Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

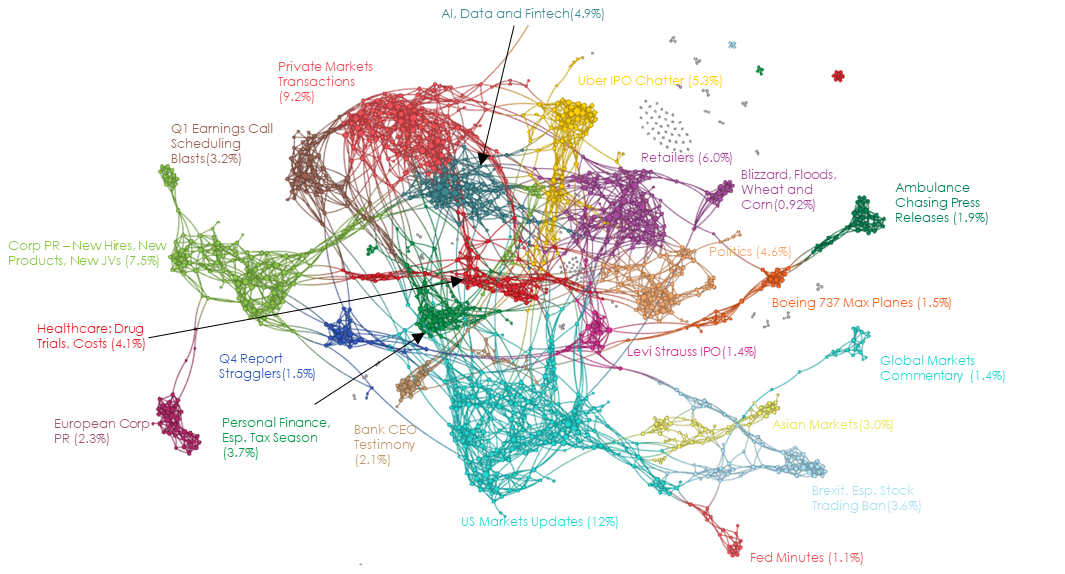

April 11, 2019 Narrative Map – US Equities

How People Redirect Their Careers After Getting Laid Off [Harvard Business Review]

Leading off this morning on the Zeitgeist, an HBR article on “the career trajectories” and “mourning patterns” of former Lehman employees.

We call these two groups “Recreators” and “Repurposers.” Recreators tend to find similar positions, in comparable types of organizations and industries. For Lehman bankers, this meant securing jobs at other financial institutions, often as bankers. Repurposers, by contrast, typically leave organizational careers to pursue entrepreneurial opportunities, in finance or other fields. For Lehman bankers, this involved launching various types of new businesses, including for example travel, education, and e-commerce ventures.

I think we need a third category for the “mourning pattern” of Dick Fuld. I’m going to suggest Regrifter, but only because ET is a suitable-for-work publication.

Also, I made a promise to myself that whenever someone wrote an article about the Lehman collapse, I would reprint this:

If you don’t know what Repo 105 was, you should. If you do know what Repo 105 was, you should find someone who doesn’t and tell them about it.

Why Aren’t Markets Worried About Profit Warnings?: Taking Stock [Bloomberg]

One possible reason for the strength is that earnings-per-share expectations seem to be on the rise after several months of decline. After a rally driven by dovish central banks, easing trade tensions and signs of a bottom out in PMIs, companies may need to show some profit growth. At the moment, the expectation bar is still quite low.

BREAKING: 67% of S&P 500 Cos Beat Earnings Expectations in Q1

Tomorrow’s headlines today … just another service provided by the Daily Zeitgeist.

ECB statement after policy meeting [Press Release]

Based on our regular economic and monetary analyses, we decided to keep the key ECB interest rates unchanged. We continue to expect them to remain at their present levels at least through the end of 2019, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2 percent over the medium term.

If you can only read one book on the end of an ancien regime and the magical thinking that ALWAYS takes place in its wake, you must read Ryszard Kapuscinski’s The Emperor. Kapuscinski chronicles the final years of Haile Selassie’s reign in Ethiopia from the inside out, interviewing dozens of courtiers to paint a first-hand portrait of an entire society lost in the fantasy world of Collective Solipsism.

Selassie and his Inner Party maintained the fantasy for years after it lost all connection with reality, so that a mighty fleet consisted of a single ship with a malfunctioning engine, promotions and medals were conflated with real-world power and influence, and bad people and bad ideas were constantly lauded and rewarded to keep hard questions from being asked.

The last years of Selassie’s rule are more than a parable for our times … they ARE our times.

Here’s the long-form ET note on all this …

A Deep Dive into Deep Learning [Scientific American]

Really good intro article. Read this and at least you’ll be able to nod sagely at your next cocktail party. Or the next Context hedge fund speed dating conference, which is really the same thing. I’ll highlight one quote:

It turns out that the learned features (outputs of neurons at the bottleneck) that emerge in this process are often useful. They can be used, for example, for building a supervised predictive model or for unsupervised clustering.

The network maps you see from our NLP partners at Quid are an example of unsupervised clustering. The investment applications we are building at Second Foundation Partners around, say, sector rotation are an example of a semi-supervised predictive model.

For more, here’s the ET note …

Lyft’s stock slide casts long shadow on Uber’s IPO [Reuters]

Lyft shares ended on Wednesday down 11 percent at $60.12, well below their $72 IPO price. Lyft was the first in a string of technology IPOs expected this year, including food delivery service Postmates and smart exercise bike Peleton.

Lyft’s poor stock performance bodes ill for these IPOs, especially for companies like Uber with no profits to show.

I have no idea where Lyft goes from here. Maybe up, maybe down … I really have no idea. But I will tell you that this is classic wall-of-worry narrative creation to set up a resolvable “crisis” for the overall market.

Start the discussion at the Epsilon Theory Forum