloomberg]

Something Has Spooked the Currency Markets [Bloomberg]

The world’s largest market isn’t buying the feel-good narrative that investors have embraced this week with global stocks sitting on the cusp of setting a record high and the riskiest corporate bonds soaring like the world economy is back in synchronized growth mode. But traders in the $5 trillion-a-day foreign-exchange market are flocking to the dollar, yen and Swiss franc, which is a bit odd since those “haven” currencies normally outperform when the outlook is worsening, not improving.

What’s spooked the fx markets?

It’s every DM central bank for itself today, ladies and gents, so if you’re an EM currency you should be afraid. Be very afraid.

Wealth hitting all-time highs, unemployment rate reaching all-time lows under President Trump [Fox Business]

That’s Kevin Hassett, Chair of the Council of Economic Advisers, describing for reporters the President’s preferred level of Fed independence. Or maybe he’s describing optimal interest rate policy … I get it mixed up.

Hassett’s previous claim to fame before becoming Donald Trump’s CHEIF ECONOMIC ADVISUR was writing the not-at-all silly book “Dow 36,000” back in 1999.

How could “leverage with real estate” go wrong in a retirement account that can’t be refunded?

“Google is the new Ma Bell” yes, but Ma Bell existed in an era of (for the most part, post-Depression) humbled employees; Google exists in the snowflakes-are-us era of employees. Good luck with that Google.

What if Ma Bell did a better job of owning the fruits of Bell Labs? Yes, Google is Ma Bell. The utility and the labs.