To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

That’s Minneapolis Fed President Neel Kashkari on the left and JR “Bob” Dobbs, High Epopt of the Church of the SubGenius, on the right.

I know, I know … it’s me being mean to Neel again.

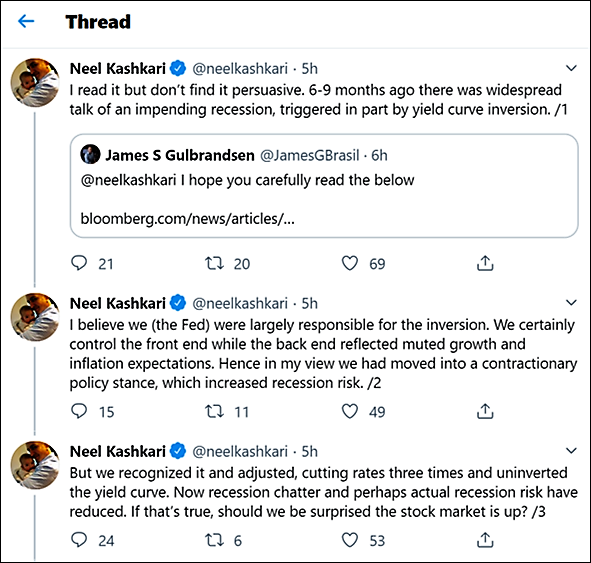

But I just couldn’t help myself when I saw this Twitter thread yesterday from my favorite stalking horse of Team Elite.

A little background here. The article that Neel is responding to is a spot-on Bloomberg Opinion piece by Elena Popina.

The Debate Over Whether to Call It QE Is Over, and the Fed Lost [Bloomberg]

In the court of investor opinion, the verdict is in. The Federal Reserve is guilty of quantitative easing.

Never mind that Chairman Jerome Powell tells everyone his efforts to shore up funding markets are “in no sense” QE. Try as policy makers may, they’ve lost the ability to convince people that Treasury purchases aren’t at least partially why the Dow Jones Industrial Average is up almost 4,000 points since late August.

Sure, it’s all labels. If you want to call it QE, you can. Or not. If you want to ascribe the rally to Powell, that’s up to you. Certainly the Fed thinks it’s on solid ground. Rather than trying to drive down long-term interest rates to stimulate the economy, a la QE, it’s simply buying T-bills to keep the financial system’s plumbing in order.

And then here’s the money quote:

The problem for policy makers is that perceptions matter in shaping sentiment. If everyone believes central bank largess is pushing up prices, what happens in the market when it’s turned off?

So right.

Anyhoo … Neel’s inability or unwillingness to engage with the actual points and questions raised by this Bloomberg article is nothing new. I’ve had my own run-ins in this regard.

My Dinner With Neel

So I had a Twitter “debate” with Neel Kashkari. But it wasn’t a real conversation. It was me talking to a wall. Maybe one day I’ll get to have a genuine conversation with Neel or Jim or Jay or Lael or Richard or one of the gang. But I doubt it. We can’t have a real conversation with central bankers because they are both guards and prisoners of the island of policy and thought that they’ve created. … Continue reading

No, I’m just going to take Neel on his own merits today. I’m just going to take his actual words as an accurate representation of his actual beliefs and intentions.

Here’s what Neel tweeted yesterday …

By inverting the yield curve, the Fed created a Cartoon of recession risk in the real economy. Not an actual cause of recession risk in the real economy, because that’s not how a yield curve works. I mean, the yield curve isn’t a thing. It’s a derivative of market data observations that market participants assign meaning to as a predictive signal of recession risk. The shape of a yield curve has zero actual impact on the real economy. To use ten dollar words, it is epiphenomenon not phenomenon. To use Epsilon Theory words, it’s a cartoon. It’s a market cartoon of real world recession risk named “Inverted Yield Curve!”.

That cartoon had absolutely no impact in the real world, of course. It can’t. It had a huge impact though, in the market world.

The Fed created FEAR in market world that a recession might be coming.

Then the Fed took that fear away.

In the immortal words of Neel Kashkari … Should we be surprised that the market is up?

At no point did the Fed’s actions, either in creating market fear or in taking away market fear, have any impact on the real economy.

It was entirely an exercise by the Fed to maintain control over market world.

It was entirely part and parcel of the effort to transform capital markets into a political utility.

Exactly this.

The Long Now is the construction of artificial fear and the removal of artificial fear in order to maintain the social POWER of the constructors and removers of those fears.

They’re. Not. Even. Pretending. Anymore.

Neel’s just putting “Slack!” into the system …

Maybe I’m just proving your point (?) but you’ve posited a framework in which there is a separate real economy/world and a market world. When was the last time that framework was actually representative of reality? When have market prices not impacted real world decisions and not had real economy impacts?

Perhaps I’m completely missing your definition of the “real economy” in this discussion…but just to state one example of a transmission mechanism, confidence levels of consumers and corporate executives as reflected in spending decisions is one example of market fear/sentiment having real economy impacts. (See Duke CEO Survey in mid-September “Optimism sinks to 3-year low”; surveys probably taken during July/August when yield curve most inverted, aided & abetted by trade war headlines = weaker capital spending/durable goods activity)