Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

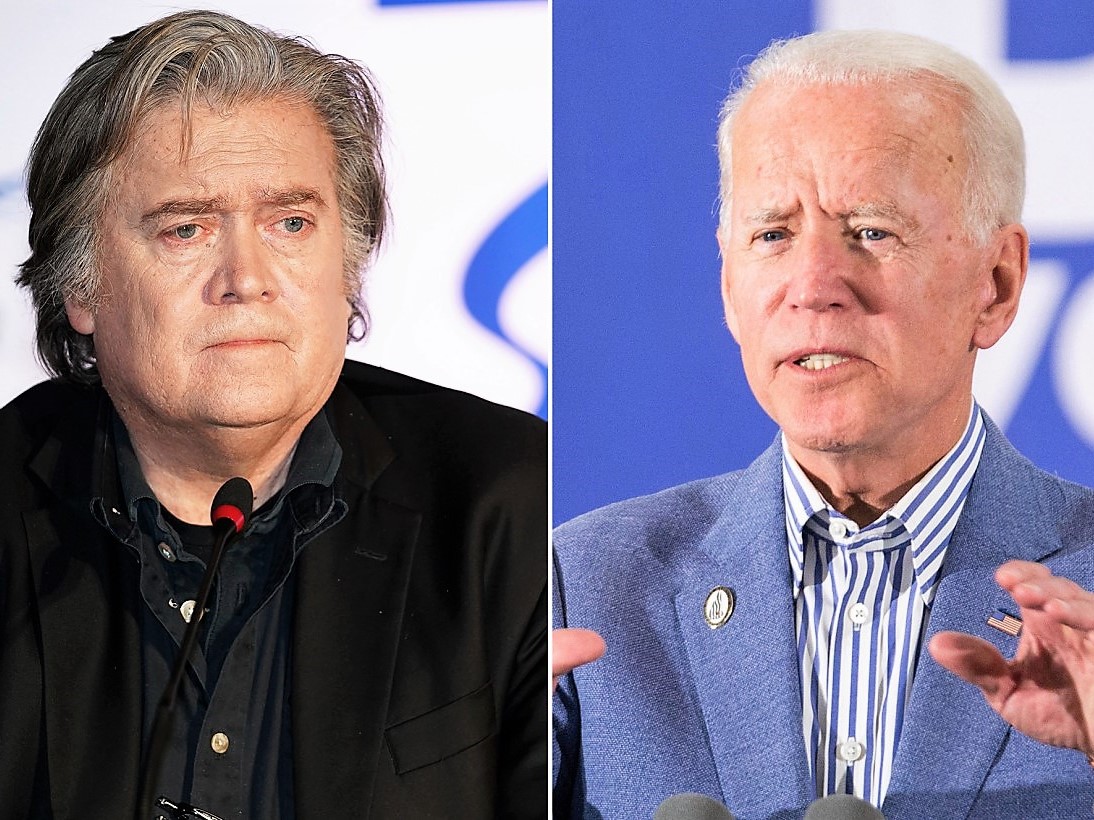

Bannon: Biden must release tax returns to address China connections [NY Post]

“We have to see Joe Biden’s tax returns because we have to see if Joe Biden was a financial consultant to [the fund] or an adviser. Biden has got to answer some basic questions: if he’s been compromised by the Chinese Communist Party? What was his involvement during the Obama administration?”

I know, I know … it’s impossible for a thinking human being to believe that a Trumpkin would demand that a politician must show their tax returns.

I know, I know … it’s impossible for a thinking human being to believe that a Trumpkin would accuse a politician of harboring secret financial ties to a hostile foreign country.

Well, believe it.

What’s next? I’ll tell you what’s next. Bannon and the rest of the America First brigade (which includes a LOT of bedfellows you see all the time on CNBC, like Kyle Bass) are going to go full-McCarthy. They’re going to have a “list”. They’re going to accuse anyone and everyone of “treason”.

This is part and parcel of the China narrative transformation that Rusty and I have been talking about for a month now: the US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.

It’s not a secret plan.

“The Democrats, the longer they talk about identity politics, I got ‘em. I want them to talk about racism every day. If the left is focused on race and identity, and we go with economic nationalism, we can crush the Democrats.”

―Steve Bannon, from his August 16 exit interview with Robert Kuttner in The American Prospect.

That’s from Always Go To The Funeral. It’s how Nixon and Agnew got away with this crap in the 1972 re-election campaign, and it’s how Trump and Bannon will get away with this crap in the 2020 re-election campaign.

“[T]he US-China narrative is now a national security narrative, not an economic trade narrative, and you can’t walk that narrative back until after the 2020 election.”

I agree with the first half of the sentence but I disagree with the second half. I do not believe that this a merely a political calculation that can switch quickly given the shift in behaviour amongst the security apparatus in the United States and other allies. This is a secular shift towards seeing China as a geopolitical adversary. The only way this stops is if it becomes a party political issue and Democrats become reflexively pro-China because the Trump Administration is becoming increasingly bellicose. Otherwise this is a secular shift above and beyond party politics that needs to be factored into investor thinking for the next decade or longer.

Sean is likely correct about the secular shift. Confluence IM had a great geopolitical note out yesterday on this very topic, “Reflections on Tiananmen.” The basic argument being, the idea of participating in China’s speedy growth and turning a blind eye to it’s repressive character is probably over for the West. Since Nixon, the thought has been “they’ll come around” once everybody has running water, electricity and a tv (smart phone). It appears that thinking has evolved now to “contain the tiger.”