Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

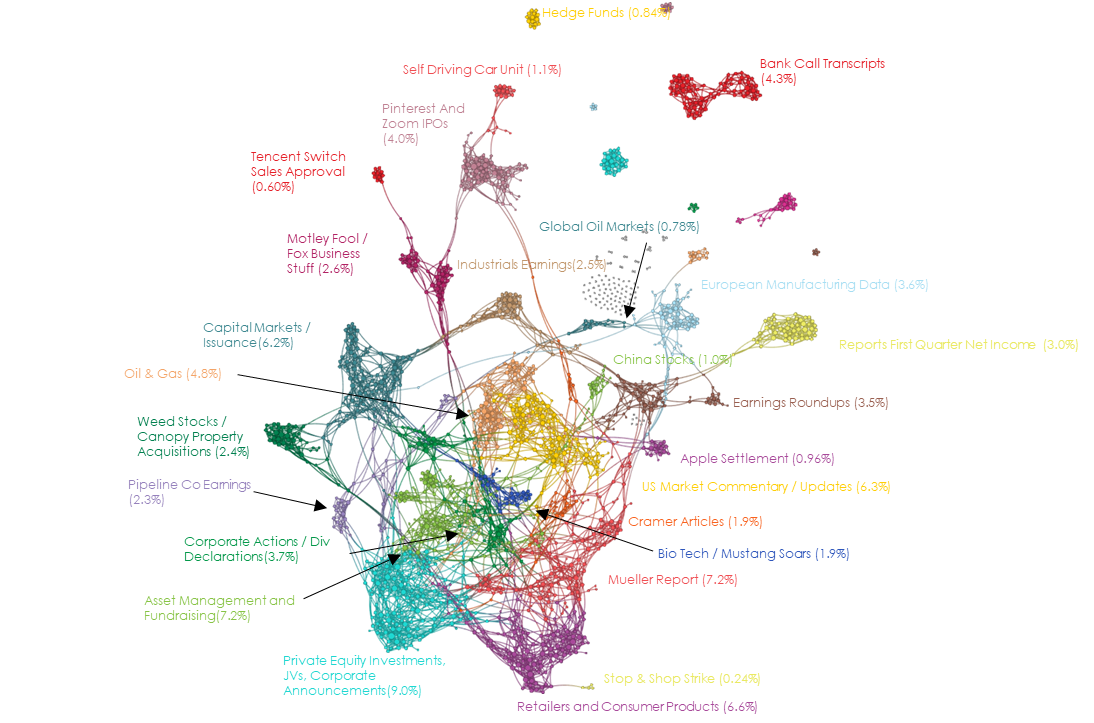

April 19, 2019 Narrative Map – US Equities

Debate rages over practicality of modern monetary theory [P&I]

General “Buck” Turgidson: Doctor, you mentioned the ratio of ten women to each man. Now, wouldn’t that necessitate the abandonment of the so-called monogamous sexual relationship, I mean, as far as men were concerned?

Dr. Strangelove: Regrettably, yes. But it is, you know, a sacrifice required for the future of the human race. I hasten to add that since each man will be required to do prodigious… service along these lines, the women will have to be selected for their sexual characteristics which will have to be of a highly stimulating nature.

Ambassador de Sadesky: I must confess, you have an astonishingly good idea there, Doctor.

That’s actually not a quote from the Pensions & Investments article, but it’s a pretty good approximation of the MMT “debate” when it’s held on MMT turf … meaning when the discussion accepts the language and terminology of MMT as its starting point and moves onto questions of practicality.

It’s what Socrates called sophistry, and he knew a thing or two about debates.

Here’s the Epsilon Theory effort to call MMT by its proper name:

China Stimulus Not Good Enough. Beijing Planning Even More. [Forbes]

Good thing you didn’t short China.

No, you didn’t short China, but if you are an active EM portfolio manager, you are almost certainly underweight China.

Rusty discussed this at length on our last ET Live! webcast.

What Moore And Cain Would Bring To The Federal Reserve Board [Forbes]

Cain’s greatest contribution to the Fed would be his business perspective. Historically, Fed governors have been academics and finance professionals. Main Street is absent. Cain, in contrast, has large corporation experience (in Minneapolis) and worked with pizza franchisees, which are mostly small businesses. Having a good handle on the challenges that small businesses face is a plus.

TFW … you’re a “Leadership Strategy” Forbes.com contributor and you’ve got to say something to get on the Weekly Traffic Report.

Being a Forbes.com contributor is the new being an adjunct professor at a community college.

Pinterest and Zoom Debuts Point to ‘Bull Market’ for IPOs [Fortune]

I have no idea where Lyft goes from here. Maybe up, maybe down … I really have no idea. But I will tell you that this is classic wall-of-worry narrative creation to set up a resolvable “crisis” for the overall market.

That’s actually not a quote from this Fortune puff piece, either, but from an ET Zeitgeist last week.

Here’s an actual article quote:

The new IPOs are “great for the capital markets, which need high-tech growth companies,’’ Santosh Rao, head of research at Manhattan Venture Partners, said in an interview. “The market is yearning for growth stocks. These companies are very good, very disruptive.”

Huzzah, market crisis averted! We’re saved!

DAX Subdued On Growth Concerns [RTT]

German stocks were subdued on Thursday ahead of the Easter holiday break. Most European markets will remain closed on Friday and Monday for the Easter holiday.

European markets are closed for 4 days, and judging by volumes on Thursday they might as well have been closed yesterday, too. Fair enough. But what always surprises me is that when European markets are closed, senior European investment professionals don’t work. At all. They don’t come into the office. They don’t catch up on work from home. They just don’t work. It’s a degree of separation from work that is literally unthinkable for senior American investment professionals, all of whom are absolutely working from home today.

I’m not saying that this difference is good or bad. I’m just saying that it IS, and the difference is not mean-reverting over time.

I saw my first “The conservative case for MMT is…” piece earlier this week. You betcha, this quote from Strangelove and Ben’s “its going to make landfall” quote popped into my head immediately. That and “We are so f’d.”

The argument that the Lyft situation is a manufactured crisis is really compelling. What I would love to understand better is whether the manufacturing is being done by a party that has a deliberate plan to make it play out in a certain way, or if the whole thing is kind of emergent from the actions, interests, moral hazards of a bunch of independent actors, none if whom is really aware of the “plan”.

It’s easy to picture the cliche of a smoke-filled room, but the alternative is actually scarier to me.