Magical Thinking

September 1, 2016·4 comments·monetary policy

Can I confess something? I tell you this as an artist, I think you’ll understand. Sometimes when I’m driving … on the road at night … I see two headlights coming toward me. Fast. I have this sudden impulse to turn the wheel quickly, head-on into the oncoming car. I can anticipate the explosion. The sound of shattering glass. The … flames rising out of the flowing gasoline.

Well, I have to — I have to go now, Duane, because I … I’m due back on planet Earth.

Annie Hall (1977)

One of my all-time top-ten movie scenes. Of course, Duane ends up driving Alvy and Annie back to the airport that night. No one does crazy better than Christopher Walken. Except maybe the Fed’s #2, Stanley Fischer. We’re all just passengers in the backseat of the Fed-driven car.

This guy goes to a psychiatrist and says, "Doc, my brother's crazy; he thinks he's a chicken." And the doctor says, "Well, why don't you turn him in?" The guy says, "I would, but I need the eggs." Well, I guess that's pretty much how I feel about relationships; y'know, they're totally irrational, and crazy, and absurd … but, I guess we keep going through it because most of us ... need the eggs.

Annie Hall (1977)

We’re all passengers in the backseat of the Fed-driven car, and we all suspect that our drivers might be high-functioning lunatics, and we’re all terrified about what they might do next.

But we need the eggs.

"What are the stars?” said O'Brien indifferently. “They are bits of fire a few kilometres away. We could reach them if we wanted to. Or we could blot them out. The earth is the centre of the universe. The sun and the stars go round it.”

“For certain purposes, of course, that is not true. When we navigate the ocean, or when we predict an eclipse, we often find it convenient to assume that the earth goes round the sun and that the stars are millions upon millions of kilometres away. But what of it? Do you suppose it is beyond us to produce a dual system of astronomy? The stars can be near or distant, according as we need them. Do you suppose our mathematicians are unequal to that? Have you forgotten doublethink?”

Winston shrank back upon the bed. Whatever he said, the swift answer crushed him like a bludgeon. And yet he knew, he knew, that he was in the right. The belief that nothing exists outside your own mind — surely there must be some way of demonstrating that it was false? Had it not been exposed long ago as a fallacy? There was even a name for it, which he had forgotten. A faint smile twitched the corners of O'Brien's mouth as he looked down at him.

“I told you, Winston,” he said, '”that metaphysics is not your strong point. The word you are trying to think of is solipsism. But you are mistaken. This is not solipsism. Collective solipsism, if you like. But that is a different thing: in fact, the opposite thing.”

George Orwell, “1984” (1949)

As O’Brien patiently explains to Winston between torture sessions, or what we would call today “FOMC meetings”, Collective Solipsism is the voluntary abdication of empirical and independent thought. But it’s not ordinary solipsism — a pathological egocentrism where reality is entirely defined by one’s own thoughts. Instead, Collective Solipsism annihilates one’s own thoughts and replaces them with state-sponsored thoughts. Your reality is just as fake. But you’re living someone else’s fantasy.

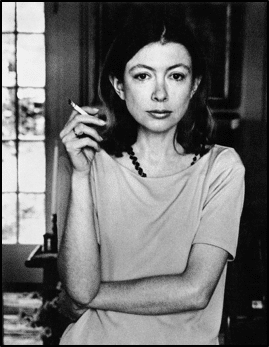

Grief turns out to be a place none of us know until we reach it. … We might expect that we will be prostrate, inconsolable, crazy with loss. We do not expect to be literally crazy, cool customers who believe that their husband is about to return and need his shoes.

In the version of grief we imagine, the model will be "healing." A certain forward movement will prevail. The worst days will be the earliest days. We imagine that the moment to most severely test us will be the funeral, after which this hypothetical healing will take place. … We have no way of knowing that this will not be the issue.

There was a level on which I believed that what had happened was reversible.

Joan Didion, “The Year of Magical Thinking” (2005)

The best book I’ve ever read on the emotion of grief. Central bankers today are grieving the death of the so-called Great Moderation, and they are expressing their grief in the same way that Didion expressed hers — through magical thinking, through the pathological belief that if only the right words are said and the right thoughts are thought, then the dearly departed might walk through the front door and ask for his shoes.

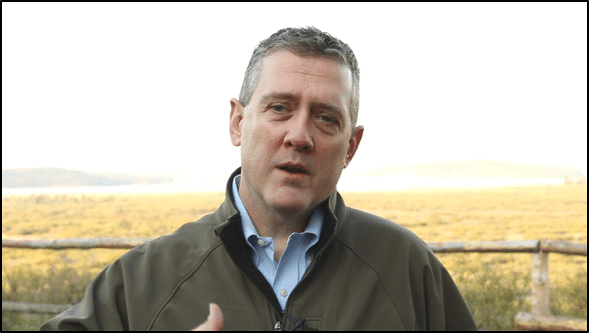

Mr. Hilsenrath: What kind of compromise would it take to get the FOMC to move in September? I mean, so the tradition is there’s some kind of — like you say, some kind of agreement. What would it take to get them there?

Mr. Bullard: Well, I have no idea, so — and it’s really — it’s really the chair’s job to fashion that. But I will say that — I’ll talk historically about the FOMC, the kinds of things that the FOMC would do. You would trade off. You would say, OK, we could hike today, but then we’ll not plan to do anything in the future. That would be one way to — one way to go about a consensus. So that often happens on the FOMC. Or vice versa. If you read the Greenspan-era transcripts, he’ll do things like, OK, we won’t go today, but we’ll kind of hint that we’re pretty sure we’re going to go next time.

Mr. Hilsenrath: Right.

Mr. Bullard: And so you get this inter-tempo kind of trade-off, and that often — that often is enough to get people to sign up.

Mr. Hilsenrath: So, hike today and then delay.

Mr. Bullard: Yeah. (Laughs.)

Mr. Hilsenrath: Or, no hike today and then no more delay.

Mr. Bullard: Yeah, yeah.

Mr. Hilsenrath: Something like that.

Mr. Bullard: Yeah, those kinds of trade-offs are, historically speaking — I’m not saying I know what Janet’s doing, because I don’t. But, historically speaking, those are the kinds of things that the FOMC has done.

Mr. Hilsenrath: I came up with my catchphrase for the — for the month. (Laughter.)

Mr. Bullard: Those are great. That’s worthy of a T-shirt. (Laughs, laughter.) You could have one on the front and one on the back.

Ms. Torry: Or a headline

Mr. Hilsenrath: Well, that’s the St. Louis framework now, right?

Mr. Bullard: Yeah.

Mr. Hilsenrath: Hike today and then delay.

Mr. Bullard: Yeah. That’s what it would be, yeah.

Mr. Hilsenrath: But if you decide to use that, maybe you can credit — you know, include a little footnote to the Wall Street Journal.

Mr. Bullard: OK. (Laughs.)

Wall Street Journal, “Transcript: St. Louis Fed’s James Bullard’s Interview from Jackson Hole, Wyo.” (August 27, 2016)

Reading this transcript made me throw up in my mouth a little bit. And Bullard is the best of the lot. At least he’s honest about the intellectual poverty about the whole FOMC interest rate-setting exercise. They’re just making it up as they go along, a hallmark of magical thinking.

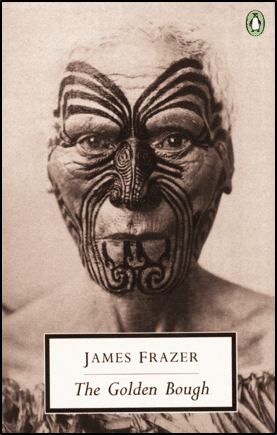

In point of fact magicians appear to have often developed into chiefs and kings.

James George Frazer, “The Golden Bough” (1890)

Frazer’s book on the history and anthropological foundations of magic was a revelation to me when I first read it, as it was to as disparate a group of writers and poets as Yeats, TS Elliot, Freud, Hemingway, Joyce, and … Jim Morrison.

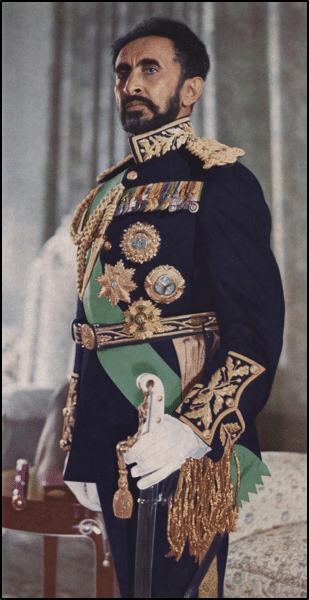

Courtier T.L. — Amid all the people starving, missionaries and nurses clamoring, students rioting, and police cracking heads, His Serene Majesty went to Eritrea, where he was received by his grandson, Fleet Commander Eskinder Desta, with whom he intended to make an official cruise on the flagshipEthiopia. They could only manage to start one engine, however, and the cruise had to be called off. His Highness then moved to the French shipProtet, where he was received on board by Hiele, the well-known admiral from Marseille. The next day, in the port of Massawa, His Most Ineffable Highness raised himself for the occasion to the rank of Grand Admiral of the Imperial Fleet, and made seven cadets officers, thereby increasing our naval power. Also he summoned the wretched notables from the north who had been accused by the missionaries and nurses of speculation and stealing from the starving, and he conferred high distinctions on them to prove that they were innocent and to curb the foreign gossip and slander.

Ryszard Kapuscinski, “The Emperor” (1978)

If you can only read one book on the end of an ancien regime and the magical thinking that ALWAYS takes place in its wake, this is it. Kapuscinski chronicles the final years of Haile Selassie’s reign in Ethiopia from the inside out, interviewing dozens of courtiers to paint a first-hand portrait of an entire society lost in the fantasy world of Collective Solipsism.

Selassie and his Inner Party maintained the fantasy for years after it lost all connection with reality, so that a mighty fleet consisted of a single ship with a malfunctioning engine, promotions and medals were conflated with real-world power and influence, and bad people and bad ideas were constantly lauded and rewarded to keep hard questions from being asked.

Spoiler alert: it doesn’t end well for Selassie or for Ethiopia. In the words of another famous solipsist, Louis XV, “après moi, le deluge.” After Selassie came The Dergue. Think Pol Pot in committee form.

The last years of Selassie’s rule are more than a parable for our times … they ARE our times.

Magical thinking is a term of art in both clinical psychology and cultural anthropology, and it refers to the common belief among both children and “primitive” societies (yes, intentional quotation marks there to show my arched eyebrow at the word) that thinking the right thoughts or saying the right words can control the invisible forces that shape our world.

For example, as Jean Piaget (the father of developmental psychology) noted, children from the ages of 2 to 7 tend to have very little conception of real-world causality. Tell your four-year-old son that the family dog has died, and he is likely to a) blame himself for something he did or didn’t do for “causing” the death, and b) believe that there is some combination of proper words and proper thoughts and proper actions that can make the dog come back to life. That’s magical thinking. It’s a profoundly ego-centric conception of the world, and if you’re a parent you know exactly what Piaget is talking about. Every four-year-old child is an egomaniac, in the clinical, non-judgmental sense of the word.

It’s the same thing with what cultural anthropologist Claude Lévi-Strauss called “The Savage Mind” in his groundbreaking 1962 book. Societies without a causal explanation for, say, the weather will always construct some sort of combination of words and thoughts and actions to be performed by privileged caste members like priests or kings, through which the entire society convinces itself that humans exercise some sort of control over these incredibly powerful real-world forces and that they aren’t just buffeted this way and that by the inexorable might of a big bad world that really couldn’t care less about them. In fact, that’s the literal origin of the word “inexorable”, from the Latin in (not), ex (away), orare (to pray) — something that cannot be prayed away.

In early days of any human society, this sort of magic usually emphasizes some form of sympathetic or like-for-like object … for example, you might rub a banana-shaped crocodile tooth against a banana plant to make it bear fruit (I’m not making this up). Over time, however, the spellcasting caste and society at large convince themselves that you don’t really need actual crocodile teeth, but you can instead invoke the power of a crocodile tooth by calling it by its secret name. Maybe you need to write down that secret name using the secret language of the priests in order to make the spell work, but you definitely don’t need to go out and hunt down a real-world crocodile. It’s at this point that hunter/soldier-kings are replaced by academic/priest-kings … the pen is truly mightier than the sword, or at least writing “crocodile” carries a longer life expectancy than hunting crocodiles. Over still more time, the secret names and the secret language of the priest-kings become a vast edifice of magical thinking, an edifice that provides great comfort and stability to the entire society. Because there is nothing more important to societal stability than the belief that nature is under control. That the invisible forces of nature can, in fact, be prayed away.

Until they can’t. Until all the banana plants die because of some rare nematode infestation in the roots, and all the secret words and secret languages and even the “old magic” of the actual crocodile teeth are useless. They were useless all along, of course, as the banana plants would have borne fruit for the past 50 years with or without the spells, but hey … until this year there was a 98% correlation between the spells and a healthy banana crop! And my VAR was really quite negligible!

Okay, Ben, we see what you’ve done here. Yes, yes … quite droll, really … you’ve found a clever metaphor for railing against our central banker ruling class. Again. Thanks for the diversion, but now we need to get back to planet Earth. Important work to be done, and all that. Love your quotes, by the way.

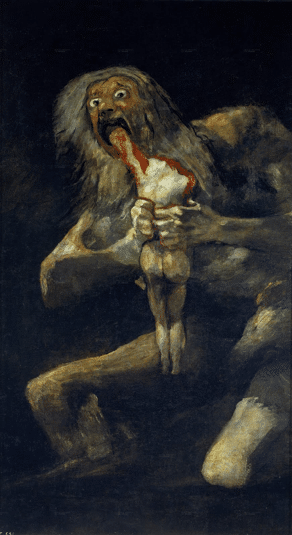

Wait! This is not a metaphor. This is not an anthropological parable for our times. This IS our times. Want to see what a magic spell looks like? Here you go:

This is the Gaussian Copula spell. It’s what you write down to make sure that your AAA-rated slice of a massive bunch of mortgages pays you 6% a year with only an infinitesimal risk of default. It’s not a metaphor for a spell. It is an actual magic spell, exactly the same in form and function as the talismanic scripts written on, say, Egyptian funerary urns in 1000 BC to make sure that your body and soul get to the afterlife with only an infinitesimal risk of default.

Secret language no one can read or understand? Check. Not really comprehensible even by most magicians? Check. Administered by a privileged caste with appropriate pomp and ceremony? Check. Reflective of an innate human desire to control invisible forces that are, in fact, uncontrollable and inexorable, like death and business cycles? Check. Highly effective in motivating human behavior and supporting status quo political institutions? Check. And mate.

The Gaussian Copula spell wishes away the possibility of a nationwide decline in U.S. home prices (if you haven’t already, please read Felix Salmon’s 2009 Wired magazine article on the Gaussian Copula — “The Formula That Broke Wall Street” — my all-time favorite piece of financial market journalism). The magical thinking embedded in this spell is that a nationwide decline in U.S. home prices is not just unlikely, it is — literally — unthinkable. It is an incantation that generated enormous societal stability and wealth, creating out of whole cloth a belief that a $10 trillion (yes, that’s trillion with a T) asset class in residential mortgage-backed securities (RMBS) was a solid thing, a triumph of Science (why, just look at all those Greek letters and the mathematical stuff!), an example of man’s mastery over the invisible vagaries of nature.

And then we had a nationwide decline in U.S. home prices. Which broke our world.

Here’s another spell:

This is the Taylor Rule spell. It’s what you write down to make sure that the inflation rate in your economy goes up or down the way you want it to go up or down. There are lots of other spells that go along with the Taylor Rule spell for “controlling” inflation, but it’s the main one, I’d say. This is the spell that has created a $12 trillion asset class in negative yielding sovereign debt. Because, you know, the lower interest rates go, the more you’re going to borrow and spend, and the higher inflation goes. Right? Right?

If the Gaussian Copula is like a funerary spell, trying to assure investors that they will get to investor heaven like dead Egyptian Pharaohs were assured of getting to dead Egyptian Pharaoh heaven, the Taylor Rule is like a weather spell. When I read this from James Frazer’s The Golden Bough:

So in Scotland witches used to raise the wind by dipping a rag in water and beating it thrice on a stone, saying:

I knok this rag upone this stane

To raise the wind in the divellis name,

It sall not lye till I please againe.

I can’t help but think of Stanley Fischer, vice-warlock of the Fed coven, saying in Jackson Hole that we need thrice interest rate raises (one last December, two more this year) to quell the inflationary winds. Or raise them. Or whatever sort of weather that Fischer is trying to manufacture. It’s really hard to tell.

But here’s the kicker. When a spell doesn’t work, no one in the magically thinking society believes it’s because spell-casting itself doesn’t work. It means that the spell wasn’t performed properly. Either the priest-kings said the words wrong or they didn’t think the right thoughts or there’s some other invisible force that we need to propitiate first. So what always happens, and I mean “always” in the sense of This. Is. Human. Nature. and has been happening in a rhyming sense for tens of thousands of years across every human society that ever lived, is this:

In phase 1, the priest-kings try harder. They seek out purer ingredients for their spells. They speak more loudly, more convincingly, more stridently. If two crocodile teeth were used in the past, now they use four. Or eight. It’s not just “more”, it’s “MOAR!”. Often there’s an internal purge near the end of phase 1.

In phase 2, the priest-kings regroup and tweak the spell. Maybe instead of “targeting” (another word for “praying for”) a 2% inflation rate, we need to “target” a 4% inflation rate. Maybe we should change the magic word “inflation” to “nominal GDP growth” and see if that works any better. Sure, why not? This tweaking process has happened, it is happening now, and it will happen all the way to the bitter end. What will never happen is that the priest-kings quit. There’s always another tweak, always another word choice, always another order in which the words can be said.

In phase 3 — and this is where we are now in the historical process, somewhere near the end of phase 2 and the beginning of phase 3 — the priest-kings are challenged by a rogue priest in their midst (rare) or an alt-priest coming out of nowhere (common). By “nowhere” I mean that the alt-priest is an Other, whether that’s a foreign religion or a foreign geography or a foreign (i.e., non-priestly) caste. The alt-priest isn’t about tweaking the spell or casting it louder. He’s about doing an entirely different spell, and he’s about accusing the incumbent priests of incompetence or worse. The alt-priest is always a populist, and populism comes easy when the incumbent spells have been failing … and failing … and failing.

So what happens? It depends on reality. It depends on whether the banana plants get better on their own or if they die. If they get better on their own (and this happens more often than you might think), then the incumbent priest-kings remain. If the banana plants give up the ghost, then the incumbents are swept away. For future reference, this is what dead banana plants look like.

Interestingly — and this was Frazer’s big point in The Golden Bough — even if the incumbent mode of magical thinking survives, it’s necessary for societal stability to perform a public human sacrifice of the primary incumbent priest-king. The king is dead. Long live the king. Fortunately for all involved, human sacrifice today is a lot less literal than it was during, I dunno, the heyday of the Etruscans. A little public shaming, a tearful interview with Anderson Cooper, a quiet hermitage in the form of a deanship at a small New England college … yeah, that should do the trick.

The way this all plays out also depends on how deeply the incumbent priest-kings retreat into their fantasy world of tweaking spells and magical thinking, and that’s where I’m most concerned. The fact is that the global economy — particularly the U.S. economy and the Chinese economy — is more robust than the alt-priests tend to let on. Amazingly enough, the U.S. can still grow its way out of the massive debt we’ve taken on. I know … hard to believe. But it’s true. The power of compounding is truly inexorable, and it’s amazing what a steady 3.5% growth rate on a huge economic base can do to make manageable even trillions of dollars in debt. The rest of the developed world? Impossible to grow their way out of debt. They’re finished. Or rather, to use the lingo of my distressed debt friends, Japan and Europe ex-Germany are now “work-out situations”. But if the U.S. could just get out of its own way … if we could stop arguing about who gets to use what bathroom and start arguing about how to increase productivity (i.e., how to make technology a tool for humans doing more stuff rather than a replacement for humans doing stuff at all) … then we could actually come out of this okay.

I know, I know … I’m a dreamer. And for all the political fragmentation and polarization reasons that I write about ad nauseam, or at least here, here, here, and here, the politics of identity are unlikely to be replaced by the politics of growth anytime soon. Not in the West, anyway. But that’s why I want to pull my hair out when I watch the Jackson Hole theatre. Guys, you’re not helping!

I was dumbfounded by the stultifying, excruciating more-of-the-sameness that came out of Jackson Hole. Oh my god, are we really saying that the entire FOMC decision-making process comes down to whether there’s a good jobs report on Friday? Why don’t we just inspect the entrails of a goat? Are we really still arguing about one-raise-or-two when LIBOR is now pushing 90 basis points? Was there any mention — any mention at all — of LIBOR during the entire Jackson Hole meeting? Do these people, and it’s not just the central bankers themselves but all the courtiers — the journalists, the academics, the hangers-on — do they even recognize that a world exists outside of their imaginations and theories? Answer: NO.

Yep, at first I was disappointed in them. But on reflection I became more and more disappointed in us.

See, the problem isn’t with the Fed. They’re going to do what solipsistic, magical thinking priest-kings have done for ten thousand years … more of THAT. More solipsism. More magical thinking. More 4 year old egomaniacal determination that their spell casting efforts are the ONLY thing that stand between us and utter ruin.

No, the bigger problem is with us. The bigger problem is that we cannot imagine a solution for our current economic and political problems that does not rely on greater and greater state-directed spell casting. Monetary policy spells not working? Well, golly, I guess our ONLY alternative is to try some fiscal policy spells. Really? That’s the best we can come up with? I understand that this is what the courtiers are going to say. But I expect more from the rest of us. I expect more from myself.

Look, I get it. To riff on Woody Allen’s famous joke, we need the eggs. We need a stock market that goes up, not down. We need financial asset price inflation. We need the eggs so badly that we’re willing to support the magical thinking crew and smile at their courtiers even though we think they’re totally out of touch with reality. We’ve become so used to getting our eggs delivered on time and without fail that our first, second, and third responses are to ask for more magical thinking from the incumbent priest-kings, not less.

This is a dangerous, myopic game. Because we will get what we ask for. We will get more magical thinking. Only it won’t come just from the status quo magicians. It will also come from the alt-priests, some of whom will represent the absolute worst impulses of humanity. There are really bad ideas lurking on the wings today — there always are — but these really bad ideas about how human society should be organized always resurface and grow more powerful at times like this. Because it’s the old magic, an old magic that the human animal is hard-wired to respond to.

Maybe we’ll get lucky. Maybe the banana plants of global growth will turn green again, and we can have a grand celebration of the particular variant of the policy spell that was coincidentally cast at the same time. That could happen. As Otto von Bismarck, the Iron Chancellor of 19th century Europe supposedly said, “there is a special providence for children, fools, and the United States of America.” Any portfolio manager with long enough tenure knows what it’s like to be bailed out by the market, and it’s a beautiful thing. Now we just need that to happen on a much larger scale.

But we should do better than just trust to luck. I’m not saying that we have to deny our human nature and stop believing in the act of spell-casting itself. I’m not (that) delusional. What I’m saying is that the more we embrace and encourage state-directed magical thinking, whether it’s of the monetary or fiscal policy sort, what we are actually doing is opening the city gates to the old evil magic and the alt-priests of fascism and totalitarianism. We don’t need the eggs that badly. What I’m saying is that we need to think less about Scottish witchcraft, a la Macbeth and James Frazer and Stanley Fischer, and more about the Scottish Enlightenment, a la David Hume and Adam Smith and Alexander Hamilton. What I’m saying is that we need to focus on empiricism and on what works in the real world, not theory and what “works” as an equation. What I’m saying is that usually the better course of state-directed action is to do less, not more, and the better course of individually-directed action is to do more, not less. What I’m saying is that the old good magic of small-l liberalism and technological innovation in the service of man rather than the replacement of man is pretty darn powerful itself, and the stories still inspire. Let’s embrace and encourage THAT as we make our way through what is still a largely inexorable world.

It matters whether or not we call things by their proper names, because the words and the spells motivate human behavior like nothing else. It matters whether or not we sleepwalk our way through our own fin de siècle, because the really bad people and the really bad ideas that periodically wreck our world can’t be wished away. It matters whether or not we become courtiers ourselves, because the courtiers always fall the farthest. The problem with magical thinking run amok and its perpetuation of a fantasy world is that sooner or later the dream of the delusional king becomes a real world nightmare for real world people. It’s time to wake up.

PDF Download (Paid Subscription Required): http://www.epsilontheory.com/download/16223/

DISCLOSURES

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results.

Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Comments

At least part of the problem here is that most of society finds the comfort created by artificially deferring the inevitable is preferable to confronting reality. Most of society prefers to work less (or better still, not at all) than to use tech and innovation to boost productivity, and nobody is structurally motivated to set us on a different course. Our reliance on magic spells provides the alt-priests with a source of power, which they like, and a basis for paternalistic overlord-like behavior, which they also like. As long as this setup also suits those holding political power, it’s hard to see any catalyst for change until some fairly disastrous consequences fall upon our economies and society. Then, after some period of extreme social and economic pain, everybody will forget and it can all start over.

Amazingly enough, the U.S. can still grow its way out of the massive debt we’ve taken on. I know … hard to believe. But it’s true. The power of compounding is truly inexorable, and it’s amazing what a steady 3.5% growth rate on a huge economic base can do to make manageable even trillions of dollars in debt.

Ben just wondering if you think this is still true ….it’s hard to believe it’s been over 5 years since I first read this note

On the same line, isn’t the US national debt actually a US national asset? Paying off the national debt would actually be the destruction of money. A 3.5% growth rate would just mean the national debt could grow larger. The US isn’t going to grow its way out of massive debt, it will grows its way into more debt. If stuck at 1% or 2%, then no more debt growth? I’m not sure, I think I have Lacy Hunt’s diminishing rate of return on debt in my head.

Ben,

lpusateri brought this to our attention on the Financial Nihilism thread… I’m taking the liberty to move it up.

The original three commentators offer hope. We can grow out of this. Lacy Hunt’s commentary over the last ten years, imo, MAY, somehow be tweaked to use debt for increasing returns.

We’re using debt for all the wrong reasons.

Jim

Continue the discussion at the Epsilon Theory Forum...