Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Wall Street Used to Crunch Numbers. They’ve Moved On to Stories. [Bloomberg]

U.S. business may have been talking itself into a slowdown.

That’s one way of reading a study by the Carlyle Group, using techniques from narrative economics –- an emerging field set to gain momentum with the publication of Nobel prize-winner Robert Shiller’s much-anticipated book on the topic.

So this article is part of the publicity effort behind Robert Shiller’s forthcoming book, Narrative Economics. I’m sure I’ll have more to say about the book after it’s formally released, and I’m glad that narratives are getting more mainstream attention, and imitation is the sincerest form of flattery, and Robert Shiller is a really smart guy. Yep, I think I’ll leave it there for now.

Ah, who am I kidding?

The central metaphor for Shiller’s book is that narrative = disease, that (some) narratives are “contagious”, and that the spread of an “infectious” narrative “virus” can best be understood through the toolkit of epidemiology.

I think this is … wrong … not just in its conception, but even more so in how Shiller’s book will be USED.

Narrative is NOT a virus. Narrative is not something that exists outside of us. Narrative is not something that infects us or just happens to us if we are unlucky enough to catch it.

NO.

Narrative is intentional. Narrative is motivated. Narrative is done TO us. Narrative is – quite rationally – embraced BY us.

Narrative is entirely human, entirely part and parcel of what it MEANS to be the human animal … a social animal.

I can’t express strongly enough how dangerous I think it is to conceptualize narrative as a contagious disease, rather than as the medium of a social game – the Common Knowledge Game.

Why?

Because a contagious disease is something to be CURED.

And that’s exactly how Shiller’s book is going to be used.

Here are some more quotes from the Bloomberg article above:

“Central bankers can’t just watch. They need to promote their own narratives, too –- and it’s getting harder.“

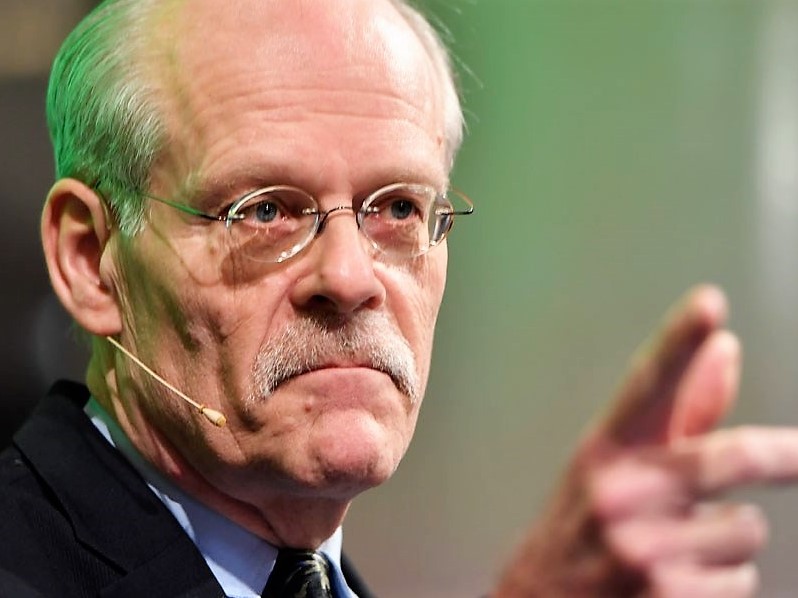

“I’m a shaman,” said Stefan Ingves, governor of Sweden’s Riksbank. “I’m a weatherman, I’m a showman, and I’m an economist.’’ But above all: “I’m expected to be, and I am, a storyteller. I tell stories about the future.”

“And if I’m successful in my storytelling,” he added, “people say: ‘Hmm, that’s reasonable.’’’

That’s Stefan Ingves, storyteller and central banker, shaking his finger at us and telling us HOW TO THINK about economic news and economic facts. Thank goodness!

Because in the Shiller universe of narrative = disease, it is the “reasonable” narratives of experts and academics that serve as the medicine for narrative epidemics like Bitcoin or market panics or gold buggishness or real estate booms or “talking ourselves into a recession”.

Just like these guys. They’re all doing EXACTLY the same thing that Ingves is doing.

Although I’d wager a lot of money that only 70% of these guys would be seen by Shiller or Ingves as promoting a “reasonable” narrative.

I think it’s a cop-out to think of narrative as disease, as something that just happens to us from time to time, as if it were some act of god.

Because if that’s how you think of it, then obviously that’s something that an “advanced” society should want to FIX. And how does an advanced society “fix” this?

Through the Nudge.

There is another way.

The other way is the anti-nudge. The other way is the encouragement of an individual autonomy of mind.

Clear Eyes, Full Hearts, Can’t Lose.

Not from the top-down, but from the bottom-up. Not from a political party, but from a social movement.

This is Make/Protect/Teach.

Those fingers all seem to say “I know” or “You should” !

It might start as a nudge, but a widening nudge is likely to follow.

Yeah, more like a shove.

Shiller published a paper in January 2017 titled Narrative Economics. I think this book is moving on from there. You can download the paper and save yourself the cost of the book. Published as COWLES FOUNDATION DISCUSSION PAPER NO. 2069, look on the Yale website.

,