Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

$108 Billion Fund Plans London, New York Hiring Spree [Bloomberg]

Australia’s largest pension fund plans to open an office in New York and expand in London as it outgrows its local market and seeks more investment opportunities overseas.

Mark Delaney, the chief investment officer of AustralianSuper Pty, said the more than A$155 billion ($108 billion) fund will have 30 employees in New York by 2022, focusing on property, infrastructure and private equity investments. Its London office, currently home to about 10 staff, will grow to around 50 by the same date, with a focus on property, infrastructure and foreign-exchange dealing, he said in an interview.

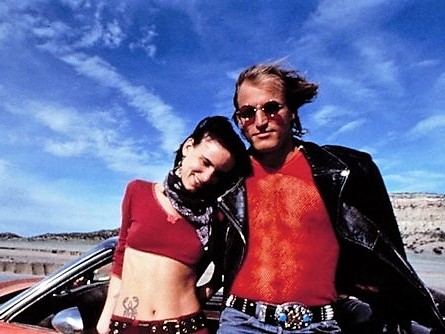

Headline writers just love a good spree. Well, I’m sure they don’t love a killing spree, per se, as headline writers are people, too. I think. But the word “spree” is so evocative in narrative-world, implying at a minimum some sort of wantonness and excess, some sort of moral bankruptcy.

The article itself is fairly humdrum. It’s another triumph of scale in the modern financial world, this time in the form of an Australian superannuation fund.

But this is where we are in 2019.

The financial services world is so threadbare … so slow-growing and right-sizing and mundane … that now it’s a “spree” to open up a New York office. With 30 people. By 2022.

Start the discussion at the Epsilon Theory Forum