If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

Catch – 22

Four times during the first six days they were assembled and briefed and then sent back. Once, they took off and were flying in formation…

The Clash of Civilizations

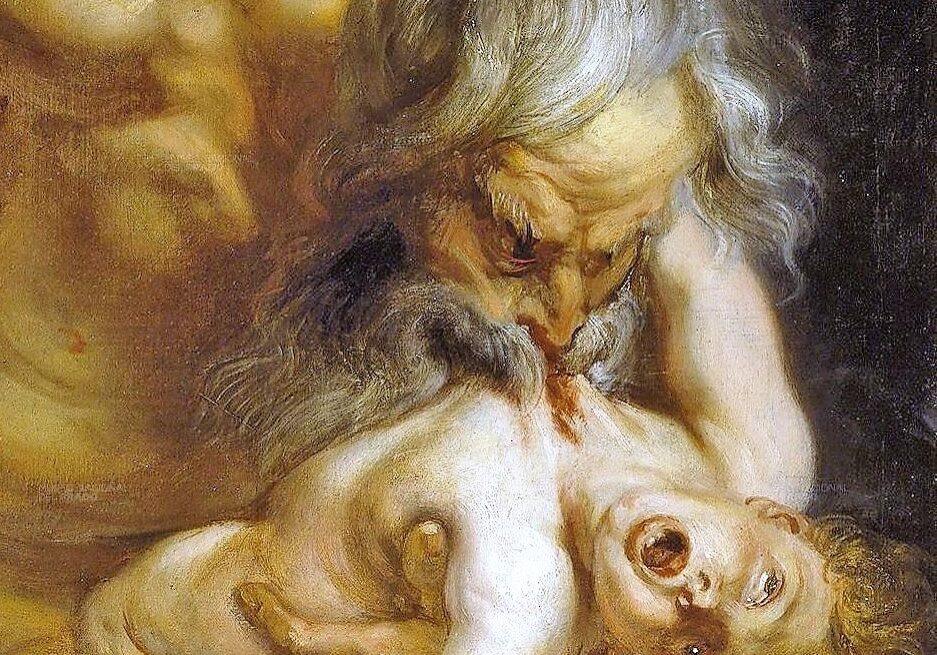

Thomas Cole, “The Course of Empire: Destruction” (1836) In the emerging world of ethnic conflict and civilizational clash, Western belief in the universality of Western…

Now There’s Something You Don’t See Every Day, Chauncey

Narrator: Well, today we find our heroes flying along smoothly… Rocket J. Squirrel: Flying along smoothly? Bullwinkle J. Moose: You’re just looking at the picture…

Narrative Uber Alles

Yesterday the Wall Street Journal ran a front page story titled “OPEC Sees Less Demand for Its Oil in 2015”, as well as another article…

We Now Return to Our Regularly Scheduled Programming

Hilsenrath Analysis: Friday’s Jobs Report Assures Global Central Banks Going in Two Directions ― Wall Street Journal, December 5th, 9:59a ET Earlier today I tweeted that “I…

Signs and Portents

Young nanny: Look at me, Damien! It’s all for you. [she jumps off a roof, hanging herself] – “The Omen” (1976) When one has…

The Unbearable Over-Determination of Oil

Market outcomes are always overdetermined, which is a $10 word that means if you added up all of the likely causes and their likely percentage contribution to the outcome you would get a number way above 100%.

Nowhere is this more true than the price of oil.

Mike Tyson: Master Game Theorist

Everyone has a plan until they get hit in the mouth. – Mike Tyson My long-term strategy turned into a 12-hour strategy. – “Survivor” contestant…

Wherefore Art Thou, Marcus Welby?

Seek not the favor of the multitude; it is seldom got by honest and lawful means. But seek the testimony of few; and number not…

Calvin the Super Genius

People think it must be fun to be a super genius, but they don’t realize how hard it is to put up with all the…

Hey Spike

The strong do what they can, while the weak suffer what they must. — Thucydides, “The History of the Peloponnesian War” (395 BC) Global growth…

Going Gray

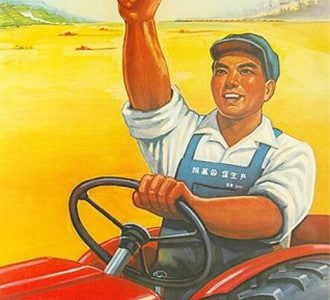

Everything under the sun is in chaos. The situation is excellent. – Mao Zedong (1893 – 1976) Forget it, Jake. It’s Chinatown. – Chinatown (1974)…

Best of List

I’ll have a new full-length Epsilon Theory note out early next week (“Going Gray”), but wanted to pass along two background points. First, a replay…

Finest Worksong

Take your instinct by the reinsYou’d better best to rearrangeWhat we want and what we needHas been confused, been confused– REM, “Finest Worksong” (1987) The…

The Game of Thrones and the Game of Markets

Two items for the mid-week. First, an invitation to attend a Salient Webinar I’ll be presenting next Thursday, September 18th at 2pm ET, titled: “The Game…

The Ministry of Markets

– Actual conversation as I left a client meeting with a Salient colleague last Friday and we checked our phones… Colleague: Wow, looks like the…

The Name of the Rose

If names be not correct, language is not in accordance with the truth of things. ― Confucius, “The Analects of Confucius” (551 – 479 BC)…

An Ice Bucket Dilemma

Something on the lighter side from Epsilon Theory today, as summer winds downs here in the last week of August. Most of us have seen videos galore…

One Little Old Russian Convoy

You know what I’ve noticed? Nobody panics when things go “according to plan”. Even if the plan is horrifying. If, tomorrow, I tell the press…

Here We Go Again

From an Epsilon Theory perspective, the scariest, most market risk-creating event of the past 48 hours had nothing to do with Iraq, nothing to do…