Month: October 2018

Inflation Monitor – 10.31.2018

After several months of increasing cohesiveness around an inflation-is-coming Narrative, attention to the topic has been tapering in early Q4 Right now we think this…

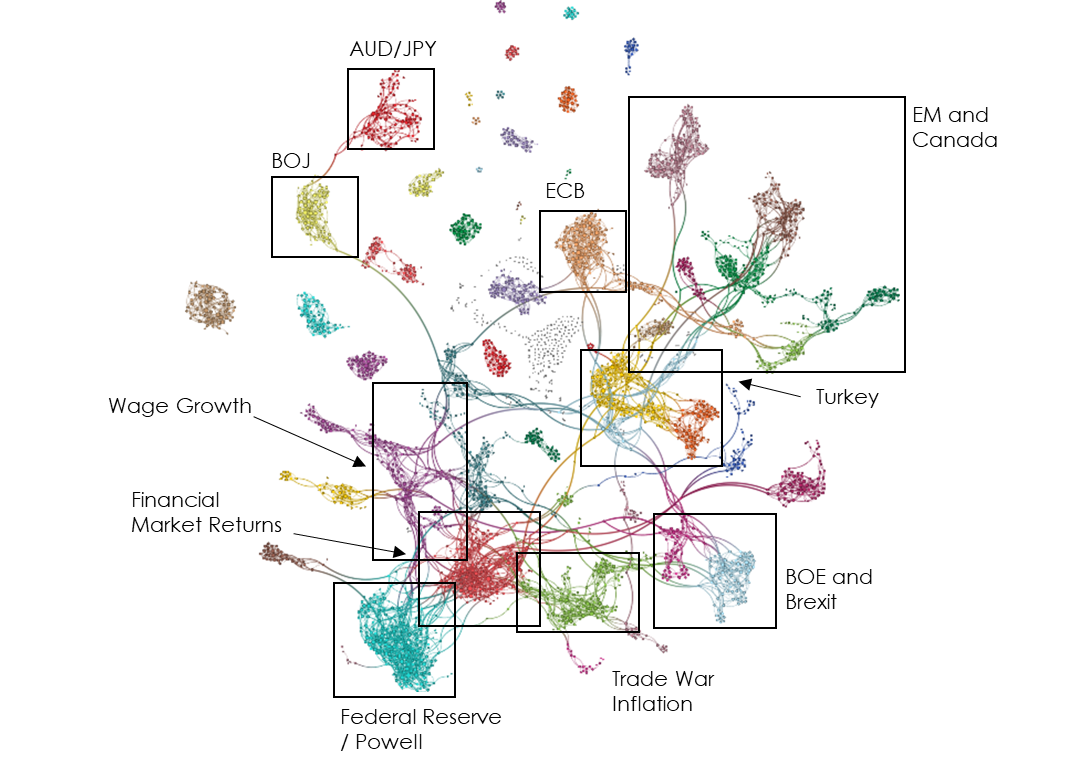

Central Bank Omnipotence Monitor – 10.31.2018

The Narrative of coordinated global central banking policy has been restrained for an extended period, including most of 2018. After a brief rise along with…

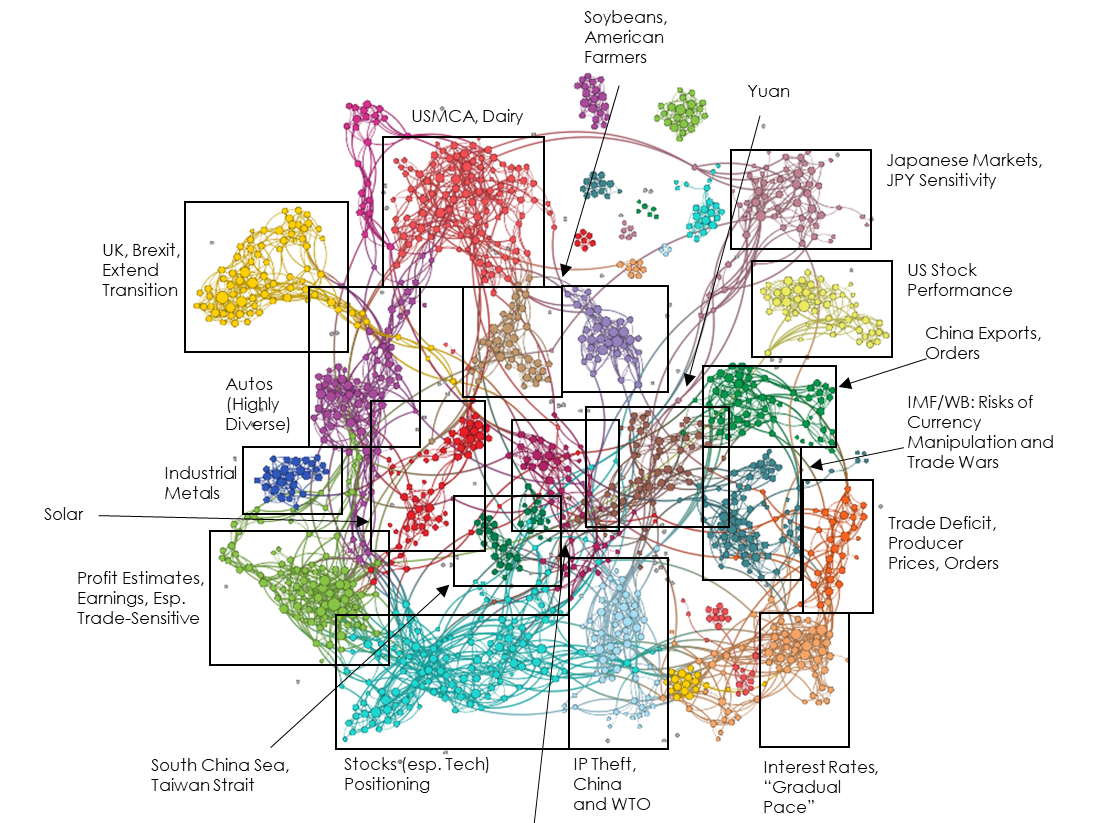

Trade and Tariffs Monitor – 10.31.2018

While it is only a single data point, our October attention measure rose from its very low base over the prior three months. Our aggregate…

US Fiscal Policy Monitor – 10.31.2018

After climbing as usual (and, we think, in more muted fashion) in connection with mid-term elections, attention to US Fiscal Policy narratives ticked down modestly…

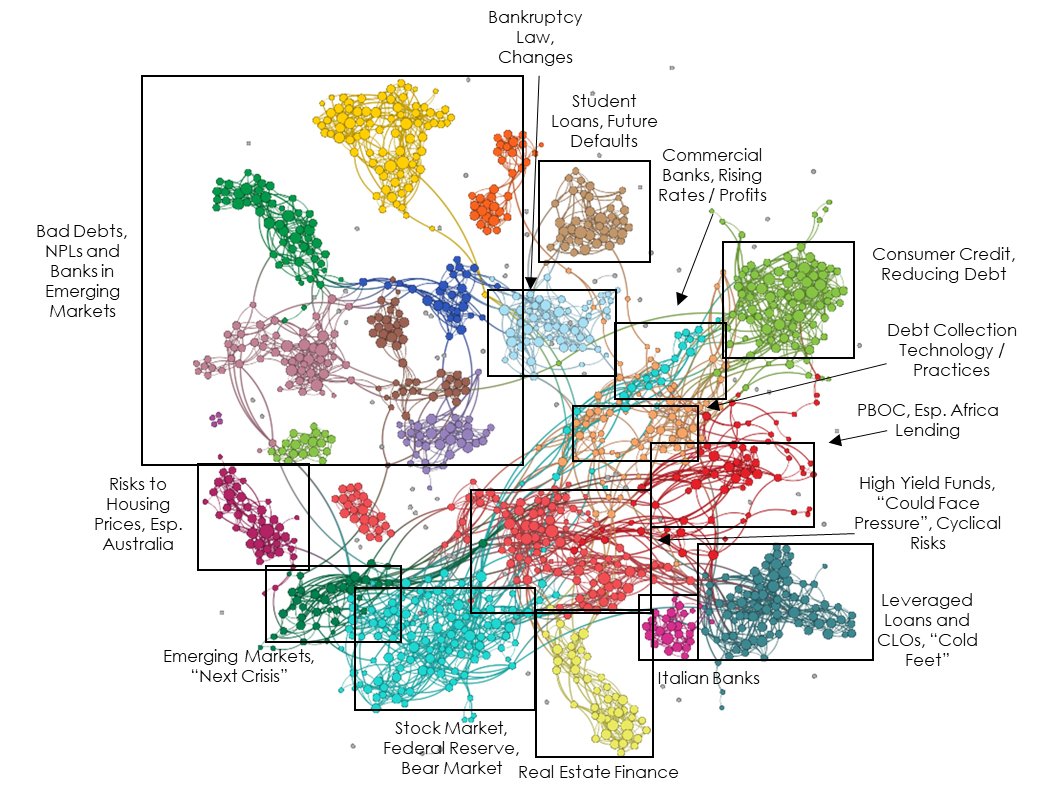

Credit Cycle Monitor – 10.31.2018

While articles including key credit terms continued to rise in October, their internal coherence continued to fall. This means that stories tended to cover individual…