Epsilon Theory runs the world's financial news through natural language processing-based cluster analysis to identify the most on-Narrative stories. We scan for those with the most similarity to all other stories as well as those with the most interconnectivity to multiple different key topics.

A tariff three-fer, subsidizing orphans like it’s a bad thing, Buffett buffetted, and MMT/GND propaganda shifts into a new gear.

Highs on trade hopes, mixed on trade talks, creepy refrigerators, CRM for Main Street and Insurance Love Stories.

In which we focus on struggles and changes at asset managers, Soc Gen misses the boat, and markets ‘move’, ‘inch’ and ‘advance’ on trade optimism.

Pesky stock analysts, an earnings season focus on power and energy, and a late run on descriptive terms for the China Trade negotiations.

In which we learn about new voices in the hospital, we pile on the Fed, and we exult in stocks “edging up” on trade talk progress (I’ve forgotten what take we’re on).

Lots of ‘playing’, ditching New York, and a piece of hard-hitting analysis demonstrating that sitting at the crossroads of government and business can be personally profitable.

Today’s Zeitgeist poses a riddle: what is noxious, may not be a catalyst, extends a rally and awaits cues all at the exact same time?

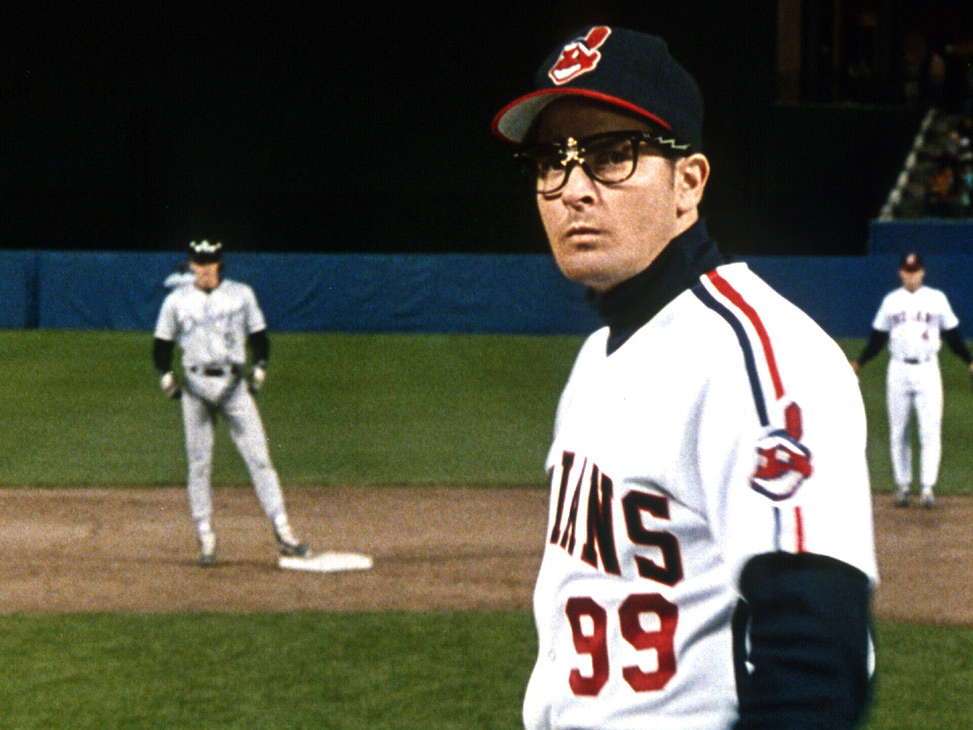

In the 8th or extra innings (what about the 9th?), allocations to alternatives, fixed income ETFs, offensive hacking and “markets up on trade deal hopes” (again).

Maine cashes in, investors cash out, stocks get a lift from trade hopes (version 28), the Brexit pantomime and a shadow over strawberry fields.

Why VC loves fintech for some reason, populist messages, “optimism over trade talks” take 25, and more popullsm.

Fawning Tesla press, coming storms, ESG and data, striking a balance between tasteful display of art collections and pay cuts at banks, and post-Yorkshire pudding walks.

Today’s specials: Megadevelopments in Chicago, online grocery shopping, slowdowns at Apple, vagueness at Alphabet and Canadian weed.

In today’s edition, it’s captain obvious takes on the ECB, is there anything active funds CAN do?, more Brexit and dead-cat bounces.

In which we hear the term, ‘megadeal hunger’, contemplate a Larry Fink v. Ken Fisher celebrity steel cage match, and boggle at the unironic advocacy of regulation as the solution for lack of trust in blockchain applications.

The near-term focus of financial markets coverage seems squarely on M&A in the U.S. Elsewhere, Lord Fink (!) roasts Corbyn and Australian housing has become a media obsession.

Amazon ‘buts’, all sorts of January 1987 comparisons, a grab bag of central banking and politics, and a notable omission from your Brexit Bunker.

A big day for the Green New Deal, tax policy old and new, a solution for morale problems at Palantir and a solution for god only knows at Davos.

Today’s Zeitgeist has a bit of private markets, Boeing and Apple, conspiracies and tax avoidance.

Food and retailing are top of mind (and…bullish?), trade continues to dominate content and commentary, and a hero rides in to protect the Lu Ann Platter.

Oil falls, gas bounces, banks are buoyed. It’s apparently a weird gravity metaphor grab-bag on a Monday Zeitgeist.