If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.

Our kids are being rewired.

The data implicating the smartphone-based childhood are compelling but not conclusive – and may never be.

So how should governments, communities, schools and families decide what to do?

City of God / City of Man

An AI in the City of God

The City of Man always wins.

The Visigoths always sack Rome. The Vandals always sack Hippo. Augustine always dies in the siege. Bad things always happen to good people … at scale.

Here’s how we use generative AI to flip the script.

Men of God in the City of Man, Part 1: Virus

This is a story about a virus and the gain-of-function research that produced it.

It’s not what you think.

Men of God in the City of Man, Part 2: Carriers

Every virus needs carriers to spread. Even a Narrative virus.

We can learn a lot from what they have in common.

Men of God in the City of Man, Part 3: Memetics

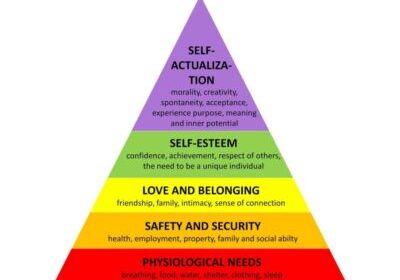

In the same way that genetics governs how physical viruses reproduce within a host, memetics governs how narrative viruses reproduce within a culture.

And the memes which govern our narrative virus are powerful.

Men of God in the City of Man, Part 4: Epimemetics

Every narrative is built on memes that have evolved and adapted to human culture over centuries.

But some environments change the way that those memes are expressed. The effects can be explosive.

Men of God in the City of Man, Pt. 5: Epidemic

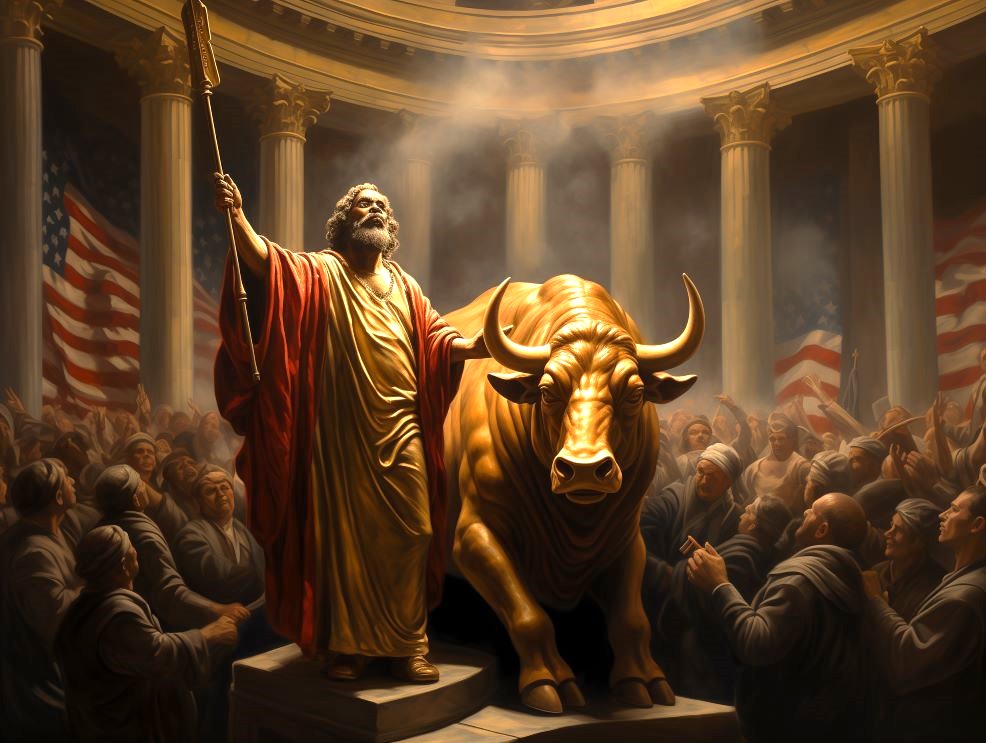

Men of God prophesied as early as 2007 that God would make Donald Trump the President of the United States.

Our narrative virus gave these predictions fertile ground to take root.

Men of God in the City of Man, Pt. 6: Pandemic

Surprising outcomes in reality world that seem to confirm a narrative often produce explosive growth in its scale.

But also in its scope.

Men of God in the City of Man, Pt. 7: Mutation

Narrative viruses are not immune to events in reality world – especially when we have made those narratives part of our identity.

And when a narrative becomes part of our identity, it changes what we need to be true.

Men of God in the City of Man, Part 8: Zoonosis

Physical viruses sometimes jump from one species to another.

Narrative viruses sometimes jump from one culture to another.

All it takes is the right virus and a susceptible host.

Men of God in the City of Man is a nine part series about a narrative virus that infected the charismatic and Pentecostal churches in the United States. It isn't a story about Christian Nationalism. It isn't a story about January 6th. It isn't a story about why people voted for Trump. It is a story about a story. It is a story about the language that created a self-sustaining movement defined by its unwavering belief in a fundamentally corrupt electoral system.

Recent Notes

Useful Idiots

Yes, Virginia, western news media are often useful idiots.

But let’s be real: so is Tucker Carlson.

The Bitcoin ETF Tipping Problem

ET contributor Dave Nadig was there at the beginning of ETFs, and he’s forgotten more about their structure and operations than I will ever know.

In this excellent note, Dave digs into the Bitcoin ETF “tipping problem”. It’s a fascinating read on where narrative runs headlong into the real world of market mechanics.

Death and Rebirth: In Precious Metals, Crypto, and the 6th Grade

“Nice yellow pants, freak.”

Nobody is immune to getting slapped with a label, especially when you’re a new kid in middle school. The trick is not selling out. The trick is owning your identity.

That’s true for Wall Street, too.

It’s All True

Eight thoughts that I can’t reconcile about about Justin Mohn, the 32-year-old in Levittown, Pennsylvania who murdered his father, cut off his head, and made a YouTube video showing off his trophy and saying he did it because his father, who worked for the US Army Corps of Engineers, was part of the “Biden regime” and was a “traitor to his country”.

It’s All True (Eight Thoughts on Justin Mohn)

Eight thoughts that I can’t reconcile about about Justin Mohn, the 32-year-old in Levittown, Pennsylvania who murdered his father, cut off his head, and made a YouTube video showing off his trophy and saying he did it because his father, who worked for the US Army Corps of Engineers, was part of the “Biden regime” and was a “traitor to his country”.

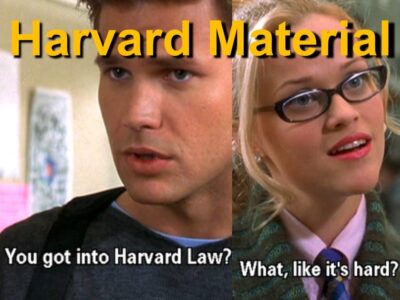

Breaking News #14: Harvard Material

Harvard has some of the most stringent admission standards of any university. Most people will never have the opportunity to receive a degree from this elite institution. But that doesn’t mean you can’t obtain your “graduate certificate” in fields like Museum Studies, Social Justice and Digital Storytelling all for the bargain price of $12,880 from the Harvard Extension School. Of course, Harvard won’t accept these credits in its main programs and you can’t get any federal loans for it, but you can tell your friends that you attended one of the world’s elite institutions. In this episode, we discuss how things got to the point in our higher education system where programs like this exist and what can be done to fix it. We also cover the declining narrative of electric vehicles, the challenge of measuring inflation, Vivek Ramaswamy’s master plan, 90s alternative music and a lot more.

Men of God in the City of Man, Part 9: Pathogenesis

A single virus can cause disease of the body in several ways at once.

A single narrative can cause disease in society in several ways, too.

This is the story of a new disease from an old acquaintance.

The Intellectual Rot of the Industrially Necessary University

The intellectual rot of the modern University perverts and diminishes the works of its faculty and administrators, no matter how smart they are, no matter how well-intentioned they are. It is a rot that requires plagiarism and promotes antisemitism.

We require a new Reformation, and here are its theses.

Breaking News #13: The Curious Case of Claudine Gay

Claudine Gay recently resigned as President of Harvard due to allegations of plagiarism. But the story behind that is far more important than the headline itself and gets at much bigger issues within the academic world, In the episode, we dig into those details. We also discuss what the recently launched ETFs mean for the future of Bitcoin, why attacks of hedge fund managers based on the carried interest deduction are misplaced, whether a soft landing is possible and the legacy of Dr. Martin Luther King.

Non-Linguistic Inflation Framing in the Wall Street Journal

We do a lot of work here to understand how the media frames issues linguistically, but we haven’t done much to see how that carries over in graphical narrative representations. Would the same patterns we see in the WSJ’s words be represented in the WSJ’s pictures?

Oh yes.

“Yay, College!”

Every once in a very great while, the direct beneficiaries of a yay-something narrative construction overplay their hand so egregiously, embarrass themselves so publicly, reveal their mediocrity so clearly, that the Common Knowledge propping up the yay-something narrative collapses.

This is the breaking of “Yay, College!”.

Breaking News #12: The Aggrieved Trump 2024 Narrative

The news about the election has been heating up recently. But it unfortunately has not revolved around the process of people voting to determine the outcome. The combination of Donald Trump’s legal issues and efforts to remove him from the ballot in blue states have dominated the recent election coverage. In this episode, we tackle both of these issues and how they are playing out in narrative world. We also discuss the reporting around the recent ceremony in Iran to mark the anniversary of the death of Qasem Soleimani, why S&P 500 yearly forecasts still exist and what we can learn from Rick Rubin. We also all offer our New Year’s resolutions for 2024.

Breaking News #11: Women and Risk: A Wall Street Narrative

It is no secret that women are underrepresented in the finance industry. That is especially true with respect to the “risk-taking” roles that people tend to associate with a career on Wall Street. While there are many reasons fort that, one of the primary ones lies in the stories we have been told in the media about women in finance. In this episode, we dig into those stories, how they influence us and how they also may offer us a potential solution to the problem. We also discuss the recent college president testimony in front of congress, Joe Biden’s tweets about inflation, the amazing story of the creator of Barbie and a lot more.

I Got You Fam

Last week, Jay Powell told you that the Fed intends to cut interest rates next year, not because they must, but because they can.

But inflation is a bird that always comes home to roost. And when it does, we will look back at Powell’s Christmas 2023 “I got you fam” pivot as a BFD in the Great Unmooring.

The End is My Beginning

Sir Steven Wilkinson returns home to Lancashire to say goodbye (?) to his father. There’s no true conversation to be had, only fragments to be gleaned, which will have to be enough. Tick-tock, everyone. Tick-tock.

Cursed Knowledge #26: Singin’ in the Rain

Movie musicals are a Hollywood staple. A spectacle of dance, emotion, and music. Proving which Hollywood stars are actors only and which are true triple threats. But it turns out a lot of our favorite classics have been keeping some pretty big secrets. Including who’s really singing.

The Changing Narrative of Women on Wall Street

Sure, you can do it. But you shouldn’t.

This used to be our common knowledge about risk-taking men on Wall Street. Today it’s our common knowledge about women.

And we are all paying a heavy price for that.

Breaking News #10: The Story of Generative AI | Bringing the Power of Discovery Back to the People

Generative AI has the power to become one of the most significant innovations any of us will see in our lifetimes. In fact, it may already be there. In this episode, we discuss the impact of this new technology on all of us and the world we live in,. We talk about what the technology is, how it works, the risks associated with it and its potential to shift the power of search and discovery from the hands of big tech companies to everyday people. We also discuss Ben’s first reader context on Twitter, whether the Rock could win a presidential election, the role of major universities in our society and a lost, but now found Beatles song.

Cursed Knowledge #25: Truffle Hunting

Truffles are well known to be one of the rarest, and most expensive, delicacies available. What’s not known is the cutthroat world of truffle hunting. Where it’s not uncommon to see fraud, theft, sabotage, and even murder.

Pain, Political Vibes, and Being a Bat

The core problem for Team Blue isn’t the candidate, it’s the team. Specifically, it’s the very online population of Team Blue journalists, academics and political operatives and their pseudo-religious, dogmatic urge to explain why aggregate economic statistics are more meaningful than lived experience.