Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

Modern Monetary Theory is neither modern nor a theory. It’s a post hoc rationalization of politically expedient policy that makes us feel better about all the bad stuff we’ve done with money and debt in service to Team Elite.

And all the bad stuff we’re going to do in the future.

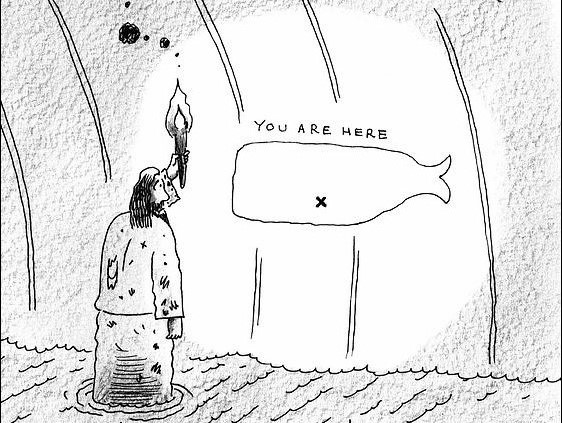

At the suggestion of one of our friends and subscribers, we wanted to provide what we think are some of the best launch points for exploration of the newly published Discovery Map. The only question: do you want to explore topics in depth or see the connections between them?

In this news cycle, if an issue sticks around for more than a week, you can be sure that it isn’t by accident. It’s because it represents an abstraction, and because those in influence like how that abstraction changes our behavior.

The greatest risk to your portfolio is a change in the zeitgeist. A change from deflation to inflation. A change from cooperative international games to competitive games. A change from capital markets to political utilities.

I think it’s all happening.

Distillation isn’t a process of concentration. It isn’t a natural progression. It is a violent changing of the underlying thing. So, too, is portfolio construction.

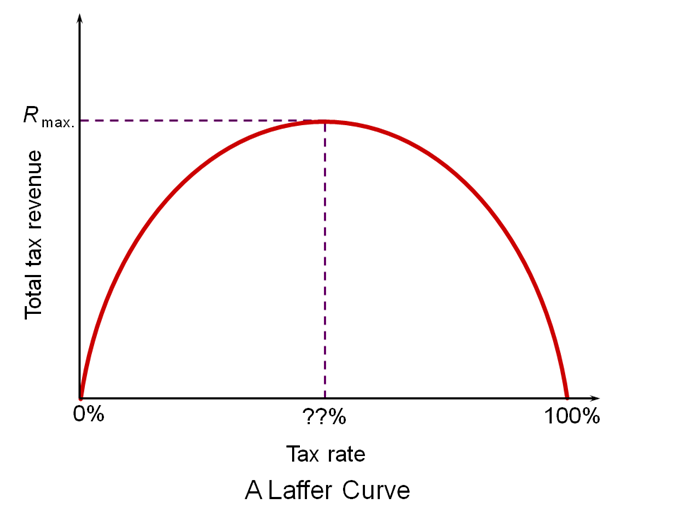

It’s easy to convince ourselves that the opposite of being Narrative-driven is being data-driven. This is a lie. The most common way that narrative influences our behavior is through unadorned data, presented with the unstated implication that it is necessary, sufficient and explanatory.

Neville’s favorite links from recent months, including an interview with a collector of mathematical toys and an ode to the hack.

I found this photo from Friday’s presser, when Jay Powell was asked to describe how much credibility he has now.

JK. But also, LOL.

When it comes to politics and social media, making up straw men about our enemies to make them look ridiculous seems like good entertainment. But beware embracing amusing-but-wrong cartoons in zero sum games.

Introducing the Epsilon Theory Discovery Map – a novel way to navigate the Epsilon Theory archives, not based on chronology or author, but based on connectivity, similarity and consistency in the underlying narratives.

We are living in a Golden Age of corporate management competence, driven by the adoption of process technologies and minimax regret strategies. That’s not going to stop in 2019, and it has major implications for your portfolio strategy.

Some resolution season advice for young professionals who would become successful professional investors without becoming charlatans – a task easier said than done.

Complex systems and uncertainty influence us to look for something – anything – to hang our hat on. The problem? We’re prone to hang our hats on extrapolations of the rare facts we can find, many of which have no explanatory power at the margin, where markets live and breathe.

Is it early days with the development of the Narrative Machine? Yes.

But not as early as you might think.

Eight crucial insights on how to incorporate Narrative data into an understanding of markets.

We’ve been doing it wrong with AI for too long. Time to do it right.

We can’t SOLVE for the future of complex social systems like markets or politics with algorithms. But we can CALCULATE the future of these systems with AI.

The problem for markets today is not the Fed.

The problem for markets today is the guy in the White House and his game of Chicken with the world.

We would usually tell you that all information is information. There is no good or bad. No right or wrong. But some things aren’t even information. Knowing what you can ignore is worthwhile.

When our processes of inquiry lack challenge, doubt and obsession with falsifying our best ideas, the result is inevitable. Our conclusions cease to be science and become something else entirely. That something else is a thing sensitive to narrative, vulnerable to priors and bias. That something else is scientism.

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.