Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

I’m channeling my inner MST3K with the comments here. Premium subscribers should feel free to join me in the Comments section (but only if you know what MST3K is!), and I’ll reprint the best ones in an upcoming Mailbag note.

UK’s May courts support for Brexit deal with workers’ rights offer [Nasdaq.com]

Brexit really doesn’t get my spidey-sense tingling. It’s a garden-variety deflationary shock for global equity markets, exactly the sort of thing that the entire arsenal of central bank firepower accumulated since 2009 was designed to defend. Brexit is a classic brick in the wall-of-worry that markets must have to climb higher.

I mean, when Neel freakin’ Kashkari is using Brexit as a “reason” for the Fed to be “patient” and MORE accommodative … nuff said.

What DOES interest me is the political gamesmanship around whatever happens here, which is what this article is talking about — Theresa May’s efforts to pick off a few Labour MPs by promising some sort of “workers’ rights” deal. Seems unlikely on the surface, which makes me think that May is already looking ahead to general elections and is using this as part of a larger Tory v. Labour metagame. Everyone seems to have concluded throughout this entire Brexit fiasco that May is an idiot. She’s not.

Healthcare stocks slide amid ‘Medicare-for-all’ proposal, Cohen hearing [S&P Global]

I see this all the time in the nexus between market-world and narrative-world … people who are immersed in a particular area of market-world, like a sell-side healthcare analyst, are almost always surprised by the market reaction to a policy announcement or initiative that “we knew was coming.”

THIS is the Common Knowledge Game in action. It’s not what you know about what’s coming down the pike that moves markets. It’s not what everyone knows (the consensus) that moves markets. It’s what everyone knows that everyone knows that moves markets. And that everyone-knows-that-everyone-knows knowledge formation occurs if and only if a Missionary makes that statement through a media megaphone.

Who’s a Missionary? A group of House Dems announcing a Medicare-for-all bill (M4A, as the cool kids would say) bill. Not a BMO healthcare analyst.

But therein lies the opportunity.

Jim Cramer Explains How Short Sellers Manipulate Stocks – Like Tesla (TSLA) [Cleantechnica]

So this article was written by one of Elon’s fanboys, not by Jim Cramer. It’s taking one of Cramer’s MANY video “explanations” of how those darn shortsellers attack an innocent stock, and repurposing it for the excuse du jour on “why” TSLA has had a bad week.

The constant Cramer shtick on “market manipulation” by “algos” or “shortsellers”, which has been going on for YEARS, is just too tiresome to address at length here. Plus, of course, there’s an Epsilon Theory note for that! It’s an oldie-but-goodie that I’ll have to dust off and revise sometime soon, but it still reads awfully fresh – Wherefore Art Thou, Marcus Welby?

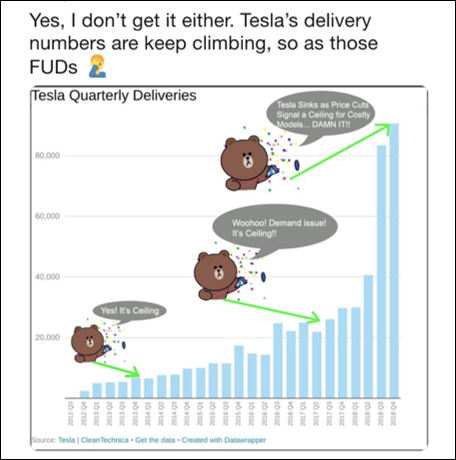

As for TSLA … I realize that I don’t have a sociology background, so take this for what you will, but what’s happening is a classic shift from Growth! to Value? in both the stock and the narrative. This will not be a fun ride for the Elon fanboys. And yes, they’re all boys.

China cuts taxes, sees ‘tough struggle’ as growth slows [Breitbart]

The market narrative on Chinese economic stats is interesting to me. We’ve gone from private knowledge that their statistics are politically constructed to consensus knowledge that their statistics are politically constructed to common knowledge that their statistics are politically constructed. And yes, I’m thinking that there’s an opportunity there, too.

Also, I can’t help but do a doubletake on the word “unleash” here. Some of us are old enough to remember when the US was threatening to “unleash” Chiang Kai-Shek.

Also, I ask myself why Breitbart is publishing a “straight” China economy piece. You should ask yourself that, too.

Fed hints at holding off interest-rate hikes until summer [The Bulletin (Bend, Oregon)]

I like to read articles from regional newspapers to get a rough sense of common knowledge on monetary policy. The Fed’s highly intentional and coordinated strategy to use their communications to shape investor behavior and beliefs is the most successful marketing campaign of the past decade.

Why is there an alternative ESG fund drought? [Citywire]

Coming soon to a pension fund public hearing near you. It’s no longer enough to have a long-only ESG mandate. It’s no longer enough to avoid companies that don’t meet your environmental or social or governmental mandate, whatever that mandate means to you. No, no … we need to allocate to alternative ESG funds (i.e. ESG hedge funds) that will actively short “unethical stocks”.

JFC.

In regards to the ESG alternative funds it would make sense in the current environment that someone would market a short ESG fund to cater to the coming common knowledge that social/environmental activism can be achieved through economic means. I don’t believe that it should/could be done that way but I can see someone trying to differentiate themselves and use that concept as a way to make money. Once the proper missionary is in place the strategy could pay off regardless of its merits. The first article alone speaks of healthcare stocks selling off from M4A assumptions.

On the healthcare article and comment Ben, I was talking to someone else about this the other day, but more in the context of everyday life. For instance, running into an acquaintance or friend of a friend and the conversation shifts to something not directly in your field, but as a well read ET subscriber, you are shocked at how much the supposed ‘reasonably intelligent and informed’ other parties are clueless on the topic.

So Ben, my question is: how does one separate the corollary of Dunning Kruger (basically that experts underestimate their expertise as they are ‘lost in the trees’) versus what you are describing in narrative generation? Is it that the ‘everyone’ in ‘everyone knows’ in the common knowledge game isn’t necessarily the base case of Dunning Kruger (rookie to the field learns a little and overestimates expertise), because they may actually know nothing about the field, or more importantly, don’t claim to know anything about the field.

I also think the Three Body Problem has huge ramifications to this phenomena as it relates to the market and expectation setting.

This is an interesting comment/question. I hope you don’t mind if I jump in with a couple thoughts (and hopefully Ben will still reply!) From my own POV I think this is less a question of knowledge/expertise than it is one of game-playing and information transmission. Thinking in terms of information, the information signal from an equity analyst’s review of the policy landscape is relatively weak. It is a small megaphone due to smaller distribution, less interest etc. A concrete policy proposal, however, is an unmistakable signal. It is an enormous, very loud megaphone. And so market participants can be certain that everyone not only “heard” the announcement, but even more importantly, that the announcement will DEFINITELY cause them to update their estimations of the probabilities and payoffs associated with the event and the stock. Knowing that everyone knows that everyone knows is what creates activation energy for market participants to actually place buy and sell orders.

To me, the new zeitgeist is the epistemology of collecting information outside of one’s personal expertise. Everyone I know who is not a zealot is struggling with this, and increasingly so. Let me list a few terms we use now (in no particular order):

Fake news - self explanatory

Gell-Mann amnesia - forgetting one’s expertise has made a presser essay wrongish

Dunning Kruger (ultracrepidarianism) - corollary noted above

Cognitive dissonance - zealot behaviour when confronted with truthiness

Confirmation bias - collecting the ‘right’ information

Ascertainment bias - sampling the ‘right’ information

Common knowledge and Narrative - defined by ET, C. Johnstone, and many alts

Crank or Kook - an expert’s (academic’s) ‘deplorable’ approaching from the internet

Troll - a vocal (vitriolic) non-expert, usually on Twitter or the commentariat

Alternativist - an academic’s euphemism for crank or kook

Bracketing (bracketeur) - staying ‘inside the box’ for fincasts, grants, & institutions…

Alt-news - non MSM truthiness websites with a pinch of self-promotion

Like Operation Mockingbird. And so on…

Regarding healthcare, the ‘Answer’ is limited universal Medicare with copays and private carriers picking up uncovered aspects, possibly allowing covered procedures to be traded, with an incremental phase-in.

I realized after reading Victor’s comment below and then re-reading that I completely misread the original comment! Sorry!

The narrative on Tesla is definitely turning negative. The Harris Poll on corporate reputation showed Tesla dropping more than any other company except for Facebook, From #3 in last years poll to #42 in the public’s esteem. Add in Ben’s Growth to Value theme and it’s not difficult to make the short case.