Month: October 2019

Yeah, It’s Still Water

Guest Post – A Conservative’s Take on The Pack

Office Hours – 10.22.2019

The Stereogram

Was That Wrong?

The Long Now, Pt. 3 – Wink

Domino Theory

To My Fellow Billionaires …

ET Election Index (Candidates) – October 15, 2019

The Common Knowledge of Inflation

US Recession Monitor – 9.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

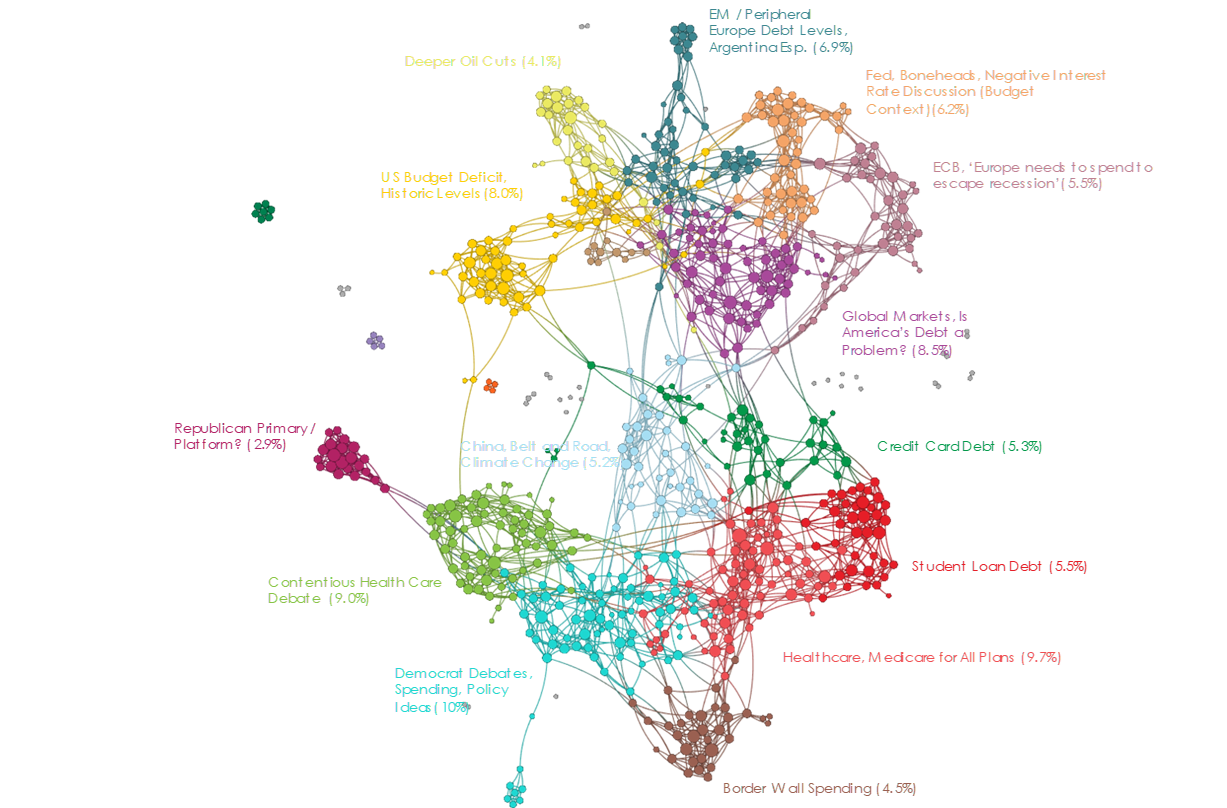

US Fiscal Policy Monitor – 9.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

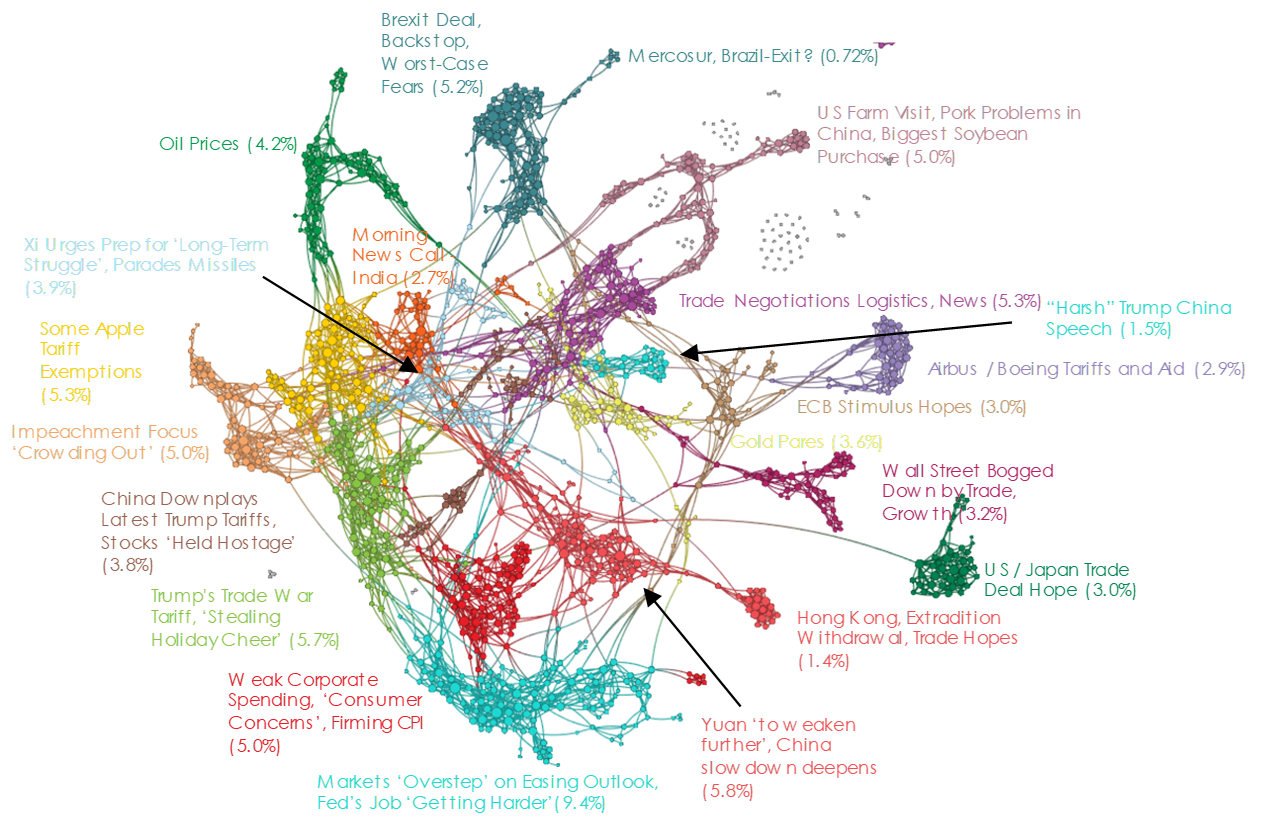

Trade and Tariffs Monitor – 9.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

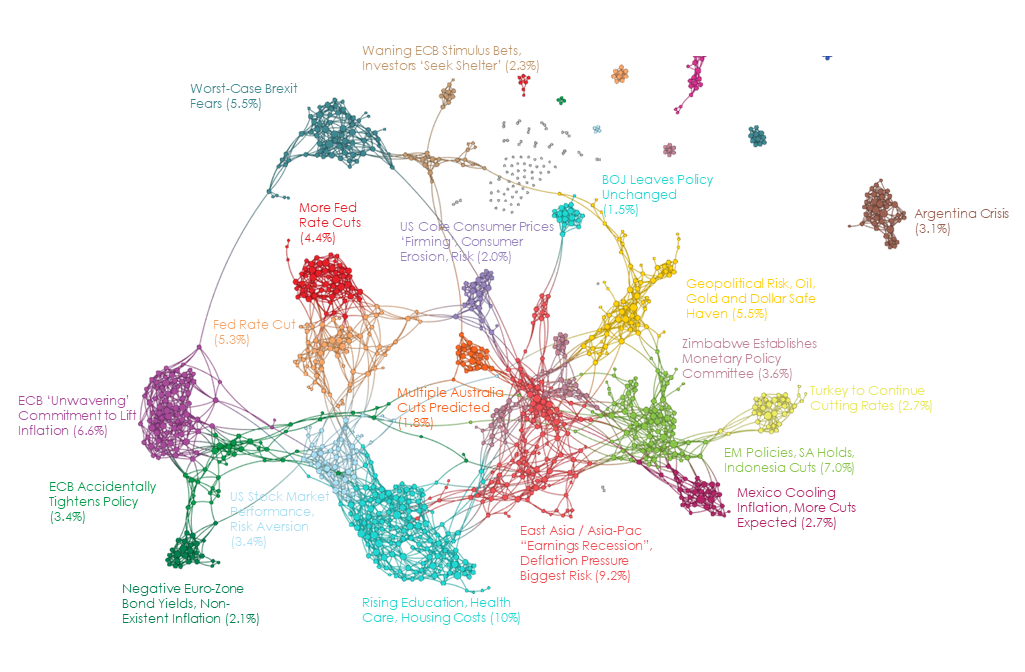

Central Bank Omnipotence Monitors – 9.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

Inflation Monitor – 9.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…