Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

Excessive complexity in a deal or structure isn’t necessarily nefarious, but it also isn’t a good sign. The distraction and confusion you and I feel reading about these deals is usually not the problem.

It is the point.

An in-depth look at the interdependence of inflation, Treasury supply, and the Fed reaction function.

Bottom line: inflation is the Fed’s kryptonite.

Very little investing today is buying and selling shares of common stock in individual companies. Instead, we buy and sell what Wall Street calls “products” – mutual funds, ETFs, options, REITs, SPACs, etc.

Dave Nadig, who literally wrote the book on ETFs, helps us understand the history and future of the business of Wall Street.

In the same way that Narrative shaped a conversation about the role of police going forward in 2020, narrative can shape a conversation about the role of teacher unions and public sector unions more broadly. My money is still on the status quo, but I’ve been wrong before.

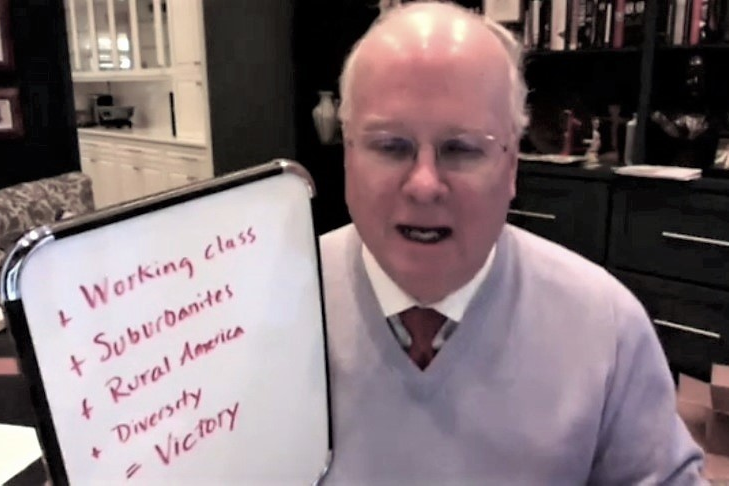

Every political movement has a political philosophy, and for Trumpism and MAGA it’s the Dominion theology of the charismatic/Pentecostal church.

Neither the rise of Donald Trump nor the attack on our Capitol can be understood without an examination of this faith and its constructed political narratives.

Believe it or not.

What’s happening with Reddit and Gamestop and Robinhood is a revolution, but not the revolution you think.

This isn’t a “democratization” of Wall Street. You were played. Again.

It’s a revolution in Common Knowledge. And that changes everything. Again.

What’s happening now in equity markets isn’t the product of some paradigmatic democratization of finance. It’s just another bubble that will end badly.

The Very Serious Investor is quite disturbed by recent goings-on in illiquid, small cap stocks with high short interests. These happenings represent an assault not only on the Very Serious Investor’s livelihood, but his entire cosmology. People placing profitable discretionary trades in the financial markets when they lack even a single Ivy League degree. Imagine!

No, the real story here probably isn’t about a revolution against Wall Street. But that doesn’t mean that there isn’t an opportunity to build a movement – right now – to transform it toward fair, free and open markets.

The South African variant virus (501.V2) is not the immediate threat to the United States as the UK variant virus (B117). But 501.V2 has the potential to create a far more powerful narrative – vaccine resistance – that can have a greater market impact than the more pressing issues of B117.

More and more, I think the variant viruses create a tradeable event for markets.

Everything you always wanted to know about r/Wallstreetbets and Gamestop*

*but were afraid to ask

The spread of B117 in a Covid-fatigued country like the US is a profoundly deflationary, risk-off, dollar higher, flight to safety event in real-world.

Does it matter to market-world?

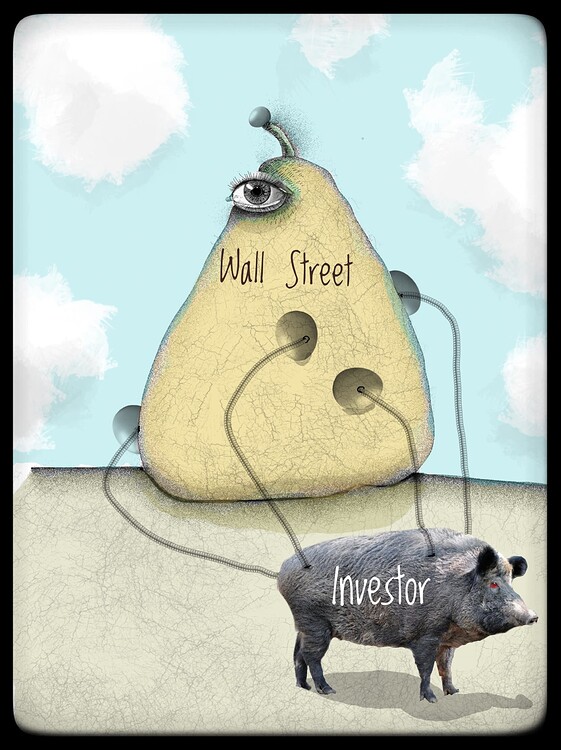

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

In episode #3 of the Epsilon Theory podcast, Rusty and I discuss the spike in Covid cases in Ireland and the risk of seeing a similar “Ireland Event” here in the US.

The time to act is NOW, not with indiscriminate lockdowns, but with strong restrictions on international and domestic air travel to contain the UK-variant virus while we accelerate vaccine delivery.

I believe there is a non-trivial chance that the United States will experience a rolling series of “Ireland events” over the next 30-45 days, where the Covid effective reproductive number (Re not R0) reaches a value between 2.4 and 3.0 in states and regions where a) the more infectious UK-variant (or similar) Covid strain has been introduced, and b) Covid fatigue has led to deterioration in social distancing behaviors.

There is a brief window where I think we have the opportunity to commit to building a common national identity together. Seizing this opportunity will mean leaving a lot of anger we will feel is entirely justified at the door.

Not seizing it, I fear, will mean that we all reap the whirlwind.

ET contributor Pete Cecchini isn’t buying the reflation / small-cap rally narrative, even with a mini Blue Wave.

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

A conversation with Brian Portnoy, author of The Geometry of Wealth, about the role of money in shaping a life of meaning. How do we give better advice about money to others … and to ourselves?

As Monty Python would say … and now for something completely different.

It’s JPow fanfic day here at Epsilon Theory! Or “every day” as they refer to it on Wall Street.