Author: Rusty Guinn

Kitchen Sink It

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every…

Thanksgiving

Office Hours – 2.18.2020

Options

We Hanged Our Harps Upon the Willows

US Recession Monitor – 1.31.2020

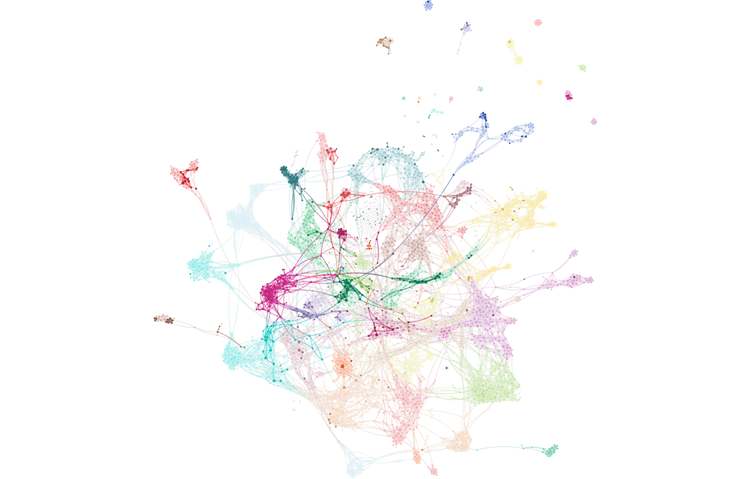

Like other topics, Recession narratives rose somewhat in attention and cohesion, but less dramatically than other categories. We believe that this is because coronavirus outbreak…

Credit and Debt Monitor – 1.31.2020

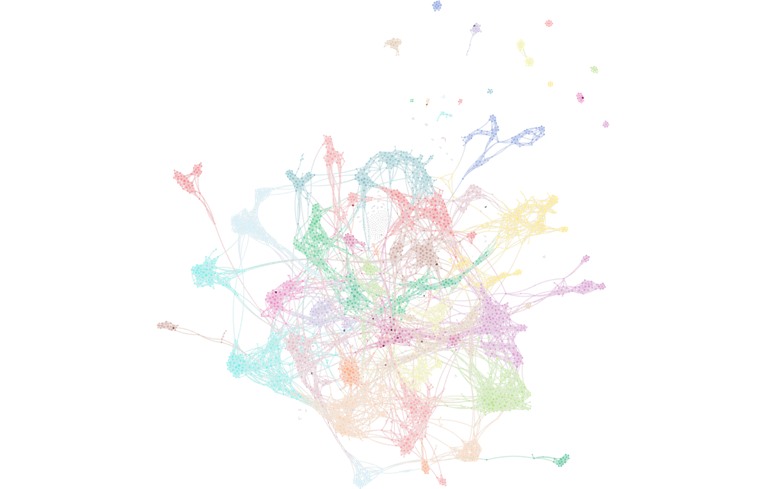

The decline in the strength of the Q4 Narrative of a risk of “collapse” in credit markets continued in January. Uniquely among our macronarratives, cohesion…

US Fiscal Policy Monitor – 1.31.2020

Like other topics, Recession narratives rose somewhat in attention and cohesion, but less dramatically than other categories. We believe that this is because coronavirus outbreak…

Trade and Tariffs Monitor – 1.31.2020

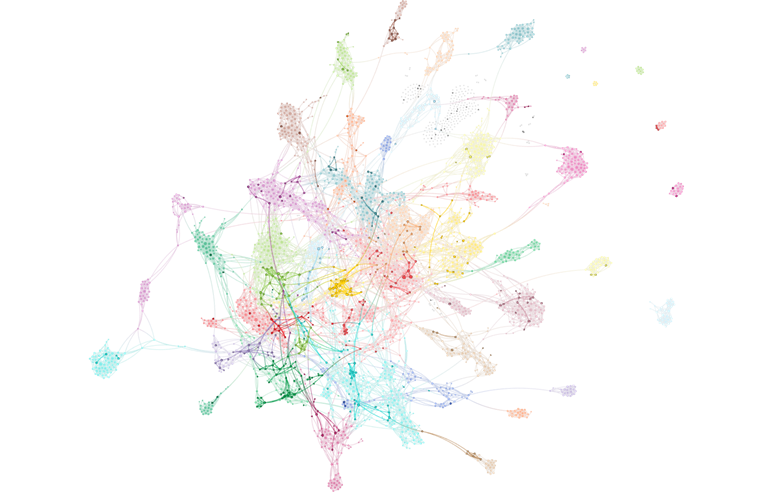

Attention on Trade and Tariffs topics rose somewhat, but the inclusion of coronavirus language proved a distraction to the stories being told about them rather…

Central Bank Omnipotence Monitor – 1.31.2020

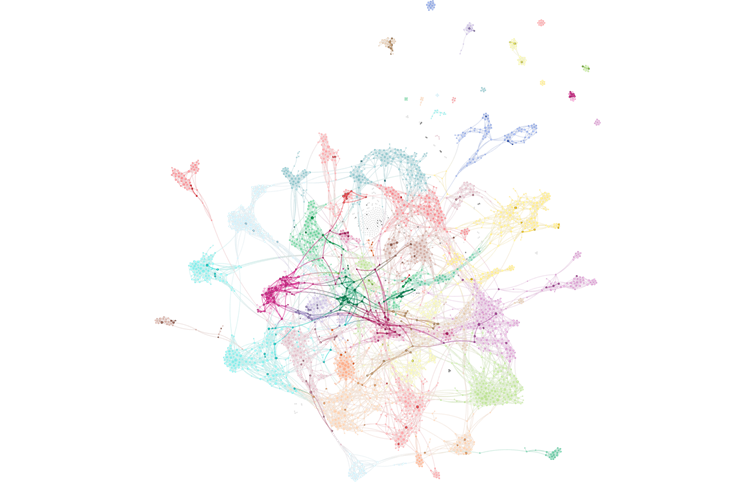

Attention on and cohesion of Central Bank macro narratives rose sharply in January. We believe that this is largely the result of a (hopefully!) short-term…

Inflation Monitor – 1.31.2020

Attention on inflation rose rapidly and surprisingly in January, we think in response to two developments: The very modest emergence of inflation in even heavily…

The Inevitable Afterbirth

The Curious Case of Candidate Sanders

A New Road to Serfdom

The Drum Major Instinct

That Which We Call a Law School

Alpha/Beta Amnesiacs

Credit and Debt Monitor – 12.31.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…