Month: June 2013

The Matrix Reloaded — Seeing Markets as Informational Structures

A review of current market informational structure one week post the June 19th FOMC announcement. epsilon-theory-matrix-reloaded-seeing-markets-as-informational-structures-june-27-2013.pdf (295KB)

2 Fast 2 Furious

We are all impaled on the crook of conditioning. – James Dean (1931 – 1955) This note is a sequel to my letter from two weeks…

The Narrative Battle is Joined

A review of Narrative formation efforts on June 21st to support the market. epsilon-theory-the-narrative-battle-is-joined-june-21-2013.pdf (227KB)

What’s the Opposite of ‘Green Shoots’?

An initial examination of the informational inflection point generated by the June 19th FOMC announcement. epsilon-theory-whats-the-opposite-of-green-shoots-june-20-2013.pdf (235KB)

Failure to Communicate, Part Deux

A review of Narrative formation immediately after the June 19th FOMC announcement. PDF Download (Paid Membership Required): http://www.epsilontheory.com/download/15677/

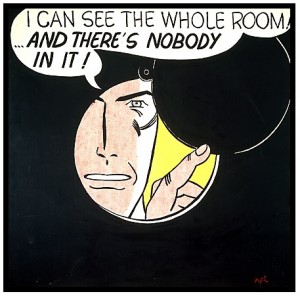

Through the Looking Glass, or … This is the Red Pill

What We’ve Got Here Is … Failure to Communicate

From the classic Paul Newman movie, Cool Hand Luke, as the Captain administers Luke’s punishment in the prison yard for yet another escape attempt: Captain: You…