That's a still photo from the Netflix documentary "Behind the Curve", a really good movie about the Flat Earth movement. I'll come back to this in a minute.

But first ... I was going to save this email for the Mailbag, but couldn't resist using it now.

Hey There Ben You and your contributors seem to be continuously complaining, whining and expressing a kind of morose discontentment. Why are you all so unhappy and dissatisfied? Maybe take a few of your intellectually earned dollars and buy yourself and each of your contributors a surfboard, mountain bike, snowboard, and climbing gear, with the proviso, all must be put to use. Then see if the tenor of future essays will have changed. Who knows, maybe action speaks louder than words. -- By the way, the idea of Joining a Pack is very unappealing. -- Anyway, Cheers and Aloha from the North Shore, Charles

I mean, Charles is an ass. But he's not wrong.

And then I came across this gem (h/t Bloomberg Radio's Lisa Abramowicz):

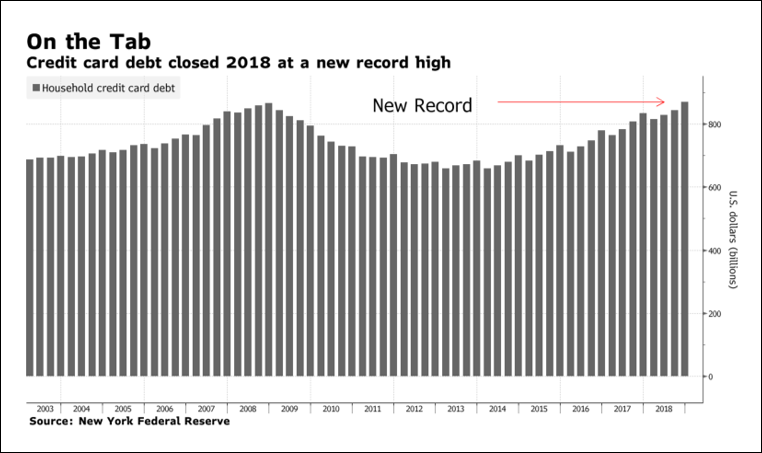

Sixty percent of that record credit card debt (per this survey) is for daily expenses (food, utilities, rent, etc.) and retail purchases. When asked what they would be willing to give up to get out of debt, only 6% would give up their smartphone. Of course, 13% said they would give up their right to vote. [Pro tip: you already have.]

I thought about this record credit card debt, mostly comprised of food and rent and clothes, when I paid $4.99 per lb for organic, boneless/skinless chicken breasts at Stop and Shop last night, because it was the cheapest chicken breasts they had for sale. I am not making this up.

And then, of course, I was greeted this morning with the news that Mario Draghi and the ECB, by unanimous vote, had decided to resurrect the term loan stimulus program to European banks as some sort of ... precautionary measure? effort to slam the euro in our DM beggar-thy-neighbor race to the currency bottom? retirement present for Mario?

As someone who has an embarrassingly large CC balance, I can assure you that it was accumulated with a second thought. And a third, fourth, fifth…every God damn day thought. But you are absolutely correct that I got it by telling myself that I derserve that lifestyle; to not eat food that is essentially poison, to not miss my best friends’ weddings because they want to hold it in Mexico or their bachelor parties because you’re only young once (two trips to Vegas in 10 years). Maybe it’s because I bought the lie that if you work hard your life will improve, or that real estate only goes up in value. It’s certainly not because I drive an '06 with 100k plus miles or haven’t taken a vacation that I wanted in over a decade. It’s certainly not because my idea of eating out is a once-a-week trip to Chipolte and live it up with double meat. In my opinion, it’s because the American dream is essentially dead in real life, but is portrayed as alive and well everywhere you look and the vast majority is too proud to admit they are struggling. So the digging continues.

Here’s an example of how it happens: Neville Crawley’s recent book recommendations came to a little over $100 on Amazon. That’s $100 I don’t have right now, but could easily charge (because I think it’s money well spent). So I did.

Ditto for my pro subscription. ; )

The Flat earth Society " with members around the globe…"

One-Dimensional Man.

Having spent over 30 days this winter kiteboarding in remote Baja California, and another two weeks in Japan on the Northern island of Hokkaido hiking mountains in search of powder snow, I can attest that it does help improve one’s perspective on life. So refreshing not to hear the talking heads on CNBC or BTV for weeks at a stretch. I suspect being on the farm provides you with similar emotional support. However, my 1040 reveals I’m a CA taxpayer, and upon returning to the Bay Area from these all too brief encounters with nature, I also wretch at the $5.99 chicken breasts on sale, the latest statistics on RE prices, and the presidential campaigning that seems like some sort of time warp back to 2015! I’ve taken to reading historical novels (have read all three books my kids got me for Christmas) and letting go of Zero Hedge (stopped reading WSJ and Barron’s after 2008). Am actively working on my permanent escape from CA, and would do same with regard to the US, but the IRS would never stand for it.

Fiat Earth… perfect. Behind every great fraud is an inherent desire to believe on the part of its beneficiaries and, at some point, even its victims. I know I wish the world was still flat.

It sounds like you’ve been harshing Charles’s mellow. Shame on you, Ben.

Same.

Seriously … everything J writes fits me to an absolute T.

Picking a small monetary bone here… An argument against fiat currency usually favors something like the gold or silver standard, where the central bank stood ready to redeem its issued paper money for gold or silver at a fixed rate.

This is the position of most modern gold bugs, and also (much less famously) a passionately held orthodoxy by the entire academic and power establishment when the standard was operating. The problem was that it never worked ‘as intended.’ On the eve of World War I, the world’s top dog, Britain, held only 3% of the gold required to redeem all the paper money it had issued. So, if the true intent of the gold standard was to keep inflation in check (as gold bugs believe today,) the British elites had been asleep for the century between the Napoleonic Wars and WWI while paper issuance gradually overwhelmed any chance of eventual stability.

No, the true nature of the gold and silver standards was an effective method of financial repression. If saving in physical gold was guaranteed to earn zero returns by the elites, savers were inclined to invest in riskier assets which helped grow the economy, inflate/support the system, and benefit the elites.

Which brings us to cryptocurrency… From the authorities’ point of view, today’s ad hoc style of monetary engineering must seem almost juvenile next to the elegance of the international gold standard (which was not without fundamental drawbacks, true, but which can be fixed.) I have said that if Bitcoin never existed, the Western elites would have liked to create it in secret. (Though I have no evidence of any kind.)

Sorry, more complaining and whining.