PDF download: The Green Protocol

This is a proposal to plant one billion new trees in North America over the next ten years.

I’m not asking for your donation to make this possible. I’m not lobbying local, state and federal agencies to spend tax dollars on this. I’m not writing grant proposals to get foundation or endowment money for planting trees. In fact, I may not plant a single tree myself.

This is a project that I hope will encourage you to want to plant trees, to want to pay money to people who are planting trees, to want to join this effort, not out of guilt or fear, and not only out of a sense of civic responsibility, but also out of good old-fashioned greed.

This is a project to establish a cryptographic protocol – the Green Protocol – that allows you to do well by doing good.

I think this is how crypto saves the world. Not as “money” and not as Bitcoin! TM and not as a security. Not by facilitating a market of goods, but by facilitating a market of good. Not by mining, but by growing.

I think this is how ESG saves the world. Not as shambolic ESG! TM metrics foisted on us by Wall Street and oligarchs, but as real-world, trustworthy instantiations of positive environmental, social and governance practices.

Will one billion new trees save the world? Nope. Not even close. A tree does a lot of good things for the environment – like carbon capture – but it just can’t compete with the environment-destroying capacity of a machine. A mature tree absorbs about 48 pounds of carbon dioxide in a year. Not bad! It takes a lot of air by volume to weigh 48 pounds. But a car that gets 22 miles per gallon and goes 11,000 miles in a year will put 4.6 metric tons of carbon dioxide into the air. That is not a misprint. A single automobile puts more than ten thousand pounds of CO2 into the atmosphere every year. Those one billion trees – and this is after 10+ years to reach maturity, mind you – will sop up the CO2 production of about 4.7 million cars. Which sounds like a lot until you see that the US has more than 270 million registered cars and trucks. Oof.

But you know what one billion new trees are? A good start.

We plant a billion trees on the way to planting a trillion trees.

We plant a billion trees on the way to reforesting the planet.

We plant a billion trees on the way to getting off our asses and taking individual and small group action to save the world.

Will this One Billion Tree project support all of the traditional tree-planting efforts out there, like The Nature Conservancy’s Plant a Billion Trees project, or the Chesapeake Bay Foundation’s Keystone Ten Million Trees Partnership? Yes, absolutely! But not in the way these organizations are used to being supported.

My goal with the Green Protocol is to stimulate a long overdue evolution within charitable and philanthropic organizations, an evolution that will make many of them obsolete, by creating a decentralized approach to good works.

That’s not a knock on The Nature Conservancy or the Chesapeake Bay Foundation. I think they are two of the good guys in the not-for-profit space! But a billion trees is a lot of trees. To accomplish my goal – one billion new trees in North America in 10 years – we will need to plant one million trees in Year 1 and double that number every year for the following nine years. That’s half a billion trees in Year 10. To accomplish that, we will need to invent entirely new technologies and develop entirely new agricultural efficiencies, and that’s where our current system of doing good deeds simply fails.

I believe that our current system of philanthropy and good works squelches technological innovation by crowding out the capital formation that drives technological innovation. Government-mandated good works, too. Government-mandated not-so-good works, even more. And that’s perfectly fine if technological innovation is not central to the social good that you wish to achieve.

But if you believe as I do that our best hope … frankly our only hope … to stop and reverse our current disastrous path of man-made climate change lies in technologies that have not yet been invented, then our current system of philanthropic and government-mandated do-gooding is itself a disaster.

It’s not enough to raise money through philanthropy or taxes to plant a few million more trees.

What is required is a system of for-profit capital formation that spurs for-profit technological innovation and for-profit social practices to plant a few billion more trees.

This is the Green Protocol.

The Green Protocol is a set of rules for the tokenization of symbolic betting markets in positive social goods.

The Green Protocol channels what I believe is the most powerful and pervasive social transformation of the past fifty years – “the speculation layer” – into a decentralized system of capital formation for social good.

Here’s how it works.

The Speculation Layer

Within five years, I believe that almost every form of organized social behavior will be fully abstracted into a speculation layer made up of 1) objects: a set of symbols representing real world entities formerly at the heart of those organized behaviors, 2) protocols: a government-sanctioned and oligarchy-established set of rules for a virtual betting market in those symbols, and 3) tokens: a similarly sanctioned and established set of casino chips providing liquidity for the betting market in those symbols.

The future is a world of bets, on everything, all the time.

So is the present.

Absorbed by the speculation layer, “the market” is no longer an exchange for buying fractional ownership shares of real-world companies doing real-world things, but instead is a virtual casino for betting whether the numbers associated with a three or four-letter symbol will go up or down.

Absorbed by the speculation layer, “sports” is no longer a venue for passionate support of a team’s real-world competitive success, but instead is a constant exercise in odds-making across every conceivable derivative aspect of the individual competitors and the competition itself.

Absorbed by the speculation layer, “politics” is no longer a mechanism for sorting real-world policy preferences and engaging in good faith bargaining to find real-world policy equilibria across those preferences, but instead is a competitive mass signaling exercise for charismatic symbolists to position themselves for in-group rewards and ceremonial jousts at scale.

The speculation layer is easiest to establish in organized social behaviors that already possess a language for symbolic representations and betting markets, which is why it first found purchase and now oozes over every square inch of Finance, and why Sport is not far behind. Politics has a few more years left before it’s enveloped by the speculation layer, I suppose, but only a few. Beyond the distinct social systems of Finance, Sports and Politics, the only other ubiquitous organized social behavior is Religion, which should be uniquely resistant to the speculation layer. Unfortunately, it seems to me that finance, sports and politics ARE the functional religious beliefs for the vast majority of people, and that even the distinct social system of Religion with a capital R is rapidly being subsumed by the distinct social system of Politics with a capital P.

Why is the speculation layer spreading Borg-like across all of our organized social behaviors?

Because a world of bets is a world of constant neurochemical hits, as stimulative when the bets pay off (yay, dopamine!) as when they don’t (yay, norepinephrine!). In a very real sense, the speculation layer IS entertainment, but entertainment in a weaponized form which we are biologically powerless to resist. Of course, the Nudging State and the Nudging Oligarchy understand the power of this weapon all too well. How do you control the crowd? Panem et circenses. Bread and circuses. And the speculation layer is the best circus.

Resistance is futile.

In its pure grain alcohol form, the speculation layer is Robinhood. It’s DraftKings. It’s Barstool Sports. It’s FiveThirtyEight. It’s NFTs. It’s crypto. There’s little effort even to pretend that they’re about something other than speculation. And why should they? We’re all adults here! No one’s forcing you to drink, Ben.

In its 80-proof form, the speculation layer is CNBC. It’s ESPN. It’s CNN. It’s Fox News. It’s MSNBC. A wave of the hand at “substance”, but in reality 24-hour non-stop editorial coverage of horseraces that you simply must have a betting opinion about to be a smart investor or a smart sports fan or a smart Democrat or a smart Republican. You want to be smart, don’t you, Ben? C’mon, just a sip. It’ll make you smart. Promise.

The bartenders with a heavy pour, of course, are Twitter and Facebook and Google and the rest of the social media “platform” multiverse, oh-so intent to preserve plausible deniability about their intentions, but in truth completely committed to promoting our personal and collective addiction to the dopamine hits of the speculation layer. Have another drink, Ben, this one’s on the house.

Welcome to the Dopamine Economy. Welcome to the Hunger Games.

And may the odds be ever in your favor!

You know, I often think about how differently my life would have played out if online poker and FanDuel and RobinHood had been around when I was in college. I’ve got guardrails in place against that stuff today, in the form of responsibilities to my family and my partners, but when I was 21? LOL. And I’m not saying that it would have been a bad life or an unsuccessful life. My alter ego, Neb Tnuh, swims effortlessly in these symbolic seas of strategic games and Turing tests. But I am positive that it would have been a smaller life.

Because that’s what the speculation layer does.

It makes us small.

The speculation layer makes us play their game … literally their game! … constructed of ephemeral and abstracted symbols, rather than create our OWN game out of real world relationships with real world humans, imbued with the positive energy of making, protecting and teaching. Yeats wrote that “the best lack all conviction” in the Widening Gyre, but I don’t think that’s quite right today. The best of us – those for whom symbolic manipulation comes easy – have plenty of conviction, but it’s the atomized conviction of ego. It’s the little voice of conviction that whispers in our ear and says, “Ahhh, you are SO smart” when the dealer flips a winning card and we get that little hit of dopamine and we lean back in our chair and we smile at the screen and we embrace the opportunity to play yet another hand. The best of us are addicts.

It makes me very angry that my daughters are coming of age in a world that conspires to make them small, that seeks to make them addicts.

I am determined to do something about it.

But what? We can’t stop the world and its “progress”. We can’t change our brain chemistry. We can no more prevent the speculation layer from its inexorable spread than King Canute could prevent the tide from rolling in.

No, we can’t stop the future world of all betting all the time. But we can channel it. We can edit it.

We can see clearly how the rules of the current game – the existing protocol of the speculation layer – are established by and for the Nudging State and the Nudging Oligarchy.

We can determine with Full Hearts a better set of rules, a protocol based on the principles of small-l liberalism and small-c conservatism.

Clear Eyes, full hearts … you know the rest.

It’s not going to be easy, and we don’t have a lot of time. The speculation layer isn’t an academic project, and the vested interests that the Nudging State and the Nudging Oligarchy have here are enormous. All of the protocols to date have been written by billionaires and their Renfields, and they’re really good at playing the Narrative games that lull us to sleep.

Case in point, the abomination known as the carbon credit market.

The Shambolic Protocol of Carbon Credit Markets

Carbon credit markets are my poster child for a “government-sanctioned and oligarchy-established set of rules” that ends up actively perverting their original important and well-meaning social intentions. To be clear, I don’t think the people involved with carbon credit markets are bad people. But I think they are participants in a bad system.

A carbon credit market is a system where companies that put more CO2 into the atmosphere than their regulatory quota (or marketing initiative) allows can purchase “offsets” from companies that either didn’t fill their emissions quota or have carbon sequestration assets that actively take CO2 out of the atmosphere. This sounds smart and wonderful, combining all the best narrative elements of “Yay, Free Markets!” and “Yay, Environment!”.

But here’s the truth:

1) Carbon credit markets limit symbolic measurements of CO2 emissions, not real-world CO2 emissions. In fact, it’s not clear that carbon credit markets limit aggregate real-world CO2 emissions at all.

2) Carbon credit markets squelch incentives for technological innovation that could actually make a real difference in slowing or reversing climate change.

Here’s an example of that first point. Earlier this year, the EU announced with great fanfare that renewable energy generation surpassed fossil fuel energy generation for the full year 2020. A typical article: It’s Official: In 2020, Renewable Energy Beat Fossil Fuels Across Europe. And that’s great! But when you dig a little deeper into the defined symbolic measurement of “renewable energy”, you start to get a little sick.

In 2009, the EU declared that biomass – typically wood scraps from paper pulp facilities and lumber yards that are compressed into wood pellets and then burned much like thermal coal – would be given full credit as a renewable energy source. There were no regulations on the source of these biomass wood pellets, so it wasn’t required that they come from scraps, but I mean … c’mon, you’re not going to tear down hardwood forests and turn them into wood pellets. That would be insane. These trees aren’t “renewable” over any time frame that makes economic sense, and harvesting them and then BURNING them is about as bad for carbon emissions as it gets.

But that’s exactly what happened.

Except no one cuts down European forests to turn into wood pellets. No, no, hundreds of acres of American forests are cut down every day and turned into “renewable biomass” wood pellets for European power generators.

But wait, there’s more. If you’ve got a coal-fired power plant in Europe, then you get debited in your carbon account when you burn the coal and push the CO2 out through your European smokestack and into the European air. Of course the same thing applies when you burn these American wood pellets, right? The CO2 is going up through your European smokestack and into the European air just the same, right?

Silly rabbit. Why would you think that actual CO2 entering the actual air would have anything to do with this? You see, apparently in the late 1990s, some United Nations sub-sub-committee on renewable energy, never contemplating that people would cut down trees and send them to another continent to be BURNED, set up a carbon accounting standard that the carbon emissions from burning a tree would be attributed to the region where it was cut down, not where it was actually burned. Naturally the EU adopted the UN carbon accounting standards verbatim. Naturally the incumbent European utilities noticed this enormous loophole. And voila! An enormous new industry in destroying American forests to fuel European power plants in an absurdly anti-green manner was born. I am not making this up.

So yes, the EU used more renewable energy than fossil fuels in 2020. And spewed more CO2 into the European air. And cut down tens of thousands of acres of North Carolina and Georgia forests in the process. A process that continues today. “Yay, Renewable Energy!”

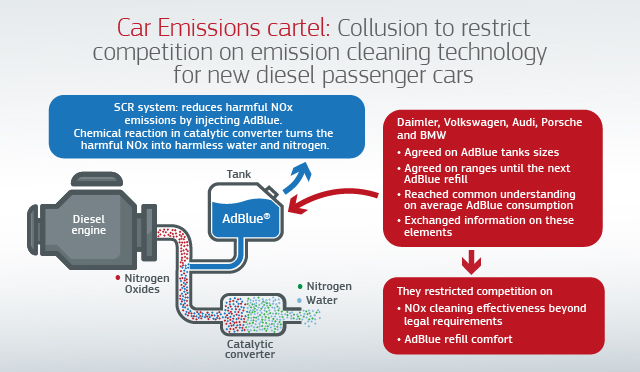

Now here’s an example of the technology squelching point, not from carbon credit markets directly, but with exactly the same dynamic. This summer, the EU announced that the Big Three German automakers – Daimler, Volkswagen and BMW – have been colluding over the past TWENTY FIVE YEARS to limit their efforts to reduce diesel engine emissions. They didn’t cheat on the legal limits for diesel emissions (no, no … that was an entirely different crime and multi-billion dollar fine), but they conspired not to do any more than the law required, even though they could do more than the law required. Even though doing more than the law required would have provided a competitive advantage. They conspired NOT to compete on diesel emissions and NOT to develop cleaner technologies and systems because … well, why rock the boat when we’ve got the German government in our pocket and the emissions standards are a joke and we’re making tens of billions of euros in profit every year? I mean, no one actually cares about diesel emissions, right? We’ll give the politicians the talking points they want, we’ll all proclaim our green goodness, we’ll all cash a bigger check, and we’ll all share a good laugh. Hahaha! And if we get caught TWENTY FIVE YEARS from now in our little plot, we’ll pay our pittance of a fine. Cost of doing business, nicht wahr?

This is what pollution “markets” do. They set a very comfortable limit on the polluters, which in turn sets a very comfortable price on their pollution. And if pollution is cheap … and if cheating on the pollution is even cheaper … then polluters face zero urgency and see little upside to investing in new pollution-limiting technologies. It’s just math, as the kids would say. Which means that the good guys – the entrepreneurs keen to develop and commercialize pollution-limiting technologies – are met with a big collective yawn. The money’s just not there. Worse, there’s no political impetus or popular narrative to do more from a technological perspective, because the “market-based solution” is already in place, and everyone knows that everyone knows that you can’t do better than a “market-based solution”!

This isn’t a market. It’s an abstraction of a market.

It’s a speculation layer with a crappy protocol.

A government-sanctioned and oligarchy-established pollution market always ends up as a perversion of its well-intentioned social impetus because it always starts off as a perversion of the intellectual foundation of market-based solutions for negative externalities – the Coase Theorem. In a nutshell, the Coase Theorem holds that IF property rights are upheld and IF transaction costs are very low to nonexistent, then over time negative externalities will get sorted out in the most socially optimal way without any government intervention other than the enforcement of property rights. In practice, of course, transaction costs aren’t nonexistent and it can take a loooong time for these negative externalities to get sorted out on their own, so governments always get involved to defray transaction costs, impose penalties for non-compliance, and fix quotas/prices. They are, of course, lobbied constantly and successfully over this process, and that’s how we end up with a government-sanctioned and oligarchy-established set of rules that bears zero resemblance to anything Ronald Coase ever conceived.

The crucial victory for incumbent corporate oligarchs in these faux-Coase Theorem, “Yay, Free Markets!” speculation layers isn’t in the details of an easy-to-achieve pollution quota or a sweet “adjustment subsidy” from the government. That’s all well and good, and that’s why lobbyists get the big bucks, but it’s not the big prize. The structural protocol element that makes these pollution markets so successful for status quo corporations and so terrible for the rest of us is the conflation of a market in positive externalities with a market in negative externalities.

As soon as you allow owners of negative externalities like power plants to purchase pollution “offsets” from owners of positive externalities like forests, then the whole structure stops working for society (and starts working for the oligarch owners of the power plants and forests).

It seems so natural to marry the two, right? Of course there should be trades between the polluters and the un-polluters. How else are you going to incentivize the good guys to build new un-polluting resources if you don’t allow the bad guys to pay them?

In truth, it’s not natural at all. In truth, fewer un-polluting resources are built when negative and positive externality markets are mixed. In truth, it’s an intentional structural flaw introduced by the polluters’ lobbyists to reduce the cost and burden of the game for them, and it works because no one – particularly not the politicians who establish the formal protocol – takes a hard look past the “Yay, Free Markets!” narrative provided by the lobbyists and considers what an externality IS.

An externality is not the thing. An externality is not the goal of the behavior. Yes, it happens as part of the behavior. Yes, it happens because of the behavior. But an externality happens regardless of the goals of the behavior.

CO2 emissions from a power plant are an externality, in this case a negative externality. The power plant doesn’t want to spew CO2 into the air. It’s not a goal of the power plant owner. Ditto CO2 sequestration from a vast forest somewhere. This is also an externality, in this case a positive externality. The owner of the forest is perfectly happy, I’m sure, that the trees are sucking CO2 out of the air, but this occurs regardless of the owner’s reasons for owning that forest land in the first place. Positive externalities do not provide any new marginal “offset” for matching negative externalities. Positive externalities are going to occur regardless of whether or not there’s a “market” for negative externality owners to buy those offsets. The existence of this “market” is a windfall revenue source for the forest landowner and an enormous cost savings for the power plant owner, and because the symbolic CO2 emission quotas in the speculation layer are met, everyone can say “Yay, Markets!” and “Yay, Environment!”.

But there is no real-world net reduction in CO2 emissions.

On the other hand, CO2 reduction from a company that built some new technology or process for this very purpose, or that plants trees for no other reason than to suck CO2 out of the air, well … this is NOT an externality. The goal of this company’s behavior is to reduce carbon emissions, and to the degree they realize their goals by selling their product or service to the polluters, there will in fact be a real-world net reduction in CO2 emissions. But so long as their positive-but-not-an-externality CO2-reducing product or service is lumped in with all the positive externalities that reduce CO2 anyway, the supply of “offset” symbols within the speculation layer is artificially inflated and the price of “offset” symbols is artificially suppressed.

As a result, the positive-but-not-an-externality CO2-reducing companies have less than zero pricing power and are squeezed mercilessly by the oligarch polluters AND the oligarch forest owners.

As a result, we get a lot less real-world reduction in CO2 emissions than we think.

All because of the set of rules governing this speculation layer. All because the protocol was written by the Nudging State and the Nudging Oligarchy in service to their interests and not ours.

This is not an unknown problem. Everyone involved in carbon credit markets understands that a large share of the actual money that changes hands within this speculation layer, in many circumstances the overwhelmingly large share of the actual money that changes hands, is going to the positive externality CO2 reducers instead of the positive-but-not-an-externality CO2 reducers. Everyone involved in carbon credit markets understands that the real-world reduction in CO2 emissions are a fraction of the symbolic reduction in CO2 emissions within the speculation layer. And so a range of administrative “solutions” have been proposed to address the problem (hey, I know, let’s establish a government-sanctioned standards-setting organization to evaluate all this! Then we can give tax dollars and tax breaks to the companies that make this green nomenklatura list!), but none of them have made a dent in this cozy system designed by the oligarch polluters and the oligarch forest owners.

I think that’s because all of these administrative solutions are … administrative solutions. I think that’s because all of these solutions get farther and father away from the Coase Theorem and closer and closer to Five Year Plans and MiniPlenty. I think that’s because all of these solutions are built on top of a fundamentally flawed protocol.

So here’s how we fix it.

The Green Protocol

The Green Protocol is a NEW set of fundamental rules for thinking about carbon capture and every other market-based system established to support social good.

But this is crazy, Ben. You can’t change the rules in the middle of the game, not for something as big as carbon capture and the way we think about reversing climate change.

Sure you can.

In 1991, Tim Berners-Lee published the first version of the Hypertext Transfer Protocol (HTTP), arguably the central building block of what was then called the World Wide Web. This protocol was not set in stone. Over the next five or six years, that core protocol was revised multiple times until it was effectively standardized. In fact, almost every protocol associated with the internet was developed and redeveloped and standardized from 1991 to 1997. Like the internet in 1991, the speculation layer in 2021 is just getting started. Its protocols aren’t set in stone, either.

I believe that 2021 is to the speculation layer what 1991 was to the internet layer – a once-in-a-lifetime opportunity to influence the operating system of a global network that will shape human society for centuries.

I’m not throwin’ away my shot.

The Green Protocol is a set of rules for decentralized financing of:

1) the organization of social good (projects-of-good, or POGs),

2) the objects of social good (tokens-of-good, or TOGs), and

3) the outputs of social good (coins-of-good, or COGs).

Structural Elements of the Green Protocol

The POGs set the goal and administer the project.

Plant one billion trees in North America in ten years.

The TOGs are the non-fungible, unique tokens that represent the non-fungible, unique objects that accomplish social good.

Plant a tree and you will receive an NFT Tree TOG.

The COGs are the fungible, non-unique coins that represent the fungible, non-unique outputs of the objects that are accomplishing social good.

Each NFT Tree TOG yields New Carbon Capture coins and other related coins.

The speculative markets in TOGs and COGs will directly spur more human work and effort to plant more trees that do that good thing.

Structural Element #1: the One Billion Trees project is a POG – a project-of-good.

You are welcome to join this POG. I hope you will! You may come up with your own POG. I hope you do that, too! Maybe you want to encourage the reintroduction of bowling leagues across the country (and if you’re read Bowling Alone by Robert Putnam, you know how valuable that might be). Maybe you want to develop a new device that captures carbon in a novel fashion. The potential range for projects-of-good is limitless. Anything that helps people to Make / Protect / Teach can be a POG.

What does it mean to Make? It means you are an inventor. A manufacturer. An artist. A craftsman. A kid at a Maker Fair. A farmer. An engineer. A home builder. A coder. It’s the creation of some THING through the application of some creative IDEA.

What does it mean to Protect? It means you are a soldier. A policeman. A fireman. An EMT. A nurse. A doctor. It’s a Neighborhood Watch. It’s a mechanic fixing a car. It’s also a unionization drive. It’s also a fiduciary managing a portfolio.

What does it mean to Teach? It means you are a teacher, of course. Or a writer. Or a researcher. Or a priest. Or a home-schooling mom. Or a Little League coach. It means you’ve got something to say to your Pack, and you’ve got the guts to say it.

What is NOT Make / Protect / Teach? Basically, if you are in the business of money or in the business of business, then it is unlikely (not impossible, but unlikely) that you are a Maker or a Protector or a Teacher in your day job. Almost all of banking is out. Corporate lawyering. Consulting. Trading. Sales and Marketing. Out. Out. Out. Out. There are no hard and fast rules here, and I mean to be more inclusive than not. But I think you understand the distinction. And yes, I realize that the vast majority of people reading this note would not be practitioners of Make / Protect / Teach, at least not in their day job.

But Make / Protect / Teach doesn’t have to be your day job. It just has to be your identity. It just has to be the story you tell yourself about who you are.

Make / Protect / Teach is a social movement for people who are IN the world-as-it-is but not OF the world-as-it-is. Your success IN the world, financial or otherwise, is neither laudable or damning. It just is. Your success IN the world, financial or otherwise, does not DEFINE you. Unless you let it.

Don’t let it. Find your pack. Find your project(s)-of-good. Find your identity in making, protecting and teaching, and watch how your world changes for the better!

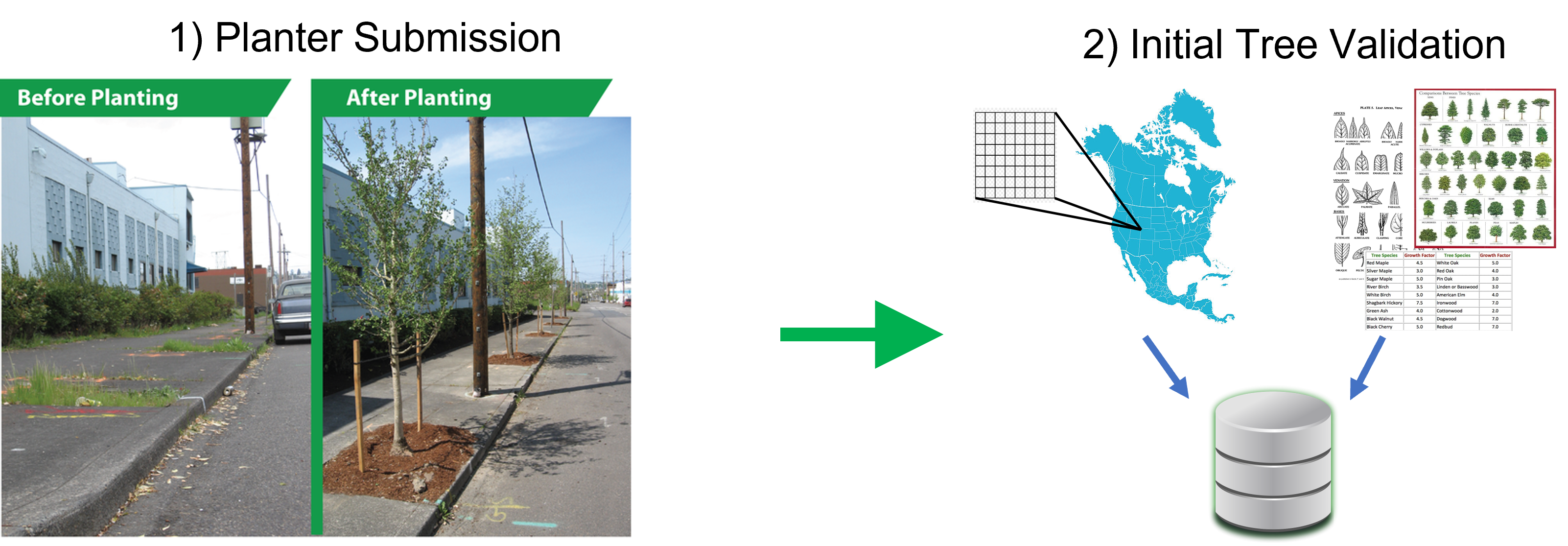

To support the Green Protocol on a POG and channel the speculation layer in support of the POG’s goals, we need to create a comprehensive database that knows everything there is to know about:

1) the objects of the POG (the unique, non-fungible, real-world things that create the social good you want to achieve), and

2) the outputs of the POG (the non-unique, fungible, real-world manifestations of the social good you want to achieve).

In the case of the One Billion Trees POG, that’s a geographic grid of all of North America at the highest possible GPS resolution, and structural plant data to drive a recognition software app. There’s more detail on this protocol set-up stage in Proof of Plant: A New Vision for Crypto, Pt. 1, so I won’t repeat all that here. Suffice it to say that this an extremely large database! But it’s only that … extremely large … not extremely complex.

It’s important to note here that the Green Protocol requires unique geographical markers that allow the adjudication of property rights. As a result, the Green Protocol is NOT a trustless or censorship instantiation of a distributed ledger. The Green Protocol is NOT like Bitcoin. The Green Protocol IS subject to whatever laws your nation or legal jurisdiction applies to property rights. If you steal or cheat within the Green Protocol, you ARE liable to prosecution and the ledger MAY be censored or edited to eliminate your tokens. Why is it so important to enforce property rights that are external to the ledger within the ledger? Because THAT is the key to the Coase Theorem – upholding property rights. Because THIS is how we apply the Coase Theorem to create a true free market in positive externalities from the bottom-up and not the top-down.

Participation in the One Billions Trees POG is simple. Use the app to take a before and after picture of the planted tree. We know the specific GPS location of the planting and we can determine the species, age and condition of the tree from the photograph.

And that’s when the fun begins.

Structural Element #2: every tree that is planted in the One Billion Trees POG generates a unique TOG – a token-of-good.

These are non-fungible tokens, unique representations of the unique human effort that went into the proven execution of this project-of-good in its specific and unique instantiation – a living, growing tree planted in a space that did not have a living, growing tree before.

Ultimately, there will be a billion NFT Tree TOGs issued within the One Billion Trees POG, each with a unique set of attributes as shown below. Some of the Tree TOG attributes will relate to the tree itself, others will relate to the creation and validation of the token, others will relate to the yields that this specific tree will produce, and still more will relate to the transaction history of this particular NFT.

Each Tree TOG will be issued to the planter of the tree. For free. The work of planting the tree is what generates the token. Plant a tree, get your efforts validated, and you receive a Tree TOG. You can keep the Tree TOG. You can sell the Tree TOG. It’s yours to do with as you wish, free and clear.

You don’t get a Tree TOG for an existing tree. You only get a Tree TOG for planting a new tree. And once you’ve planted a living, growing tree in some space that did not have a living, growing tree before, you can’t get another Tree TOG in that same space. Paper companies can’t game this system by planting trees, getting Tree TOGs, harvesting the trees some years later, planting new trees in the same space, and getting another set of Tree TOGs. You can keep the yields going with a replacement tree, but you can only plant a new tree once!

The Tree TOG has absolutely zero claim on the tree or the space in which it is planted. There are no cash flows here, no ownership of anything real here. The Tree TOG exists purely within the speculation layer of virtual reality. What is the intrinsic value of a token in the Green Protocol? Zero.

But it is unique in all the world.

And it is an honest and trustworthy representation of the honest and trustworthy planting of that specific tree in that specific space that did not have a tree before.

The value of these tokens is found in their reflection of your affective attachment to the proven human effort that went into the cultivation of a positive social good. Their value is not found in the thing. Their value is found in your positive attachment to what comes from the thing. Their value is an externality.

The Tree TOG is good art.

I think that will give these Tree TOGs a lot of value to those of us who care about planting new trees, and it is just and proper that this value will accrue initially to whoever put in the actual work to plant that actual tree. Over time, I’d expect a vibrant NFT market to exist around these Tree TOGs, particularly those that have the most narrative-attractive attributes and the strongest set of yields in this virtual speculation layer.

Now about those yields.

Structural Element #3: every good thing that a new tree does in the world is a yield, and each yield can be measured and paid out by a COG – a coin-of-good.

Trees do lots of good things! But one thing that all trees do is capture carbon, so that’s our first example of a coin-of-good: the New Carbon Capture COG.

(to be clear, the word “New” doesn’t refer to the freshly minted nature of the COG, but to the coin’s representation of incremental carbon capture that did not exist in the world before; the goodness of the coin-of-good is precisely that we are rewarding the effort to create NEW output of a social good.)

All trees capture carbon, yes, but some tree species capture more than other tree species. A mature tree with lots of leaves captures more carbon than a young tree with fewer leaves. Still, if you know a tree’s species, age, location and condition – which we do from the initial Tree TOG registration – you can predict how much carbon it will capture over a year.

That predicted amount of carbon capture is associated with the unique Tree TOG of that unique tree in the form of a carbon capture yield, and – when validated – that yield is paid in the form of New Carbon Capture COGs to the owner of that NFT Tree TOG.

Every year – when validated – that living, growing tree will pay out a little more in New Carbon Capture COGs to the owner of the NFT Tree TOG that represents that living, growing tree, because every year that tree matures a little more and captures more carbon from the air.

The validator will receive some New Carbon Capture COGs, too. So will the original planter of the tree. So will the administrator of the POG. So will the administrator of the NFT TOG market and the COGs liquidity pools.

What is the validation process? It’s an updated photo of the tree using the validation app, so that we can confirm that the tree is still alive and recalibrate the yields. Without a validation, there are no yields paid out on the Tree TOG. It’s like a non-performing bond. But like a non-performing bond that is made good, validation at any point unlocks all of the accrued yields, creating really interesting opportunities for both fundamental research and raw speculation within both the NFT Tree TOG market and the associated COGs market.

There are a lot of associated COGs for every tree, but not every tree will share the same associated COGs. This, too, creates really interesting opportunities for fundamental research and raw speculation within the TOGs and COGs markets.

For example, not all trees are planted on the banks of rivers or other places where they can prevent soil runoff or erosion. But some are, and if you know a tree’s location and age and condition – which we do from the initial Tree TOG registration and subsequent validations – you can predict how much runoff it can prevent in a year. Those Tree TOGs that are associated with a real tree that prevents soil runoff will have a soil runoff prevention yield payable in the form of New Runoff Prevention COGs.

If you care a lot about soil runoff and erosion you’ll probably want to buy the Tree TOGs with that particular yield. You’ll probably want to trade those New Runoff Prevention COGs.

Or maybe you care a lot about getting chestnut trees replanted in North America. There’s a COG for that.

Or maybe you care a lot about planting new trees in densely populated urban areas. There’s a COG for that.

There is a potential COG for anything good that a new tree does in the world, and the speculative market in that COG will directly spur more human work and effort to plant more trees that do that good thing.

There is a potential NFT Tree TOG portfolio for anything good that a new tree does in the world, and the speculative market in those NFT Tree TOG portfolios will directly spur more human work and effort to plant more trees that do that good thing.

One more structural point.

Trees are not the only things that capture carbon. I can think of dozens of projects-of-good completely separate from the One Billion Trees POG that would also make or build or grow things that would capture incremental carbon from the atmosphere. Each of these POGs would also generate New Carbon Capture COGs as the yield from their associated NFT TOGs and would also spur the speculative market in New Carbon Capture COGs.

There is a one-to-many relationship between TOGs and COGs, and there is a many-to-one relationship between POGs and COGs.

The result is a robust, self-reinforcing protocol for the decentralized financing of the organization of social good (POGs), the objects of social good (TOGs), and the outputs of social good (COGs).

Any social good. Whatever social good means to you.

One Billion Trees is just the beginning.

I started this note by talking about how the speculation layer makes us small, about how it turns us into addicts within the dopamine economy.

The Green Protocol can make us large again.

Not by fighting the Nudging State and Nudging Oligarchy head-on, but by turning their oozing, pernicious, addictive, ubiquitous speculation layer against them from the inside-out.

From the bottom-up.

So, yes, One Billion Trees is just the beginning.

But what a beginning!

PDF download: The Green Protocol

This is such an improvement over the current nebulous corporate displays of environmental-mindedness. I’m imagining Exxon-Mobil showing off its TOGs and me actually being impressed since I can compare that to other companies’ TOGs.

Flexing by showing off your TOGs > flexing by showing off your CryptoPunk (hopefully soon).

It is an impressive and thought provoking vision.

Has me thinking about a POG I’m involved with and if this is feasible for it

Thank you Ben

Very exciting stuff! Let me know if you need any beta users.

Outstanding work, Ben. In the blockchain space, you have produced what’s called the “white paper” for this project, or something close to it.

Do you have the technical competence to pull this off? The most important part of this is the “community” of developers you can attract to the project. (BTW - as you probably know, “community” is a defined term in the blockchain space where you will hear the following narrative: “…a vibrant developer community is essential to the success of an early-stage token project.”) It would be very helpful to be able to recruit an industry heavyweight who wants to put part of their efforts into this sort of a project.

Blockchain coders are in high demand right now–but I think your pitch will appeal to a certain number of them for obvious reasons. The thing is, you have to be in the flow, in the blockchain space, so you will have to find developers and coders who are already in the flow. Unless you are familiar with the various puzzle pieces, it’s easy to lose your way. Most protocols have distinct flaws as they trade off among speed, scale, and security. You can have 2 out of the 3, but not all three (yet). But you undoubtedly already know this stuff, having come up with this elegant approach.

The semi-centralized aspect of your protocol to remove certain blocks for certain reasons can be accomplished technically, but the rules and methods for detection and enforcement are going to be a bit more difficult if any discretion is involved. While there are plenty of examples of blockchains that aren’t Decentralized Autonomous Organizations, many (maybe even most?) developers like the DAO model pretty strongly. Among many of the more passionate (and relatively high-profile) in the space, the concept of coding, testing, building a community (i.e. a network), and then essentially walking away is as much a part of the blockchain ethos as are certain libertarian ideals.

But not all crypto-enthusiasts are wild-eyed libertarians. And they all do want to disrupt the existing power structures–first in finance, later in other protocols that disintermediate. They are being co-opted, though, which is one reason your Green Protocol strategy might be able to attract the coder equivalent of an ACLU attorney.

Anyway, fascinating approach, thanks.

One project I’m involved with, Helium, does not have a DAO but instead currently has a corporation which has a percentage of the returns guaranteed to it “by the blockchain”.

It’s still heavily centralized in that Helium Inc controls all of the code going into miners and validators, it picks it’s oracles who are providing USD/HNT data for it’s two token system of Helium/Data Credits which are it’s “stablecoin” like peg of bytes transferred for client devices to USD.

Generally it’s project’s users are not opposed to this level of centralization at the moment, but it did move it’s entire token generation model from a (imo) more sensible fixed inflation system to a “capped” system so that it could be more like “bitcoin”, so that the project could attract more capital. That was something which turned me off and where the lack of a real vote was really felt.

This is a really great read. Almost lost me at the beginning, but by the end I was fully into it. Love the idea and very interested in participating going forward.

One of the first thoughts I had after reaching the end was wanting to make a plan with my kids to plant a tree and show them how we can use the app to provide progress on it. Start small and grow it from there - one tree at a time. I think that would be a great way to help pass on some of my values and let them watch how it progresses.

I love this concept.

What about some mechanism for maintaining existing trees too? Might that be a separate POG? I am thinking of ways to disincentivize planting a bunch of trees, capturing the TOGs, then cutting them down and building a subdivision.

I’ll have to put aside some time to read your entire post, but I want to point you towards Project Drawdown which is a research-based effort to prioritize existing methods for getting to the theoretical future point of drawdown, or when the emissions curve reverses its trajectory and starts going down for good. There is a big debate in sustainability and cleantech circles whether we have to spend enormous amounts money on R&D to solve this (all about the flow!) or if really we just need to spend our resources deploying existing and proven tech like wind, solar, and EVs. I think we must do both but there are pretty good arguments to be made about the profit motives of those who only advocate R&D and future tech.

E.g. this opinion piece in Scientific American about how Bill Gates should STFU about how he thinks Africans should plan their food system, the outcome of which has important consequences for those people and our shared planet. Food for thought of what kind of system you are motivated to build, or perpetuate.

I thought about this too. In addition to the plant a billion new trees POG there should be a keep existing trees POG. I would think that the annual validation system for the TOG and COG’s would solve the subdivision problem as their TOG might exist for the year but once the subdivision goes up, at the next validation point the TOG would be removed or inert or canceled etc.

Great post, @twclix … thank you! To your question “do you have the technical competence to pull this off?”, the answer is definitely NO! I’m a coder and I’ve founded a successful software company, but I’m late to the crypto game and have different skill sets than I did 15-20 years ago. So as you suggest I’ll need to enlist/recruit both a core and peripheral community to help put this together.

I’m definitely a believer in the DAO way, but I don’t think it works for the Green Protocol. My strong sense is that to solve this puzzle of positive externalities using the Coase Theorem, there must be a preservation of property rights, which requires an adjudication and censorship function, which in turn requires a relatively high degree of centralization … at least on those functions. In other words, I can see the validation functions being perfectly decentralized, but I don’t think the embedded contracts here can be fully autonomous. My hope, though, is that even the most fervent DAO-enthusiast will recognize that implementing the (very) libertarian-minded Coase Theorem is just a different way of solving for a shared decentralized goal!