If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.

Sorry, we couldn't find any posts. Please try a different search.

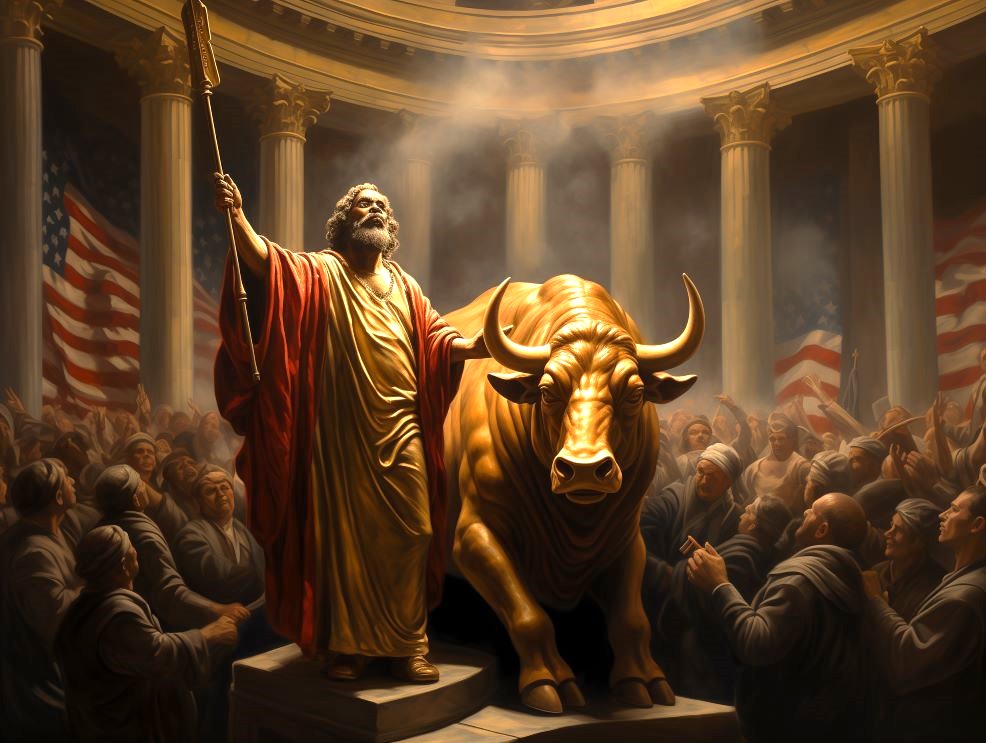

City of God / City of Man

An AI in the City of God

The City of Man always wins.

The Visigoths always sack Rome. The Vandals always sack Hippo. Augustine always dies in the siege. Bad things always happen to good people … at scale.

Here’s how we use generative AI to flip the script.

Men of God in the City of Man, Part 1: Virus

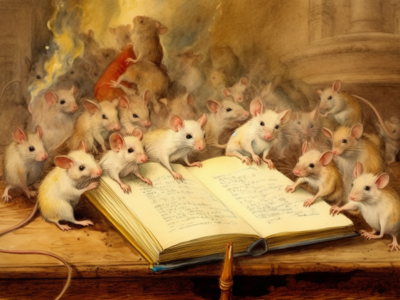

This is a story about a virus and the gain-of-function research that produced it.

It’s not what you think.

Men of God in the City of Man, Part 2: Carriers

Every virus needs carriers to spread. Even a Narrative virus.

We can learn a lot from what they have in common.

Men of God in the City of Man, Part 3: Memetics

In the same way that genetics governs how physical viruses reproduce within a host, memetics governs how narrative viruses reproduce within a culture.

And the memes which govern our narrative virus are powerful.

Men of God in the City of Man, Part 4: Epimemetics

Every narrative is built on memes that have evolved and adapted to human culture over centuries.

But some environments change the way that those memes are expressed. The effects can be explosive.

Men of God in the City of Man, Pt. 5: Epidemic

Men of God prophesied as early as 2007 that God would make Donald Trump the President of the United States.

Our narrative virus gave these predictions fertile ground to take root.

Men of God in the City of Man, Pt. 6: Pandemic

Surprising outcomes in reality world that seem to confirm a narrative often produce explosive growth in its scale.

But also in its scope.

Men of God in the City of Man, Pt. 7: Mutation

Narrative viruses are not immune to events in reality world – especially when we have made those narratives part of our identity.

And when a narrative becomes part of our identity, it changes what we need to be true.

Men of God in the City of Man, Part 8: Zoonosis

Physical viruses sometimes jump from one species to another.

Narrative viruses sometimes jump from one culture to another.

All it takes is the right virus and a susceptible host.

Men of God in the City of Man is a nine part series about a narrative virus that infected the charismatic and Pentecostal churches in the United States. It isn't a story about Christian Nationalism. It isn't a story about January 6th. It isn't a story about why people voted for Trump. It is a story about a story. It is a story about the language that created a self-sustaining movement defined by its unwavering belief in a fundamentally corrupt electoral system.

Recent Notes

Cursed Knowledge #28: Casual Gambling in Videogames

Gambling is a big deal. And everyone’s got an opinion one way or another. It’s had a pretty insane increase over the last few years. But what happens when Gambling becomes gambling? When it stops being a grand event and is instead a much more insidious and, well, casual thing. Spoiler Alert. Nothing good. It’s now showing up everywhere. From sports, to finance, to politics, to videogames. It’s rarely obvious gambling, and that’s what we need to be worried about.

The Intentional Investor #1: Ben Hunt

In this episode of The Intentional Investor, Matt Ziegler has a wide-ranging conversation with Ben Hunt, discussing Ben’s journey from academia to finance and the pivotal moments that shaped his career. Ben shares his lifelong fascination with games, puzzles, and cracking codes, which eventually led him to the world of investing. They delve into Ben’s experiences in academia, the lessons he learned from starting a software company, and his realization that fundamentals and value in investing are ultimately driven by narratives and game theory. Ben also discusses the genesis of Epsilon Theory, and his ongoing quest to find structure in unstructured data and stories. Throughout the conversation, they explore the interconnectedness of human, intellectual, social, and financial capital in shaping one’s life and career.

IT’S. ABOUT. THE. MONEY.

If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.

Breaking News #19: Number Go Up For November

In this episode we discuss how the upcoming November election is shaping the current political and economic landscape. We discuss why inflation, the stock market and the war in the Middle East are all being viewed through a political lens as the election approaches and those with a vested interest seek to influence its outcome . We also discuss the prevalence of conspiracy theories, the erosion of trust in institutions, and the importance of curiosity in a left brain focused world.

I Think The Gun Helps

Our kids are being rewired.

The data implicating the smartphone-based childhood are compelling but not conclusive – and may never be.

So how should governments, communities, schools and families decide what to do?

Breaking News #18: The Rise of the Raccoons

As anyone who has ever left their trash lid loose would know, raccoons have a tendency to come in and clean up the leftovers. And they make a huge mess while they do it. That isn’t the only place they exist, though. Raccoons also exist in the financial world, the self help world and a lot of other places. They come in and take what is leftover from what would otherwise be positive innovations and make a mess of them for their own benefit. In this episode, we take a detailed look at raccoons. We look at the tactics they use and how all of us can better spot them before they do their damage. We also discuss the danger of carved out inflation metrics, whether fundamental investing is dead, what steam boat operators have to do with finding your true self and a lot more.

Bitcoin Endgames & The New Hyper-Agents

If the HODLers are right, they’re also the new Elites.

Not in a “my thumbdrive will make me the Duke of West Hartford in this post-apocalyptic hellscape” sort of way, but in ugly-but-mainstream scenarios with ugly-but-mainstream power/wealth transfers.

Breaking News #17: The Rise of Financial Nihilism

Younger generations today feel like they don’t have a chance. Whether it be rising home prices or income and wealth inequality, they feel that they are starting with a significant disadvantage relative to older generations. One of the responses to this has been to resort to more aggressive gambling when it comes to their investments and their lives. Whether it be sports gambling or investing in riskier investments, some have sought to overcome their starting position by making risky bets. In this episode, we take a deep dive into this idea of financial nihilism and look at its real world implications. We also discuss Elon Musk’s treason allegations against Joe Biden and also look at the amazing behind the scenes story of the creation of the song “We Are the World.”

And You Wonder Why Bitcoin and Gold are at Record Highs

The Fed’s inflation-fighting credibility is shot and everyone in Washington and on Wall Street is in the bag for nominal growth, ie Number Go Up on EVERYTHING, through the November election.

After that … well, as Louis XV so aptly put it: après moi, le déluge.

Wheeee!

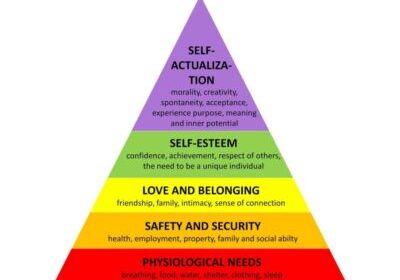

Financial Nihilism

The Boomers have all the money. The American Dream of upward mobility is dead for you. That is Financial Nihilism.

So if you’re on the wrong end of this, what do you do about it?

You gamble. You f**king gamble.

The Semantic Universe

Between the idea

And the reality

Between the motion

And the act

Falls the Shadow

Breaking News #16: Technology and the Teenage Mind

We all know that technology can be bad for children. But a new paper from 13D Research, which was republished on Epsilon Theory, really drove home the point of just how bad it can be be and the impact it has on the wirings of children’s minds. In this episode, we discuss this research and what we can do as parents to help mitigate the damage technology is doing to our children. We also cover the election and the impact of Trump’s legal problems, Elon’s Musk’s pay package Joe Biden’s scripted press conferences and the importance of embracing difficulty.

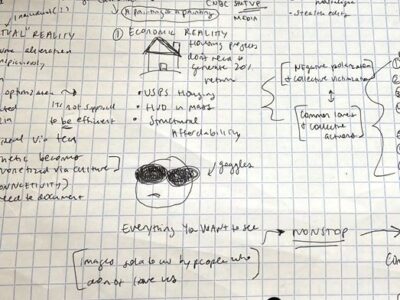

Why We Don’t Trust Each Other Anymore

We are saying everything, but also we are saying nothing, just sort of talking at each other about things like “rizz” and “Price-to-Earnings Ratio”.

How do we fix that?

The End of History and the Triumph of Fiat World

The great danger of generative AI lies in its use by governments and corporations to cement the most anti-human misalignment of all – the misalignment of rulers from the ruled, of the State from the People.

Fannie Mae’s Affordable Housing TM

Last month, Fannie Mae launched a new financial product they call a Social Mortgage Backed Security, designed to “improve access to affordable housing” by lowering credit standards for borrowers. As ET contributor Chuck Marohn points out, this makes home prices in affected areas go up, and doesn’t touch truly cheap housing.

How Does Technology Rewire the Intricate Circuitry of the Teenage Mind?

The central course of our children’s lives is being mind-warped by social media and smartphones, not in some ethereal ghost-in-the-machine sort of way but in an actual neural-wiring sort of way, and this research note by Kiril Sokoloff and the 13D team shows how.

Breaking News #15: Useful Idiots

Over ten countries are currently engaged in hot wars in the Middle East. But you wouldn’t know if from the media coverage where what has been going on has received limited attention. In this episode we dig into why that is. We also cover Tucker Carlson’s recent interview with Vladimir Putin, Joe Biden’s attempts to tackle shrinkflation and airline seating, why politicians from both sides have no interest in addressing the border and the importance of embracing your yellow pants moment.

The Washington Pravda and the Wall Street Izvestia

Today both Wall Street and the White House are determined to tell you a story that inflation is over and mission accomplished. Wall Street because they want a cheaper price of money and the White House because they want to win an election.

It’s not a lie, per se, but it’s not a truth, either. It’s all just story, all the way down.

And like all sclerotic institutions, Wall Street and the White House rely on their media organs to tell the story.

Cursed Knowledge #27: Panera Lemonade

Panera’s in hot water over their charged lemonade. After building their brand on clean and healthy food, they’re now facing several lawsuits claiming their lemonade caused permanent heart damage and even death. So what’s really going on with the lemonade? And why is the story surrounding it so misleading?

Useful Idiots

Yes, Virginia, western news media are often useful idiots.

But let’s be real: so is Tucker Carlson.