Epsilon Theory runs the world's financial news through natural language processing-based cluster analysis to identify the most on-Narrative stories. We scan for those with the most similarity to all other stories as well as those with the most interconnectivity to multiple different key topics.

“It’s a trap!” This and other evergreen memes of Fiat News, yours for the plucking in today’s Zeitgeist.

It’s not impossible for market volatility to spike massively through some deflationary shock to the financial system like a global recession or a China-driven credit crisis or an Italy-driven euro crisis. What’s impossible is TO GET PAID for taking out an insurance policy against volatility spikes from these deflationary shocks.

Jay Powell channels Arthur Burns, a Fed model for congressional budget debates, and a smorgasbord of Boeing bagholder quotes. All in a day’s work for the Zeitgeist!

Today’s Zeitgeist is about tweet nudges, massive law partner payouts, a big reason for massive law partner payouts, your closet, the people who want to sell you…rope, and more.

The Lyft IPO prospectus is out today, so we’re sure to hear plenty of dueling banjos in financial media over the next few weeks and months. It was a fun vacation for Burt Reynolds and the boys at the start of that movie.

Also, more on ESG and other myths in today’s Zeitgeist.

First it’s a healthy reminder of the narrative strength of health care costs. Then it’s a brief education on the narratives of elite universities.

But mostly it’s Fiat News. Lots and lots of Fiat News.

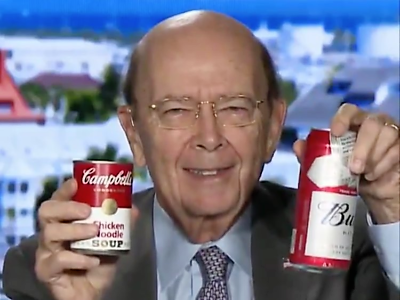

Uncle Wilbur’s MNPI trades on his personal account may get a pass, but that darn census will be the ruin of him.

Also, announcing VaxDirectClub … the safe and cost-effective way to administer your kids’ immunizations from the convenience of your own home!

TFW a Chinese “social video and online dating specialist” called Momo just isn’t momentum-y enough for you, but the Raccoon tandem of Fox Business and Motley Fool is there to help you out with “even better buys”.

Plus the Stanford shadow economy for profs, the War against Big Everything, and all the Fiat News that’s fit to read.

Honestly, you could replace 90% of the daily news with a collection of Mitch Hedberg one-liners.

“People either love me or hate me … or they think I’m okay.”

Our modern addiction? Fiat News.

Today’s Zeitgeist is about winning when we’re losing, the polarizing power of hyperbole, more on SRI/ESG, a wonderful specimen of the Mad Creditor Letter and a less-wonderful specimen of the Obligatory Press Release.

Today’s Zeitgeist is about crashes on crashes, Nplpalooza 2019 and hunger-striking ruined property tycoons.

But mostly we celebrate the hedge fund industry’s effort to shake off last year’s challenges. From all of us, thank you for this gift of what we will just assume is uncorrelated alpha.

A Weekend Edition of the Zeitgeist, where we turn from financial markets to find the narratives and stories from the last week or so that were most connected to common narratives in culture and politics.

Climate change! Secretive boards! A gazillion dollars! Boat Race Bank!

Wait…Boat Race Bank?

It’s the Zeitgeist on Epsilon Theory, where we all knew we were living in a world of Fiat News. We just needed to refocus on fundamentals.

Ladies and gentlemen, your narrative-world assault words du jour … “sponsored content”, “democratic justifications”, “fishing expeditions”, “diversification”, “value investing”, and “growth of $1”.

The ET Zeitgeist, because if you don’t know who the sucker is at the poker table … it’s you.

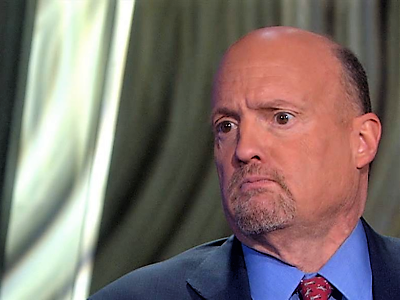

Kashkari on Brexit, Cramer on Tesla, Breitbart on China, and “shorting unethical stocks” … all in a day’s work for The Zeitgeist!

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

Fiat News and narrative construction galore in today’s set of the most on-narrative financial media articles.

What links them all? Dopamine is a helluva drug.

The new Zeitgeist is here! Now with all the snippets and twice the snark.

Every morning, we run the Narrative Machine on the past 24 hours worth of financial media to find the articles that are representative of some sort of chord that has been struck in Narrative-world. They’re not the best articles – often far from it – but they will arm you for the Narrative wars of the day ahead.

BATs vs. FAANGs, trading against institutions, trading with institutions, why Americans buy cars and a shocking J.C. Penney news bulletin.

Lots of Blockchain, UK house prices subdued, trade talks weigh, idol worship perilous, a rich kid buys gold and why Nintendo goes back to Pokemon.

A World Full of Elons, the unrevolutionary foldable era, the fastest strike in history and more arbitrary causal links in financial media.

Markets ‘seek clarity’ on China/US trade, fire engine manufacturers, drug price hearings, and lowball hostile bids.