To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

I feel like the Billy Crystal character in Analyze This all the time. There’s always some mob boss politician or central banker or CEO or asset manager pinching my cheek and telling me that it’s all gonna be okay, that I’ve just gotta understand how things are.

My god, I am so tired of having my cheek pinched.

I am so tired of being nudged in such an artless, heavy-handed way.

I am so tired of being told that 2 + 2 = 5.

Yesterday it was one of the asset managers pinching my cheek, a senior partner at Baillie Gifford, a firm that manages over $200 billion. Here’s his FT Opinion piece.

Japan’s GPIF is right — short selling is downright irresponsible [Financial Times]

“Stock and bond markets, together with their investors, have a higher purpose than mere profit: their ultimate function is to provide capital to companies creating wealth for the benefit of wider society. This is best achieved through taking a long-term perspective and considered decisions.”

“What is the value created through stock lending? Those who defend the practice cite setting fair prices as an important outcome. But how valuable or helpful is this to the broader mission? Is such price discovery really helpful or necessary?”

“Baillie Gifford does not lend out stocks for our investment trusts or mutual funds, though many of our segregated clients do so, by their own choice. GPIF should be applauded for taking the long term and principled view of its responsibilities and hopefully more of our clients will follow its example.”

I mean, this is a sentence actually published by the FT in a non-ironic sense:

Is such price discovery really helpful or necessary?

As the kids would say on Twitter, let that sink in.

What is a Nudge?

It’s an article like this, pinching your cheek and telling you that of course it’s okay if market regulators decide to institutionalize GPIF’s “responsible” decision to stop lending out stock for short-sellers. After all,

Stock and bond markets, together with their investors, have a higher purpose than mere profit.

What do I mean when I say that capital markets have been transformed into a political utility?

This.

This is the water in which we now swim.

Or to use another vocabulary in vogue these days, it’s a method of normalizing an exceptionally non-normal world, where price discovery is something to apologize for, something distasteful and uncouth, like farting loudly in public.

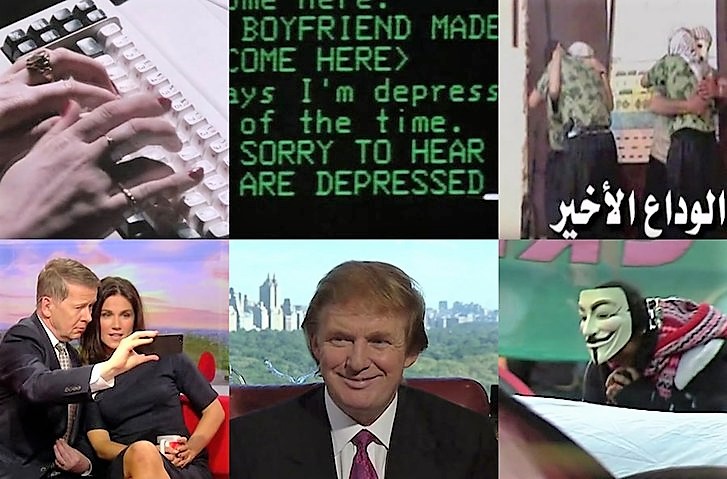

This is a cover shot for a BBC documentary by Adam Curtis, called Hypernormalization. It is, in the words of The New Yorker, “painting a picture of a world increasingly dominated by the false reality put forth by corporations and politicians.” In Curtis’s own words, channeling Alexei Yurchak:

“No one could imagine any alternative. You were so much a part of the system that it was impossible to see beyond it. The fakeness was hypernormal.”

Yep, that’s the Zeitgeist. That’s Fiat World. That’s the Long Now.

But I see people waking up to this. I get hundreds of emails every week from people opening their eyes.

Change is coming. Not from above, but from below. Yes to tear down, but also to rebuild.

Ben, as always, smart note that touches on something that’s been rattling around in my mind recently: unless self motivated, who is teaching (and has been teaching for the last few decades - as we know its not the schools) the last two or so generations about classic small-L liberalism / tradition market functions so that they can actually see all this nudging and fiat happy speak for what it is?

That’s also why, IMO, socialism/communism is attractive to so many of the younger generation - our educational system has intentionally nudged them to dislike capitalism and to like socialism.

Quick question, is Baillie Gifford forgoing the revenue it would gain by lending out its stock? If so, while I don’t agree with its argument, at least it is putting its money where its mouth is or am I missing something (which is quite often the case)?

Baillie Gifford’s discretionary account clients are forgoing the revenue from lending out the stock. Doesn’t impact BG at all. In fact, if I were a betting man, I’d be willing to wager that BG has an operational issue in booking the stock lending revenue, so they hide that in this bollocks about ooh, we’re “responsible” investors so we have no truck with those speculatin’ short-sellers.

It will effect the performance numbers for those accounts though, but I get your point: no direct dollar hit to BG. And if you’re right, they simply can’t handle it operationally, so they are making a virtue out of an incompetence - it’s the Lily Tomlin quote again: “No matter how cynical you become, it’s never enough to keep up.”

Similarly, I worked for a top-ten bank in the '90s whose large Capital Markets area could never properly account for carry (by the way, my experience has been that half the market “professionals” on Wall Street don’t really understand carry). I was stunned when I got there and only got them to focus on it by showing them how I could book a profit on when-issued trading for Treasury auctions Every. Single. Time. I literally had to run the trades in my account as they didn’t believe me. I’m far from perfect, but I know I’m not that horrible a cheat as I could have simply kept quiet and goosed my bonus-driving trading P&L all year long.

Ok, Boomer, got that out of the way. The "educational system has nudged the youth of the country towards whatever? Better that than Galt’s Gulch…Let’s say just hypothetically you arrived here in the US from outer space in 2006, with -0- knowledge of history but full understanding of the times you were placed in. 20% of US GDP in a mad housing bubble. Your parents were living the “good life” in the Nudging Oligarchy using the ever increasing “equity” in their several homes to get another loan from Angelo Mozillo and pull the money out and spend it today. In what seemed like a flash, everything collapses, and you watch as Hank Paulson walks to Congress with a 3 page bill to provide $700 billion in bank bailouts to prevent the system from collapsing. Your parents who live in Florida are subjected to years of foreclosure pushed through by judges and legislators to take away due process from you and steal the homes back. You understand that the borrowers never should have taken on that debt in the first place but jeez it was so easy. The pay raises of the judges were held up by the legislature until the backlog of foreclosures (www.peoplevmoney.com) was cleared, so cleared they were. Almost every judge had deficient financial disclosures holding stock in JPM, BofA, Wells, Sun Trust and other lenders that needed to take those homes back. You watch as Jaime Diamond, Dick Fuld, Vikram Pandit, Mozillo et. al. walk away their entities being deemed too big to prosecute by the Justice Department, no moral hazard for steamrolling the economy onto a ditch, followed by the FED’s ZIRP and BTFD zooming asset prices sky high, yet Mom and dad never recovered. The interest rate on their credit cards is higher than it’s ever been rapacious capitalism everywhere, and you want the kid and her contemporaries to say “Yay Capitalism?” Ha. Good luck. Don’t call anyone who went through that trauma and still feeling the effects from it a Commie, because the system has offered no alternative. What a reality show president born with a silver shovel is his mouth stealing millions while legally going bankrupt, buying toy doll wives and dumping them when not hot enough, pals with Jeffrey Epstein, coarse, rude, a model of leadership for the new decade…HOW COULD WE NOT END UP WITH A HUGE COHORT WHO THINK ANYTHING IS BETTER? Sorry, I’m a long suffering Cubs fan and once a century is not good enough…

They could have cleaned up lending all that TSLA that they hold!

Mark I think there’s probably a lot we’d agree on in regards to our education system and the importance of teaching small-L- liberalism. Yet, I gotta side with Bob on this one. Imagine you’re a member of this “younger generation” for a moment. Here’s the capitalism they (we’ve) experienced; One bubble after another each progressively bigger than the last, a planet destroyed, an almost incomprehensible level of wealth inequality, the list goes on and on. Then, the same people who created the shit-storm in the first place have the audacity to expect us to pick up the tab while thanking our lucky stars we don’t live in a socialist country. Yea Capitalism! Talk about someone pissing down your back and telling you its raining… Shit, to not question whether there’s a better way you’d have to be borderline insane.

*forgive my inner rhino coming out on that one, but you can imagine the frustration of someone who believes in both capitalism and small-L-liberalism that will have to spend the majority of his adult life navigating the host of bad ideas coming down the pike due to a prior generation’s selfishness, irresponsibility and greed.

This includes a response to Mr./Ms. Johnsoad too.

Here’s the thing Bob and M/M Johnsoad, I agree with much of what you say, but the difference is all the corruption (“legal” or not - like judges with conflicts of interest or TSLA, bailouts, etc.), all the back-door and front-door deals, Mozzilo, etc., are not capitalism.

It’s all corruption, fraud, crony “capitalism,” theft, etc. I get why people hate it as I hate it. But it’s not capitalism in any but the remotest of ways. You mentioned Epstein, that guy was a lot of awful things - but a small-L capitalist is not one of them.

Heck, banks were basically public utilities before they became even more like public utilities after 2008. Government guaranteed deposits, a zillion regulators with a zillion rules, some with social not monetary goals like CRA, might or might not be the right structure (I’d argue it isn’t), but whatever it is, it isn’t capitalism.

Unfortunately, through laziness by some and smart active planing by capitalism’s enemies, anything that seems “business-y” and isn’t pretty or is corrupt is labeled capitalism. I know Ben argues “Yay Capitalism” is a meme to get the public to shut up about all this corruption and ugliness, but I doubt he believes it is actually capitalism.

So I get and agree with (the large majority) of your guys’ list of things that explains why the younger generation hates “capitalism,” but I’d argue the flaw is that all but none of that is capitalism. Instead, through a very effective misinformation campaign - aided and abetted by a very leftward-leaning educational system (the voting patterns of educators are just one compelling piece of evidence to that fact) - every social, political, legal and business ill has been cynically label “capitalism” to destroy its reputation and support.

I am 55, which puts me as either in the last year of the Boomers or first year of Gen-X. I probably have more in agreement with those arguing against the Boomer generation than those with it, but either way, I find the “Ok, Boomer” comment fine as snark, but hardly reflects the spirt of pack members disagreeing in a respectful way with each other. My nieces and nephews have a lot of smart observations and ideas and some naive ones as well; sarcastically saying “Sure Millennial” when they bring up something that I believe experience has shown to be naive, is not the way I engage with them.

I have a half-baked idea, but one that might bear fruit with additional input from knowledgeable Pack members…

The technical definition of fascism is a ruling alliance between politicians and corporations. (The tribal/xenophobic bit is usually a helpful add-on but not strictly necessary.) The 1930s were a fascist era. We are in a fascist era.

This is not the preferred MO of the top elites. Much better to ally with a democratic populace (e.g. the postwar welfare state, AKA ‘Les Trentes Glorieuses.’) Or to ally with the financial elites (e.g. the Roaring 20s or Roaring 90s.) In the former, the fruits of the plundering is widespread, and in the latter, the plundering is at least well hidden. Fascism is resorted to when neither is possible any longer, for one reason or another.

That fascism is closely linked to international conflict is a reflection of how tribalism and xenophobia are a natural cousin of technical fascism. When you have finally and totally run out of justification for maintaining your ruling structure, and are forced to ally with corporate titans for obvious plundering, tribalism is a convenient last friend, and will form at least a good part of your support base.

The last fascist period was resolved by total war. Only proxy wars are now possible, if the human race is to survive. But I don’t see proxy wars resetting the world system, because your principle adversaries survive and fight on. So, this can truly be a Long Now, unless a negotiated reset among Russia, China, and the Western bloc is agreed on.

Mark, there’s really no such thing as capitalism, in practice.

From as early as the 1400s Italian Renaissance, when true money was physical gold and silver only, to the present day, what really runs the economy, any economy, has been combined political power and some level of market manipulation.

When the supply and demand for money and/or credit is not determined by the free market but by this combined power, nothing else can possibly be free. Everything ends up distorted by the policies coming out of what is essentially a centrally planned system. In other words, what we have is a hidden form of socialism.

I have the deepest sympathy for economic freedom, but in practice those who ‘champion’ this cause often work for one set of elites against another. E.g. the British empire used the idea of capitalism against their French rivals for global hegemony, as the American elites used it against the Soviets. The true feelings of the victors towards the idea of capitalism were only revealed after their victories.

Even worse (and sadly many of us become unknowing henchmen of this practice and, however innocently by intention, have blood on our hands,) the idea of capitalism is often used to support post-financial-crisis policies that essentially puts the pain of the bubble and bust (pain that comes ultimately from the centrally-planned nature of money and credit) on the shoulders of the public rather than the elites who run and benefit the most from the system. I can elaborate on this when I have time, but you see, things are as cynical as one can possibly imagine, and we older folks might find forgiveness for those among the youth who feel anything is better than what we have today.

Mark- very fair response. If I’m hearing you correctly u also believe our current economic system is broken, or at a minimum not representative of the capitalist system u would enact if u could put your magic genie hat on. Agreed

After trying and failing to come up with something clever to further elaborate on the context of my original comment, I’m just gonna level with u

I’m mad…mad because not only is our economic system failing us but its failing right alongside our political and religious institutions as well. Mad because these failings, at least in my opinion have very little to do with any glaring deficiencies in their doctrines and philosophies and very much to do with the deficiencies of the individuals who embody them. Mad because its not the Boomer’s selfishness, irresponsibility, and greed that’s to blame for our sad state of affairs but ALL, (young/old, wealthy/poor, left/right, secular/religious) of our selfish, irresponsible and greedy behavior.

But what I think I’m most angry at is even though there may be no answer with a capital A, there is an answer and its right in front of us. It’s us as individuals and a nation changing our behavior to be less of those things and more patient, understanding, disciplined, loving and caring. And, I don’t think we’re up for it.