Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He also serves as a member of the Easton Volunteer Fire Company in Easton, Connecticut. Rusty spends his free time smoking meat, working his apple orchard, enjoying whisky, badly butchering progressive rock drumming and jeopardizing long-term relationships through high-stakes board games.

Articles by Rusty:

When we talk about bias, we usually think about a political bias. But the world of 2021 now supports persistent idiosyncratic biases and frames through which information is passed. How do we ensure that our information consumption habits account for this?

No, the real story here probably isn’t about a revolution against Wall Street. But that doesn’t mean that there isn’t an opportunity to build a movement – right now – to transform it toward fair, free and open markets.

The light research poured into sentiment analysis misses one rather important fact: that’s the game we used to play. Today’s Fiat News is a different game altogether.

There is a brief window where I think we have the opportunity to commit to building a common national identity together. Seizing this opportunity will mean leaving a lot of anger we will feel is entirely justified at the door.

Not seizing it, I fear, will mean that we all reap the whirlwind.

It may seem ironic that a Narrative about the long-term could be deployed to distort the rewards of effective, market-based long-term capital allocation for short-term benefit.

This is, I think, the heart of The ZIRP Paradox:

The myth of infinite horizon investing is the enemy of long-term investing.

So an agent for a new over-the-top variety act finally gets a meeting with the biggest producer in the world. I mean, maybe ‘the world’ is selling it short. Word on the street is this guy’s even got God’s ear, if you can believe it.

Sometimes complicated is complicated because it has to be. But this nesting doll of a SPAC deal with Dyal (Neuberger Berman) IS weird and worthy of more than usual scrutiny, especially if you are an LP in one of these funds.

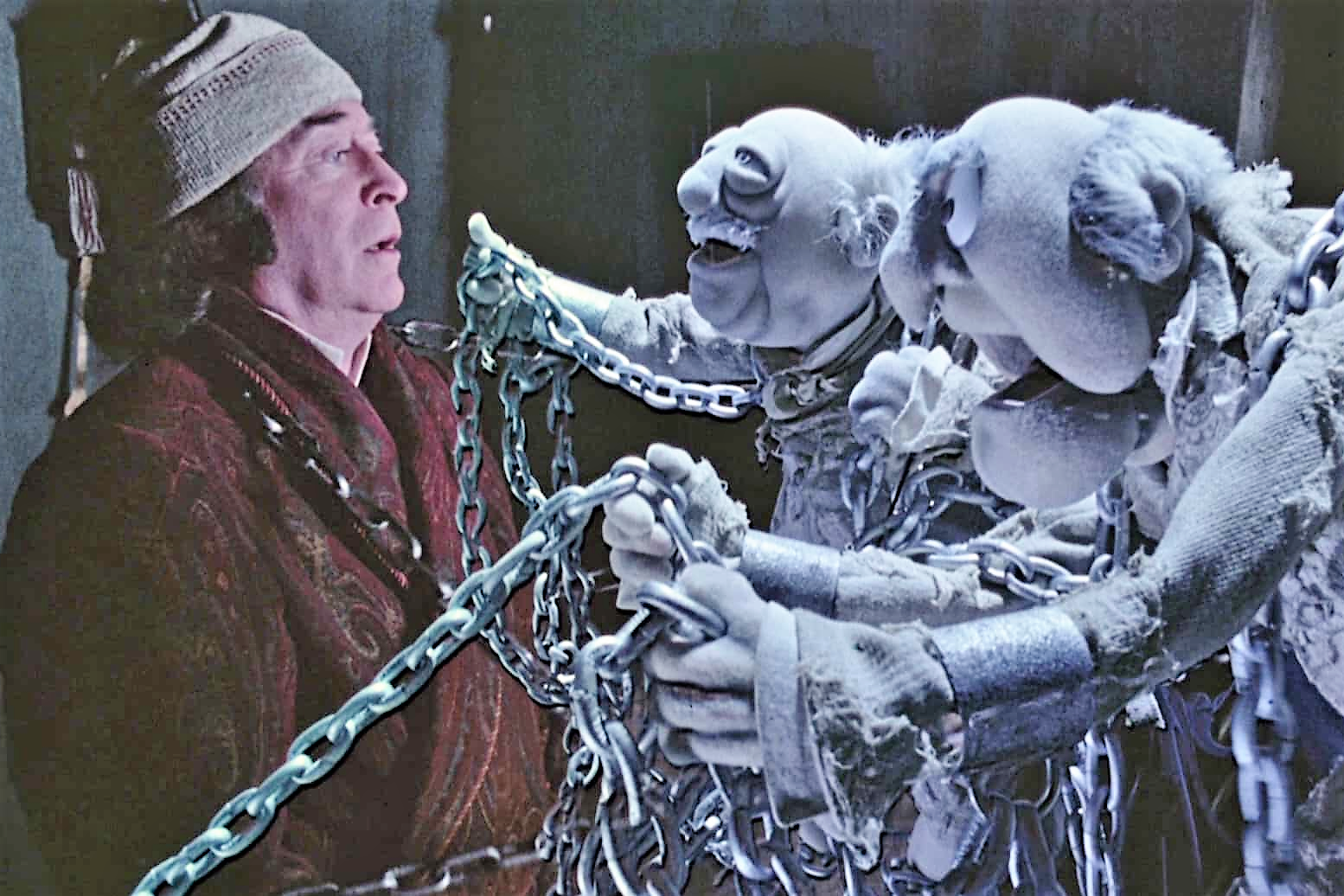

These are The Ghosts of Wall Street Commentary Future. And if their chains are not already clanking around in your inbox, they will be very, very soon.

It’s the November 17th Office Hours, where Ben and Rusty discuss all things narrative in an interactive format.

COVID-19 is endemic, and its mutations will likely be part of our lives going forward.

But there is another disease this virus has caused, and it is a disease of the mind. It is the endemic mindset. And we can eradicate it.

Today.