If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

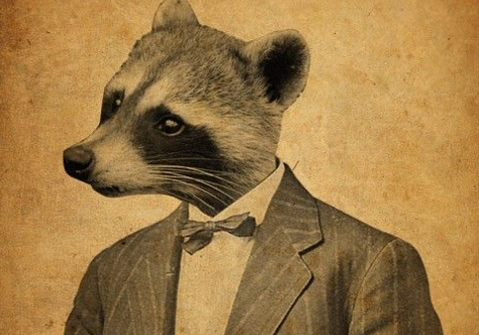

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

When the Story Breaks

The Three Types of Fear: The Gross-out: the sight of a severed head tumbling down a flight of stairs. It’s when the lights go out…

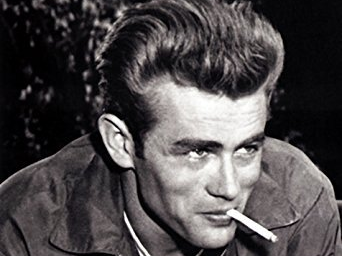

Breaking Bad

Jesse: And why’d you go and tell her I was selling you weed? Walt: Because somehow it seemed preferable to admitting that I cook crystal…

Actually Maybe Not So Excellent

Everything under heaven is in chaos; the situation is excellent. ― Mao Zedong (1893 – 1976) A quick email on China’s currency devaluation last night.…

“Suddenly, Last Summer”

A quick Epsilon Theory email and a quick announcement. Announcement first. I’ll be giving a 1-hour webcast on Risk Premia strategies next Tuesday, August 4th,…

The New TVA

War is too important to be left to the generals. – Georges Clemenceau (1841 -1929) Competition has been shown to be useful up to a…

1914 is (still) the New Black

There are decades where nothing happens; and there are weeks where decades happen. – Vladimir Lenin (1870 – 1924) In 1914, Europe had arrived at…

1914 is the New Black

Man in Black: All right. Where is the poison? The battle of wits has begun. It ends when you decide and we both drink, and…

Inherent Vice

Want to get hours of your week as a professional investor back? Want to reduce pointless portfolio activity and bad use of time with clients? Stop predicting games of chicken.

Two Growth Announcements and One Not So Much

I’m with you in Rockland where we are great writers on the same dreadful typewriter. – Allen Ginsberg, “Howl” (1956) Give me a long enough…

Sometimes a Cigar is Just a Cigar

More on Information Theory.

More Probable Than Not

The only thing that I ask from this group today and the American people is to judge me from this day forward. That’s all I…

The Talented Mr. Ripley

The more I practice, the luckier I get. – Gary Player (b. 1935) Luck is the residue of design. – Branch Rickey (1881 – 1965) I’ve…

It’s Still Not About the Nail

Reader reaction to the March 31 Epsilon Theory note, “It’s Not About the Nail”, was probably the strongest and most positive for any note to…

It’s Not About the Nail

Do, or do not. There is no try.” – Yoda, “Star Wars: Episode V – The Empire Strikes Back” (1980) I see it all perfectly;…

Troy Will Burn – the Big Deal about Big Data

For the life of me, I don’t understand the debate [over the NSA metadata program]. – Jeb Bush, February 18, 2015 The Central Intelligence Agency…

Epsilon Theory Mailbag: Bitcoin and Big Data

One of the best parts of authoring Epsilon Theory is the correspondence I get from readers. For the past few months, however, I’ve been frustrated…

Why Take a Chance?

Vinny Forlano: He won’t talk. Stone is a good kid. Stand-up guy, just like his old man. That’s the way I see it. Vincent Borelli:…

The Effete Rebellion of Bitcoin

In structure, Bitcoin is a bearer bond.

In meaning, Bitcoin is the cautious expression of a rebellious identity.

First Known When Lost

I never noticed it until ‘Twas gone – the narrow copse Where now the woodman lops The last of the willows with his bill –…

7 Quick Points on Europe

#1) Here are the most relevant recent notes for an Epsilon Theory perspective on the underlying political and market risks in Europe: “The Red King”…