Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

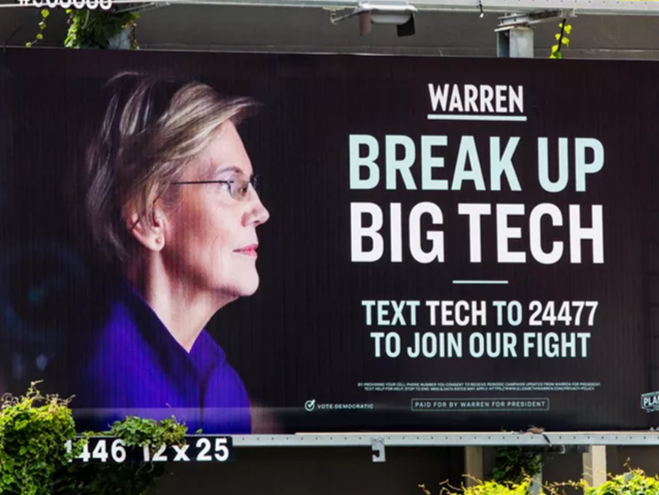

Calls to break up Amazon, Google, Facebook and Apple get louder [c|net]

These corporate behemoths, which are all among the most valuable companies in the world, are now facing a much greater threat that they’ll be broken up. Facebook could be forced to get rid of Instagram and WhatsApp, Amazon might divest Zappos and Whole Foods, Google may lose YouTube, and Apple could part with its App Store.

When I say “this is happening”, I mean that it’s happening in narrative-world. For anything to happen in real-world, you’ll have to fight your way through the phalanx of lobbyists on K Street and the legion of sleeper cells in every Congressional staff and administrative agency.

But there are two narrative structures that have grown to a size and a level of cohesion that makes them impossible to be politically ignored.

One is the student loan “crisis”. The other is the Big Tech “monopoly”.

And yes, I’m putting those words in air-quotes, because the first isn’t really a crisis and the second isn’t really a monopoly. But if you’ve learned anything from Epsilon Theory over the years, I hope you’ve learned this …

The power to name things is the most awesome power in human society. In Biblical terms, it’s logos … it’s the Word. In modern terms, it’s narrative … it’s the Cartoon.

Big Tech has been named. It’s been named by astute political entrepreneurs who know the power of naming. That name is “monopoly”.

And we all know what you do with monopolies, right?

Put another way … Big Tech has lost control of its own cartoon, just like Hillary did in 2016. And we all know how that turned out.

Ben, Rusty, I find it puzzling that Facebook is moving into the crypto currency world. Doesn’t that heighten concern by Big Government over threats to their control of the currency?

Questionable meta-game move IMO