To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Homer: That’s it. They have awoken a sleeping giant!

Marge: Homey, what are you going to do?

Bart: <chanting under his breath> Crazy scheme, crazy scheme, crazy scheme…

Homer: Get me tools and a beer!

The Simpsons, Season 13, Episode 15 “Blame it on Lisa”

The crazy Kodak scheme we wrote about a week and a half ago is still an influential part of the Zeitgeist.

It sits atop the Zeitgeist this week for two reasons. First, there has been another event in this absurd saga, and coverage of it has been significant. To wit, on Friday, the U.S. International Development Finance Corporation announced that it was putting the announced loan on hold because “allegations of wrongdoing” raised “serious concerns.”

This is good news.

The announcement from the DFC also spawned a lot of articles with shared language, including this one from CNBC that ranked near the top of our list of financial articles with the most structurally similar language over the weekend.

Kodak pharma deal held up over reported questions about stock move [CNBC]

There is a second reason for the high degree of connection around this topic, however. It is being forcefully attached by political and media missionaries to the rapidly emerging Narrative of deglobalization and reshoring of critical American manufacturing. This narrative will be an old friend to most Epsilon Theory readers, who read about its emergence in March in a note we published called Lack of Imagination.

Since we spotted those early Missionary drum beats in early-mid March, the narrative exploded in coverage volume across financial media, reaching its peak this summer.

To be fair, there is a very good case to be made that COVID-19 laid bare how the globalization of pharmaceuticals supply chains and manufacturing created unacceptable fragility and vulnerability in exchange for an extended period of higher margins and capital efficiency. Depending on your political proclivities, there is a very good case to be made that government policy will necessarily play a role in reversing, or at least patching, those vulnerabilities. There is room for disagreement, but there is nothing crazy about believing that it is strategically important that America have a strong, complete domestic pharmaceuticals manufacturing industry.

But the gap is WIDE between that belief and the belief that the only way to achieve this is by demanding your tools and a beer so that you can come up with a crazy scheme like tagging the International Developement Finance Corporation to facilitate that transition through a no-strings-attached loan to a government official-linked company that hasn’t had competitive expertise at scale in chemicals, pharmaceuticals or really anything else since it shuttered or sold such businesses over the last few decades.

This topic sits at the top of the Zeitgeist in part because narrative missionaries are aggressively trying to tell each of us how to think about the gap between those beliefs. They are telling us that the gap doesn’t exist. They are telling us to think that extending no-strings-attached financing to Kodak is inextricably related to – no, synonymous with – “doing something about reshoring pharmaceuticals manufacture.”

We are told that they are the same because the narrative missionaries want to be able to produce an unassailable, physically compelling response in us if we or anyone else express doubts. If we say, “Wait, why Kodak?”, they want to be able to respond, “Why don’t you care about restoring American pharmaceuticals manufacturing?” It is the oldest trick in the memetics playbook – the abstraction of A into B, where B is a thing that everybody knows everybody knows is unassailably important. In this case: The Kodak deal is the restoration of American pharmaceutical manufacturing.

In other words, Yay, reshoring!

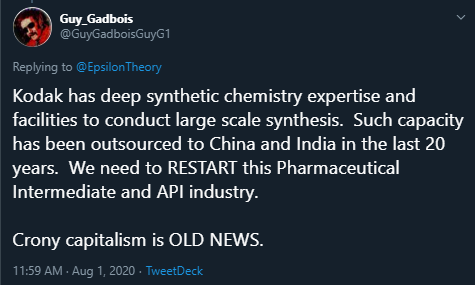

Here’s what it looks like when a political missionary promotes this narrative with a “Yay, reshoring!” Meme attached.

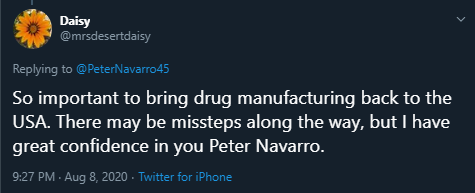

Here’s what it looks like when a media missionary promotes this narrative with a “Yay, reshoring!” meme attached.

And here’s how the echoes of those missionary statements begin to reproduce in the mouths of others. Like the original missionary statements, they ignore the criticisms of the Kodak grift and reframe them as assertions about the need for pharmaceuticals reshoring.

The trick to seeing through these forced abstractions is always the same: we remember that two things can be true at the same time. In this case, it is true that restoring domestic manufacturing capacity in certain critical industries is a legitimate policy aim. AND it is true that the Kodak grift is exactly the crazy scheme it appears to be on the surface.

Anyone who implies that these two assertions are in opposition is selling you on an intentionally constructed narrative.

From a funny desk calendar from years ago:

Hah! I have not seen either of these before.

They were mostly conjured from thin air. Hilariously so.

i can’t figure out why Twitter even exists, except to give a playground for media and fake bots to spin. At Least Facebook has sweet cat videos, and grandchildren pics…

Trolling celebrities, too, I suppose, although I think most of that has moved to Instagram.

The people need their entertainment. Plus it allows the Hunt household to operate more calmly since Ben can unleash his rage on twitter and not on the fam.

¿Por qué no los dos?

If the Federal Gov’t had asked Eastman Chemical (spun off from Eastman Kodak in 1994) to produce pharmaceutical chemicals, instead of Kodak, this wouldn’t seem nearly so crony-strange. There are a number of other chemical manufacturers in this country that could conceivably participate in Pharmaceutical Production Reshoring. Why is this so strangely difficult?

It is mind-boggling, and I have trouble conjuring any explanation other than those Ben suggests in his piece.