Author: Rusty Guinn

The Zeitgeist | 2.12.2019

In the News | Week of 2.11.2019

The Zeitgeist | 2.11.2019

Blast from the Past

The Zeitgeist | 2.8.2019

The Zeitgeist | 2.7.2019

The Zeitgeist | 2.6.2019

All Along the Watchtower

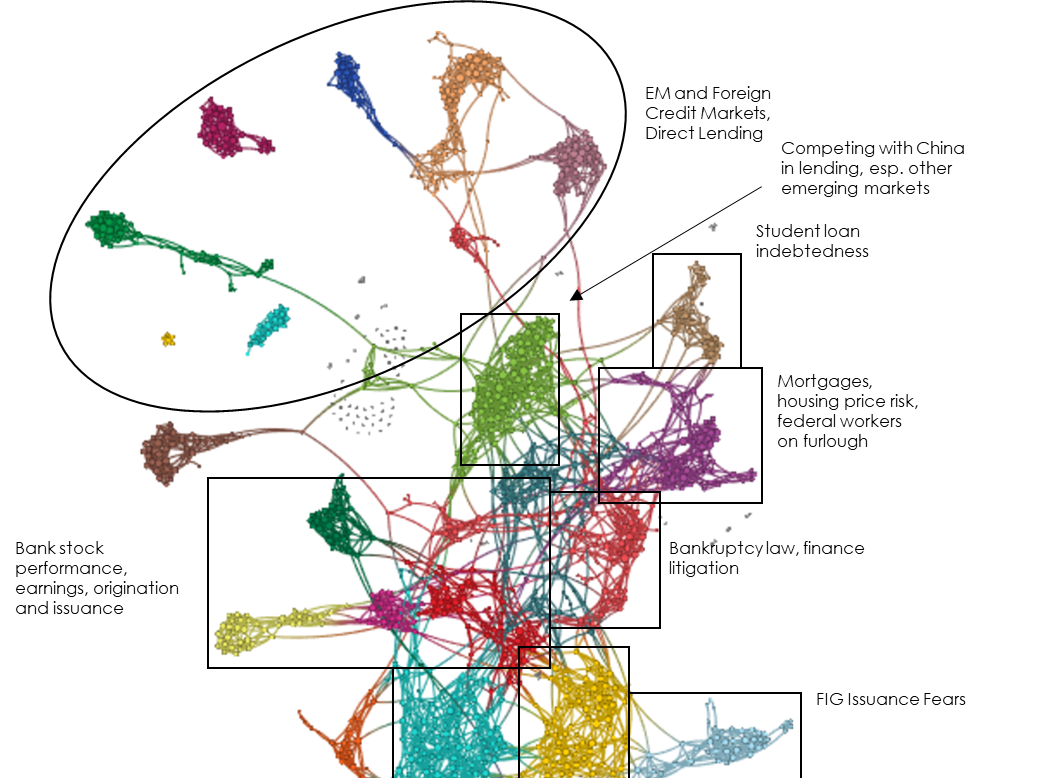

Credit Cycle Monitor – 1.31.2019

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. The attention on credit and credit cycles has increased slightly, but most of…

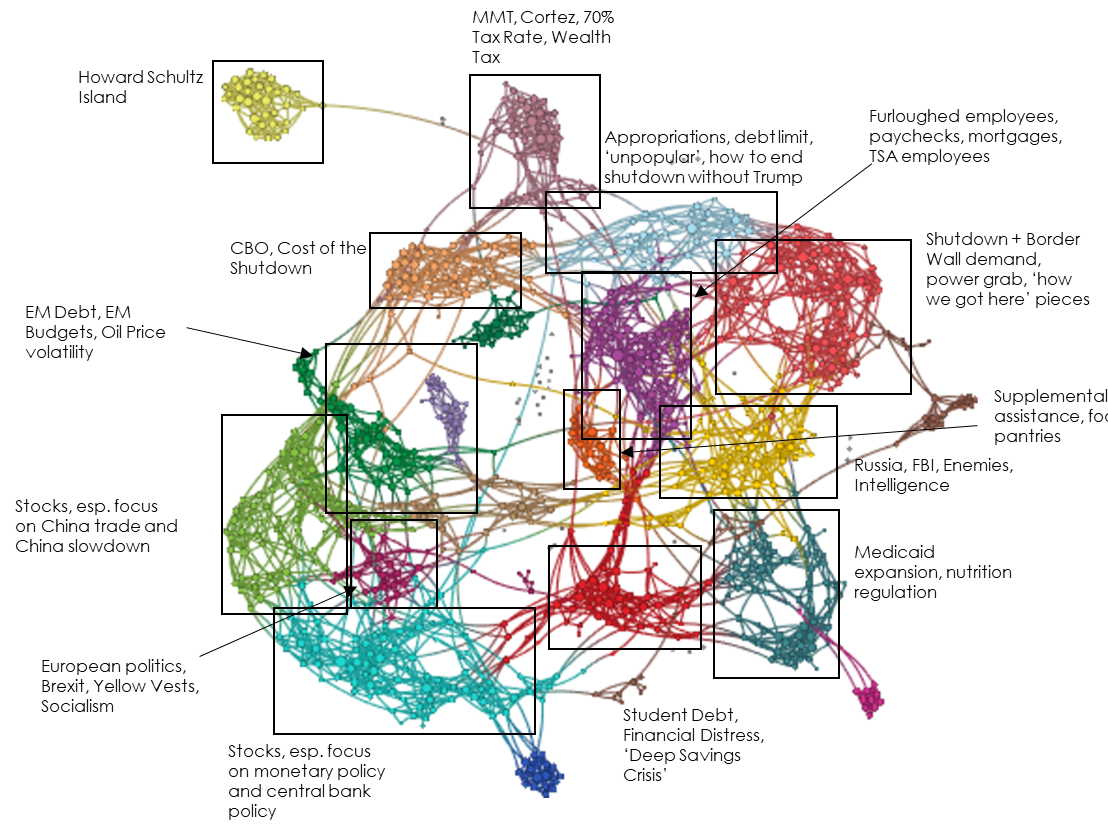

US Fiscal Policy Monitor – 1.31.2019

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to fiscal policy narratives has dramatically increased in January. The shutdown (and…

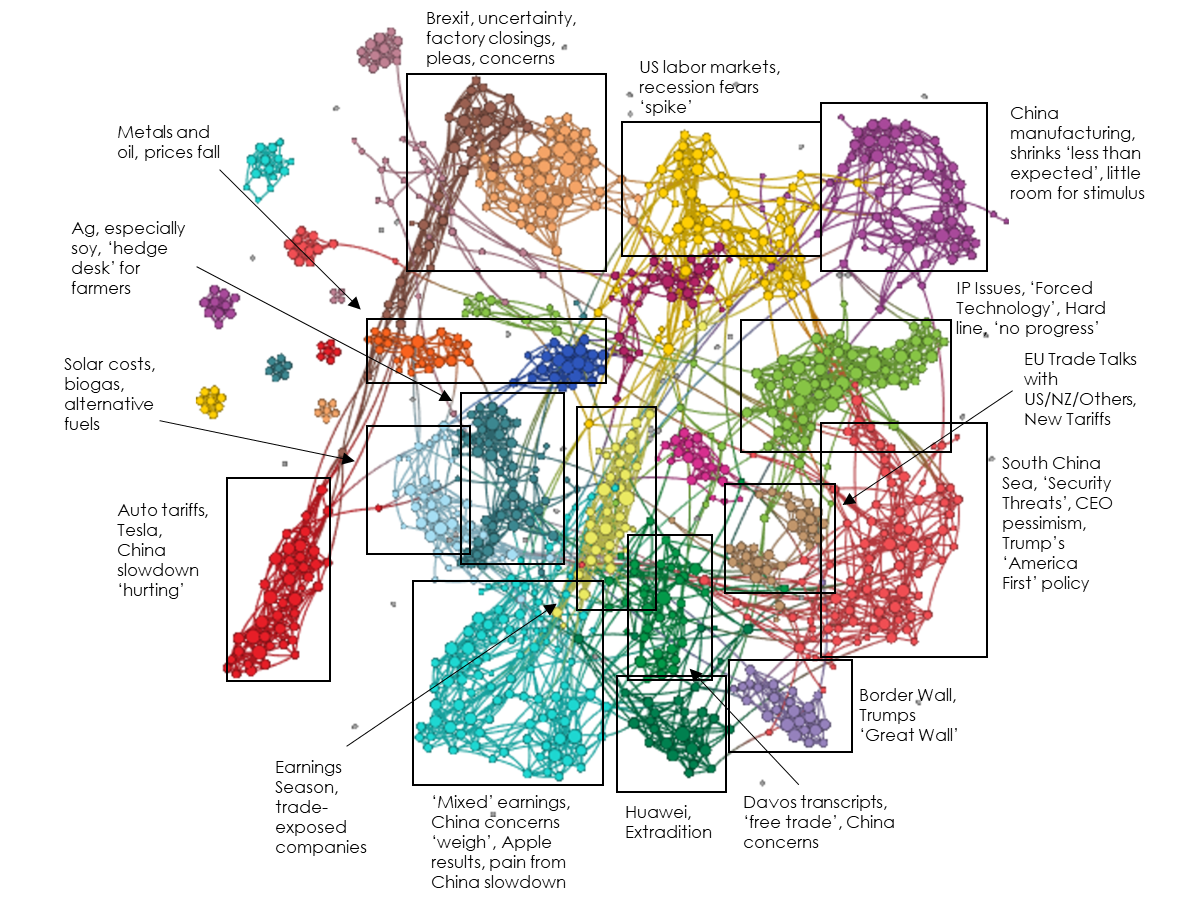

Trade and Tariffs Monitor – 1.31.2019

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention on Trade and Tariffs is now as high as we have measured…

Central Bank Omnipotence Monitor – 1.31.2019

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Attention to central bank narratives continued to rise in January, to nearly the…

Inflation Monitor – 1.31.2019

Access this month’s monitor slides in Powerpoint and in PDF. Access the data in Excel. Our attention measure for Inflation narratives rose somewhat in January, probably the result…