We’ve had a heckuva busy year at Epsilon Theory, so to ring out 2017 I thought it might be helpful to distribute a master list of our publications over the past 12 months. We’re long essay writers trying to make our way in a TLDR world, so even the most avid follower may well need a map!

In a two-body market, the interactions of fundamental data and prices are generally predictable. In a three-body market, the epsilon — investor behaviors in response to narratives — exerts a powerful gravitational force which must be considered when building a portfolio.

What if I told you that the dominant strategies for human investing are, without exception, algorithms and derivatives? I don’t mean computer-driven investing, I mean good old-fashioned human investing … stock-picking and the like. And what if I told you that these algorithms and derivatives might all be broken today? You might want to sit down for Part 9 of the Notes from the Field series.

The libertarian paternalism of a Nudge culture in finance has created an industry of investors who care about fees but have forgotten about taxes, trading costs, slippage and behavioral costs of actively trading passive instruments.

The pecking order is a social system designed to preserve economic inequality: inequality of food for chickens, inequality of wealth for humans. We are trained and told by Team Elite that the pecking order is not a real and brutal thing in the human species, but this is a lie. It is an intentional lie, formed by two powerful Narratives: trickle-down monetary policy and massive student debt financing. Part 8 of the Notes from the Field series.

If you can manage to find a truly independent voice in your personal, political and financial life, pursue it with reckless abandon. Don’t set it to the side so that you can build a brand or make an impact. Get your ass out of the boat, grab your bow, strap on your broadsword and sound the pipes. All that’s left is to decide what song you’re going to play.

On episode 26 of the Epsilon Theory podcast, we welcome back Rusty Guinn, our executive vice president of asset management, to talk about political markets — a topic just as important to Ben as capital markets. Be sure to also check out the companion pieces to this podcast: “Always Go To the Funeral,” “Sheep Logic,” and “Before and After the Storm.”

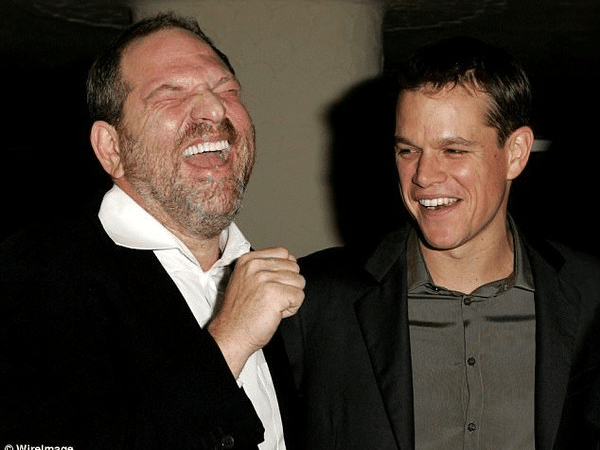

It was no great secret that Weinstein was and is a serial rapist. Apparently everyone in Hollywood was familiar with the stories. It was ubiquitous private knowledge, and pretty darn ubiquitous public knowledge. I mean, if you’re making jokes about it on 30 Rock, it’s not exactly a state secret.

But there was never a Missionary.

The behaviors that influence markets must be considered in context of archetypes, the languages and identities which group investors every bit as much as identity politics groups voters.

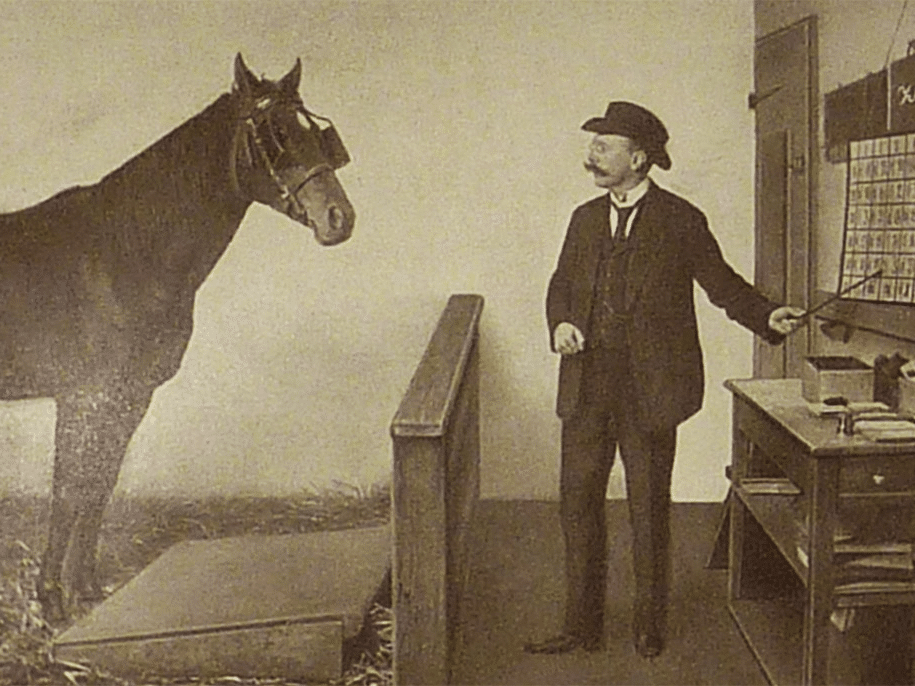

Part 7 of Ben’s Notes from the Field series reminds us that you don’t break a wild horse by crushing its spirit. You nudge it into willingly surrendering its autonomy. Because once you’re trained to welcome the saddle, you’re going to take the bit. We are Clever Hans, dutifully hanging on every word or signal from the Nudging Fed and the Nudging Street as we stomp out our investment behavior.