Hey, Maybe It’s the Needle

To learn more about Epsilon Theory and be notified when we release new content sign up here. You’ll receive an email every week and your information will never be shared with anyone else.

Continue the discussion at the Epsilon Theory Forum

The Latest From Epsilon Theory

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results.

Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

I am fully confident that I am no better than anyone else, but as the political gyre has widened, my response - my first inclination and, now, my thought out one - has been to withdraw from the discussion. I am still actively engaged in following the issues and forming (what I hope are) my own thoughtful, rational opinions based on - what you importantly note are still things - “truth and reality.”

For example, when, months ago, waiting at a blocked-to-pedestrian-traffic street corner in Manhattan for a Trump motorcade to pass and listening to a very elegantly dressed, middle aged woman, incredibly, scream (with rage in her face) at random police cars and black SUVs “we hate Trump!” all I wanted to do was withdraw (from the human race at that moment).

As to Thanksgiving, by now, I have perfected my conversation-avoidance techniques which will be employed all day to not engage in political conversation. A day I used to love is now one I just want to be over - I’ve even thought about being fake sick to avoid it all together.

My question to you, Ben, and other ET pack members - while this ET brief implies we are all fighting harder, arguing more - and it certainly feels that way to me - are there other ET members who feel like I do? Are there others who just want “out” of the discussion, who know that they aren’t going to change anyone’s mind and, even if they miraculously did, there’s 150 million more minds that won’t be changed? I’ll happily have a spirited and rational conversation with anyone who disagrees with me, but I’m done talking (metaphorically) to people who scream at motorcades and that is what most of the conversations are like today.

Mark,

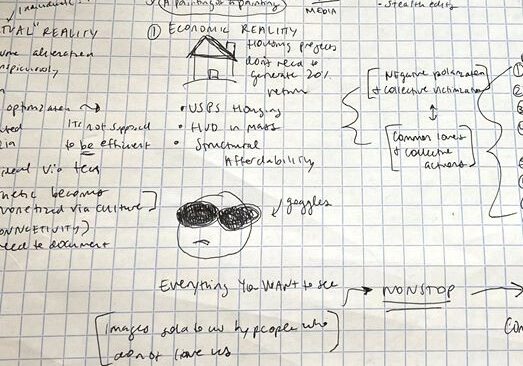

Evasion is my first inclination as well—particularly when it means I am able to fully digest my turkey. However, more recently when I do engage I’ve focused on uncovering that abstraction cloud Rusty talks about. Saying Yes AND in order to dismiss the googolphonic speaker and try to talk about the needle.

For example:

Uncle Jim: “Can you believe Acosta hit that staffer? He deserves to have his credentials revoked.”

Me: “It certainly looked like that in some of the videos I saw. I’m more disheartened in general at how combative the relationship has become between media outlets and the President. It distracts from engaging with policy issues and damages trust in what should be a source of facts. What’s presented as ‘news’ should really be filed under opinion piece—and that goes for Fox and the NYT!”

This is a pretty silly example, and it’s probably not Phase 2 in solving society’s problems, but even Uncle Jim can agree with the growing need for a critical eye to sniff out fiat news. Most conversations devolve from there anyway, but some get through—sometimes the centre holds.

I, for one, am still trying to figure out what’s true, and so I am happy to learn that my mixed reactions to the accosted video could be secondary. Meanwhile, as far as your paragraph 4 lament, I found Jordan Peterson’s ‘12 Rules’ an antidote, not to chaos, but to my own negativity. (Grandchildren work, too!)

I just find it ironic that without vinyl records becoming hip again, entire generations would have had no idea what you meant by “it’s the needle!”

Hah! But somehow we’ll be left with the term “rewind” from inferior cassette technology forever, even if the collective understanding of its origin is lost to history.