To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Love’s heralds should be thoughts,

Romeo and Juliet, Act 2 Scene 5

Which ten times faster glide than the sun’s beams,

Driving back shadows over louring hills:

Therefore do nimble-pinion’d doves draw love,

And therefore hath the wind-swift Cupid wings.

That’s how Shakespeare described the speed of thought – ten times faster than the speed of light.

He was talking about thoughts of love, of course.

Thoughts of a stock market rally move even faster than that.

The word selection here in this Wall Street Journal headline is a masterclass in Narrative creation.

“Heralds”

“ascent”

“signals”

“more”

“beginning”

“participate”

“new”

“offering hope”

“long waited”

“rally”

“widen”

Even the obligatory counter-bullet beneath the headline is conditioned as merely a “pause”.

None of these words are accidental. They are all intentionally chosen to promote the idea of stock market rally that YOU need to participate in.

They are all intentionally chosen to appeal with particular urgency to the largest single demographic of Wall Street Journal readers – the value investor.

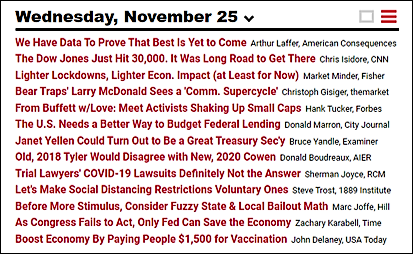

And it’s not just the Daily Diary of the American Dream ™. Here are today’s market headlines as compiled by RealClearMarkets.com on the left, and RCM’s complete list of today’s relevant “Entrepreneurs & The Economy” articles on the right.

I love that top market headline – “We Have Data To Prove That Best Is Yet To Come” – by ((checks notes)) Arthur Laffer. Yes, Art Laffer. On November 25 in the year 2020, Art freakin’ Laffer is the leading market voice of the day.

All of these article headlines have a market-positive theme and word selection, although my personal fave is “Janet Yellen Could Turn Out to Be a Great Treasury Sec’y”. Sure. Why not?

And as for ALL the articles you really need to read today on Entrepreneurs & The Economy … well, let’s just say that Ken Fisher’s “editorial staff” is …

No. You know what? I just can’t do it. I can’t make some sort of jolly joke about this. Four out of four articles placed by the marketing machine of Ken Fisher as a supposed “news aggregation” is just sheer mendacity. Stop it.

But that’s the point.

ALL of this is marketing. ALL of this is advertising. Whether it’s as obvious as the placement of Ken Fisher “editorial content” or as non-obvious as a WSJ headline … it’s ALL advertising.

This is the business model of the entire Wall Street ecosystem.

Will it work? Of course it will work. Advertising works! I’m not saying that this “Buy Cyclicals!” and “Buy Value! At Long Last! Buy Value! And Small Caps, Too, While You’re At It!” rally isn’t real. I’m not saying that it doesn’t exist or that it won’t continue. On the contrary, in fact.

I’m saying that you should reconsider what “real” means.

Art Laffer is what happens when the Star Wars ‘No one’s every really gone’ meme manifests in human form.

I laughed at Mozilo’s dancing metaphor, then I cried when my value investing tanked for a decade. I have no idea what is real.

Okay, I physically LOL’d at this.

I knew you were a closet fan of Derrida (and deconstruction)!

But here’s a question: Are you proposing that there’s a text that cannot be deconstructed? That’s there’s a text that’s not “sheer mendacity”? That there’s a text that’s not ALL marketing? That there’s a text that’s not ALL advertising? That there’s a text that does not attempt to construct knowledge (truth)?

Which text would that be? (Waiting anxiously with pencil and pad…)

If we can agree that ALL text and speech is an attempt to construct truth, can we also agree that the problem with any text or speech can’t be that it is mendacious, since it’s purpose is not to “be true,” but to “construct true”?

https://en.wikipedia.org/wiki/Deconstruction

American Consequences is nothing but a shill for it’s contributors. P. J. O’Rourke used to be interesting and insightful, when he wrote “Parliament of Whores” and “Eat the Rich” among other novels. Now he has decided to monetize this by including such luminaries as Laffer, Trish Regan, Buck Sexton (really? Makes me think of Buck Nekkid from Seinfeld), Sebastian Gorka, Dan Ferris of Stansberry Research publisher of the most execrable “Financial Newsletters” (just ask the readers of stockgumshoe.com) on the planet in his e-magazine. Pump and dump. How is it it that these people are called “Conservatives?” They’re stooges of the Fascist/Corporate bought and paid for “government” we have now.

The entire modern system can be described as an ‘open conspiracy.’ A major feature is that conspirators are not shy about telling you exactly what they’re going to do, but you mortals must still play the game and lose.

Open conspiracies can only be carried out by the powerful.

Co-sign.

Every minute is the same % of one’s life. Some minutes are better than others because better is better!

Yep, if I had a dime for every time I have seen a Ken Fisher article, and another dime for every time in the future that I know I will see a Ken Fisher article (no matter how many times I have metaphorically gone down on my knees in front of LinkedIn, Instagram, WSJ, etc., etc. to beg them to somehow, any way possible, stop showing me Ken Fisher articles), I would not need to worry about saving for retirement.

Where is Louis Rukeyser when you really need him? Now that was real!

The financial industry exists for one purpose - to separate you from your money. Their job is to convince you that investing is mysterious and that you can’t do it on your own, that you need “them” to help you. They depend on the sheer volume of information that’s put out to confuse you, and make you forget what they said last week, last month, last year. They’re wrong more than they’re right… or are they? Well right now they’re all saying…