Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Three Bullish ESG Stocks This Week [Forbes]

Epsilon Theory’s unpopular opinion: ESG is not a thing.

Whatever word you use to call ESG a thing … “sector” (like this author), “asset class”, “factor”, whatever … you’re reifying a narrative. You’re making a narrative reflection of a bull market into a thing. Doesn’t mean that thing doesn’t have investable legs. Doesn’t mean that you can’t build a niche advisory business around it. Hell, look at EM. But there’s no there there. Sorry.

Also, a note on investment process (because I can’t help myself). The only words with informational content in this note are “I believe”. Once that’s stated, it is impossible for Buy recommendations NOT to exist. Which means that this is an investment tautology, not an investment process.

At Hedge Fund That Owns Trump Secrets, Clashes and Odd Bond Math [Bloomberg]

The sizzle here is Chatham’s ownership of The National Enquirer, but otherwise it’s a story of an old-school hedge fund. And to think I still get grief from people when I say that the only source of alpha is private information. I suppose these are people who have never traded a bond.

Millennials are the Fastest Growing Cohort Filing Insolvency (In Canada) [Canada Newswire]

Unlike ESG, however, usury IS a thing. JFC.

Lyft Announces Launch of Initial Public Offering [Press Release]

It’s pure inside baseball stuff, but I’m always fascinated by the teams of strange bedfellows that emerge around competing IPOs. Cue the dueling banjos from Deliverance.

It was a fun vacation for Burt Reynolds and the boys at the start of that movie.

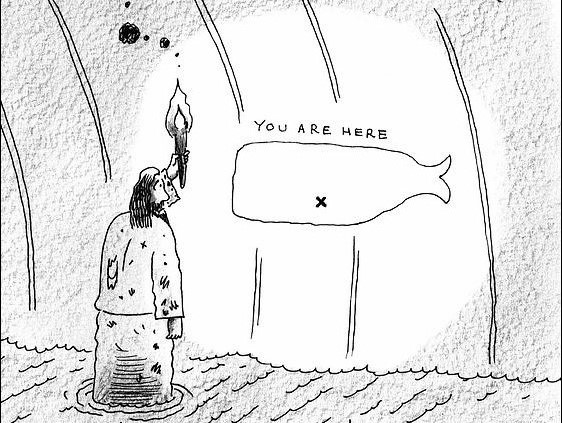

A happy retirement is more than just money [CNBC]

The caption to this article photo reads, and I swear to god I am not making this up:

If you enjoy gardening, consider working part-time at a nursery a few years before leaving your job.

What is this “retirement” thing that people keep talking about? Does it still exist? I don’t think it does.

Regarding ESG… having sat in many, many ESG-related pitches and sales-under-the-guise-of-education type presentations, it is truly a fascinating case study in Narrative, along several different dimensions. Storytelling is ever and always central to investment product sales but ESG is so strikingly zeitgeist-compatible that it even manages to subordinate performance as a consideration at times. A rare feat.

I think I’ve also seen nearly every investment under the sun justified in the context of some ESG methodology or another. Wells Fargo equity. Nuclear power generation. Physical gold. In the words of one asset manager (credit for honesty): “Especially once you’re two levels or so deep in the supply chain you really can’t make clear judgments in most cases.”

Sure sounds like a cartoon to me.